Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 09, 2020

New sector data track pandemic's impact on Australian businesses

- Previously unpublished sector data for Australia show output trends across six broad categories

- Downturn from COVID-19 lockdown in spring was most severe in consumer services

- Majority of sectors back in growth territory in November

- Finer sub-sector data shows steep impact on travel-related services from containment measures

The Australian economy has, like the rest of the world, experienced a steep decline in economic activity as a result of coronavirus disease 2019 (COVID-19) over the course of 2020. However, different parts of the economy have suffered in different ways and to varying degrees. To gain a deeper insight into these sectoral trends, we present new, previously unpublished, PMI data that track business output and other key metrics across 15 industry sectors.

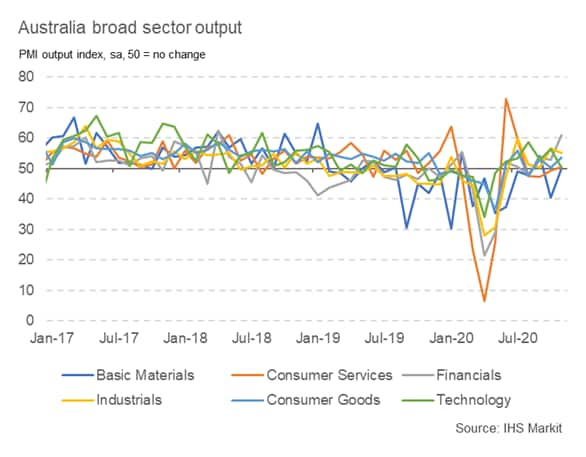

These PMI series include data for six broad industry sectors from our manufacturing and services survey panels where sample sizes are large enough to give a reliable indicator for output trends. Using the IHS Markit sector classifications, these include basic materials, consumer goods, consumer services, financials, industrials and technology.

Importantly, these data provide a more nuanced insight into the impact of the COVID-19 pandemic on businesses over the course of 2020 compared to broader manufacturing and services data as different sectors have faced varying challenges from restrictions on activity and their impact on demand.

Downturn in output over spring, led by consumer services

In April, when global containment measures designed to reduce the spread of COVID-19 were the most severe, four of the six broad sectors saw record drops in output (since Australia PMI data was first collected in May 2016), with consumer goods registering its sharpest fall during May. Basic materials was the only sector to not see a record downturn in the spring.

As was also the case for published global and regional sector PMI data, consumer services firms across Australia were notably the worst-hit by lockdown measures during April. That said, when restrictions were eased, consumer services activity rose markedly and at the quickest pace across all six sectors in June.

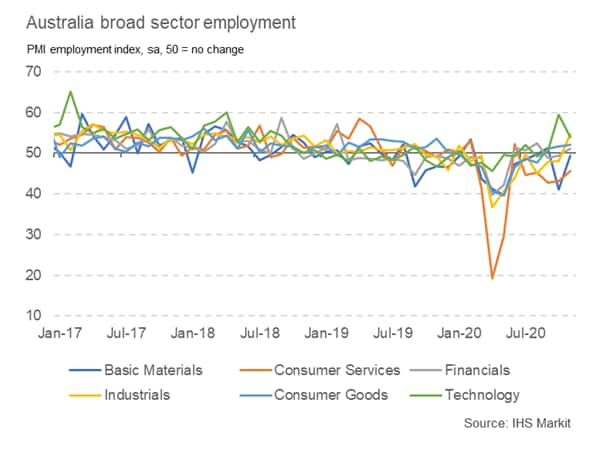

Employment PMI data meanwhile showed that consumer services firms also reported the strongest reduction in jobs as a result of lockdown measures in April. Most sectors registered steep declines in employment, with technology the only exception as firms saw a more modest decrease in staffing. Unlike output, however, employment has largely continued to fall, often reflecting efforts among companies to cut costs and reduce excess capacity.

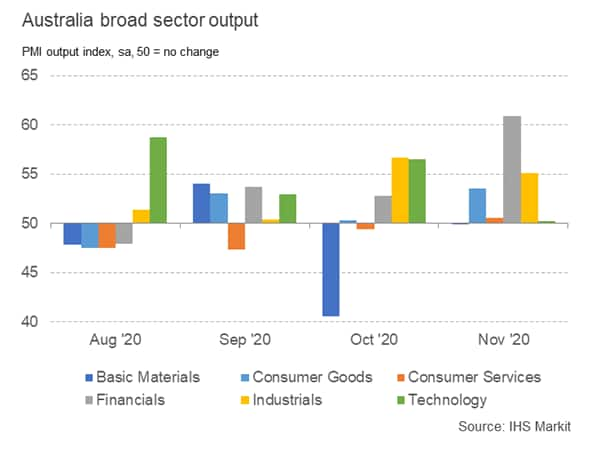

More recently, PMI data have shown that the economic impact of the COVID-19 pandemic lessened over the Australian spring, with a majority of the broad sectors having posted growth in output in each month since September. Five of the six sectors saw a rise in output during the latest survey period, while basic materials firms reported an unchanged level of production. Growth was strongest across the financial sector, overtaking industrials (which registered the second-quickest rate of expansion).

Travel-related sectors suffered steep decline but rebounded well

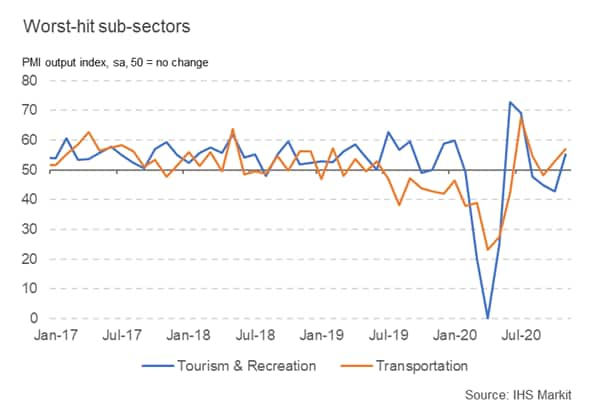

In addition to the broad sector groupings, we have also generated data for nine more detailed sub-sectors to provide more granular insights into Australian industry trends. In relation to the pandemic, these series can pinpoint which areas of the economy have endured the greatest downturns through 2020.

Notably, the two sectors facing the strongest declines were tourism & recreation and transportation, two sectors that rely heavily on travel for new business. The tourism & recreation sector also includes restaurants and other recreational venues that have faced some of the strictest COVID-19 measures over the course of the year.

Both of these sectors recorded marked falls in output during April, though subsequently reported sharp rebounds as lockdown restrictions were eased. State-level restrictions then led to a renewed, but much softer, decrease in activity in the tourism & recreation sector. In November, however, both sectors recorded solid growth.

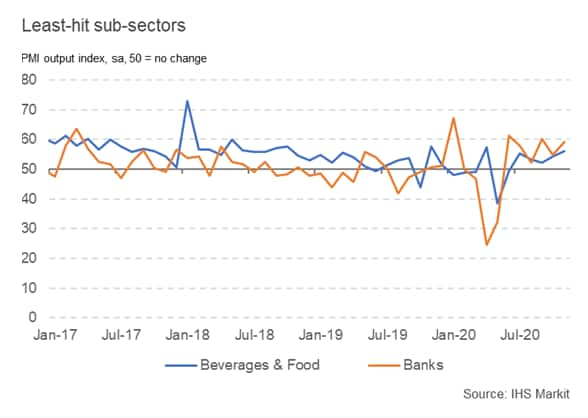

In contrast to the two worst-performing sectors, two sub-sectors have registered growth on average in 2020 so far, namely banks and beverages & food. While the banking sector saw a sharp downturn as global markets were depressed earlier in the year, it has since registered expansions in activity in each month since June. Beverages & food producers meanwhile saw a distinct rise in output in April, which was linked to increased consumer purchases of essential goods. While output then slipped in May and June, it has since returned to growth.

Going forward, these broad and finer sub-sector data series can track the pace of recovery across each part of the Australian economy through 2021 as the world looks to find its footing after the impact of lockdown measures, in addition to highlighting any persistent weakness in sectors still impacted by COVID-19.

David Owen, Economist, IHS Markit

Tel: +44 2070 646 237

david.owen@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-sector-data-track-pandemics-impact-on-australian-businesses-dec20.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-sector-data-track-pandemics-impact-on-australian-businesses-dec20.html&text=New+sector+data+track+pandemic%27s+impact+on+Australian+businesses+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-sector-data-track-pandemics-impact-on-australian-businesses-dec20.html","enabled":true},{"name":"email","url":"?subject=New sector data track pandemic's impact on Australian businesses | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-sector-data-track-pandemics-impact-on-australian-businesses-dec20.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=New+sector+data+track+pandemic%27s+impact+on+Australian+businesses+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-sector-data-track-pandemics-impact-on-australian-businesses-dec20.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}