Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 20, 2020

Monthly Trade Monitor for the Top 10 Economies of the World - November 2020

Global trade still below the 2019 levels, optimism among top 10 states, however, global PMI NExO fell month-on-month for the first time since May.

Main Observations

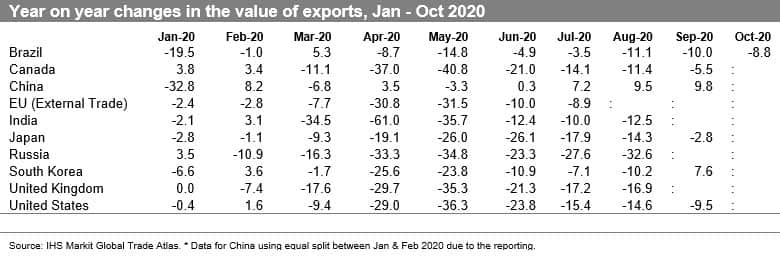

- Exports fell year-on-year (yoy) in all the top economies in Q1 2020; the fall ranged from -1.8% for Canada and South Korea to -12.8% for India and -13.4% for China; the situation changed dramatically in Q2 with exports contracting close to 30.0% or more for India (-36.7%), Canada (-33.1%), Russia (-30.5%) and the US (-29.8%); China was the only top economy reporting a slight increase in the value of exports for the Q2 (0.1% yoy)

- Without any doubt, Q2 of 2020 was the worst quarter on record for global trade, however, the situation in most markets has been improving consistently since May; Chinese exports, in particular, are showing a consistent increase over 2019 from May onwards and this is strengthening (+9.8% yoy already in September 2020), the increase is also present in Chinese imports for the first time in September (+13.6%); it applies to South Korea as well (+7.6% in exports and +1.6% in imports)

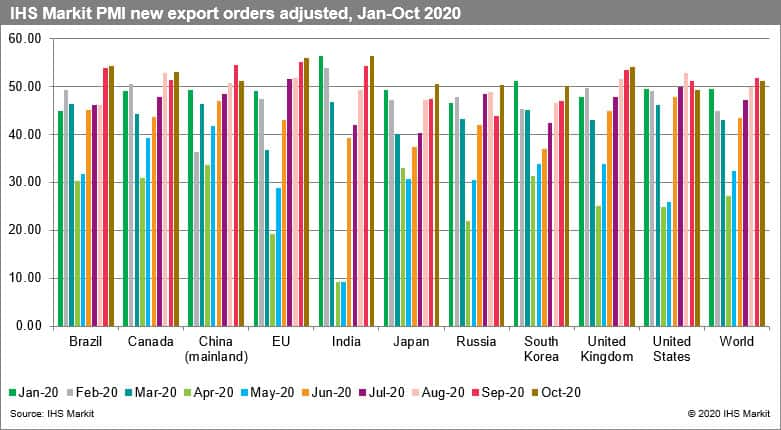

- In October 2020 PMI new export orders' readouts for all the main economies of the world, apart from the US, are above 50.0 points which is indicative of market optimism; however, PMI NExO fell for the first time in comparison to September for China, the US, and the world as a whole which could suggest an incoming change in market sentiment

- The COVID-19 pandemic exerts a negative and statistically significant impact on global trade from March 2020 onwards and the effect endures

Changes in Exports and Imports of the Top 10 Economies

- As we have all the data for the first two quarters of 2020 we can now report coherently the results for all the analyzed economies; exports fell yoy in all the economies in the first quarter 2020, the fall ranged from -1.8% from Canada and South Korea to -12.8% for India and -13.4% for China (the worst affected state); the situation changed dramatically in Q2 with exports contracting close to 30.0% or more for India (-36.7%), Canada (-33.1%), Russia (-30.5%) and the US (-29.8%); China as the only top economy reported a slight increase in the value of exports for Q2 (0.1% yoy)

- In July and August 2020, exports were below 2019 values in all the top economies once again apart from China; China is showing consistent growth from June 2020 onwards - it went up to 9.8% in September 2010

- In September 2020, apart from China, exports increased yoy also for South Korea; for the remaining economies the readouts are negative and range from -2.8% for Japan to -10.0% for Brazil; however, taking into account the situation in prior months, the situation in September 2020 was improving in particular in Japan and South Korea pointing to an accelerated recovery in East Asia

- The only country to have reported data for October 2020 is Brazil pointing to a yoy decrease of -8.8% which is still an improvement over September

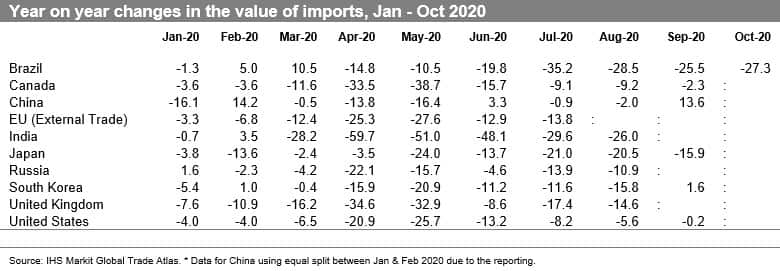

- From a quarterly perspective, imports fell yoy in all the economies in the first quarter of 2020 apart from Brazil (+4.3%), the fall ranged from -1.8% for South Korea and Russia to -11.7% for the UK (that in fact could be related to the impact of Brexit as well); similarly to exports the situation changed dramatically in Q2 with imports contracting in all the analyzed top economies yoy from -9.3% for China to a stunning -52.9% for India; the contraction in imports exceeded 1/5 in Canada, the UK, EU's external imports and the US

- In September 2020 we observed a rebound in imports yoy for China (+13.6%) and South Korea (+1.6%) but not for Japan (-15.9%), still in comparison to prior months the situation improved in all economies that reported the data

- The only country to have reported data for October 2020 is Brazil pointing to a significant yoy decrease of -27.3%

Prospects for the Forthcoming Months

- The reaction in trade in 2020 is consistent with the escalating global COVID-19 pandemic and steps taken by individual countries/territories in controlling or mitigating it

- The cumulative number of confirmed cases of COVID-19 globally exceeded 50 million and 1.3 million deaths; the number of new cases reported daily has been rising again and exceeded 530,000 cases daily on average - the highest figure from the beginning of the pandemic. The five countries reporting the highest number of cases in the past week were the US, France, India, Italy, and the UK

- The result of a new analysis by the GTA Forecasting team (https://ihsmarkit.com/research-analysis/empirical-analysis-into-the-impact-of-COVID19-on-global-trade.html) proves that the impact of COVID-19 pandemic is statistically significant and adverse, ceteris paribus, on both the exporter's and importer's side; our models re-estimated on the monthly basis have shown that the impact became globally negative in March of 2020 and endures

- The rapidly escalating indices of the COVID-19 pandemics in recent weeks could lead to stricter governments' response globally (usually with 2-3-week delay) and could mark a change in market sentiment and thus put downward pressure on global trade

- As has already been stressed several times the impact of COVID-19 on global trade and global economy will depend on the duration, severity, and spatial distribution of the pandemic and associated containment efforts taken by individual states, and critically depends on the development and implementation of a successful vaccine. The breaking news about two separate and supposedly very effective vaccines that emerged in the last two weeks is optimistic, however, we should be cautious and remember that the mass vaccination process will be lengthy and difficult in itself and could take time to bring the desired effects not expected to happen in the first half of 2021

- The threat of the second wave of the COVID-19 pandemic is materializing with the number of reported cases and new deaths increasing in recent weeks in many regions of the world and in Europe. An increasing number of states are re-imposing strict overall or partial lockdowns or declaring states of emergency

- The threat of the so-called double-hit or even triple-hit scenario has increased potentially changing the shape of the crisis from V to W; it should be accommodated in the forthcoming forecasts

- The adjusted manufacturing PMI new exports orders for manufacturing (PMI NExO) readouts for October 2020 are above 50.0 points for all the top 10 states apart from the US and are pointing to a global recovery for the second month in a row; despite the rising concerns over the second wave of the pandemic, optimism dominates; however, we have to note that the PMI NExO dropped in value for the two key economies: the US (-1.90 points, second month in a row) and China (-3.33) over the readouts in September

- The trend in the PMI NExO was clear and consistent within Q2 and Q3 2020 showing a gradual improvement in market confidence from May onwards; global PMI NExO is at the level of 51.24 in October 2020 and it fell for the first time globally since May, we thus could see the first signs of change in global market sentiment

- The real GDP growth forecasts from IHS Markit Comparative World Overview (published on 17 November 2020) point once again to a recession in most of the top economies throughout 2020 and Q1 of 2021, apart from China (recovery already in Q2 2020)

This column is based on data from IHS Markit Maritime & Trade Global Trade Atlas (GTA).

The full version of this article is available on the Connect platform for IHS Markit clients with subscription to GTA/GTA Forecasting.

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-trade-monitor-for-the-top-10-economies-of-the-world.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-trade-monitor-for-the-top-10-economies-of-the-world.html&text=Monthly+Trade+Monitor+for+the+Top+10+Economies+of+the+World+-+November+2020++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-trade-monitor-for-the-top-10-economies-of-the-world.html","enabled":true},{"name":"email","url":"?subject=Monthly Trade Monitor for the Top 10 Economies of the World - November 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-trade-monitor-for-the-top-10-economies-of-the-world.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Monthly+Trade+Monitor+for+the+Top+10+Economies+of+the+World+-+November+2020++%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-trade-monitor-for-the-top-10-economies-of-the-world.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}