Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jun 06, 2024

Learn more about our data and insights

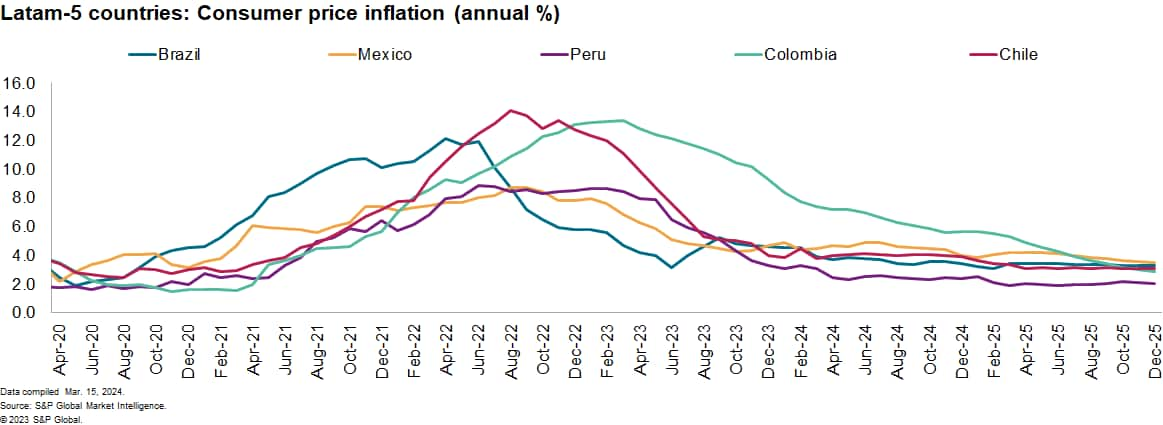

Central banks in Latin America's five major economies — Brazil, Mexico, Peru, Colombia and Chile, known as the LatAm 5 — responded more quickly and forcefully to the surge in consumer price inflation rates in 2021-22, relative to developed economies. Monetary authorities in the region have begun their respective monetary easing cycles. We explore the factors influencing monetary policy and interest rates for these economies.

Q: Where are interest rates going?

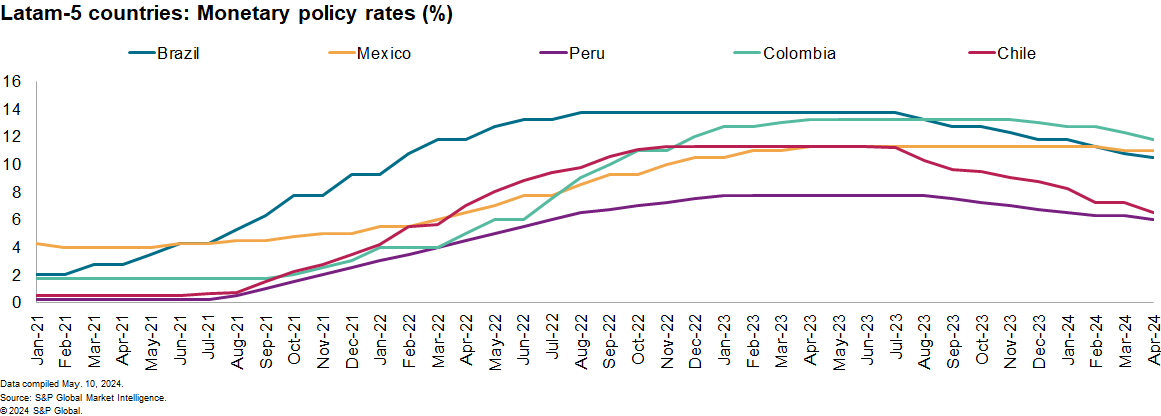

Policy rates in the LatAm 5 are being cut, with Chile being the first mover and Mexico the most recent one to initiate an easing cycle.

The Central Bank of Chile (Banco Central de Chile) started its easing cycle in July 2023 and has executed cuts of different magnitudes ranging from 50 basis points to 100 basis points, for a cumulative reduction of 475 basis points (from 11.25% to 6.50%) up to April 2024.

Mexico's central bank Banxico decided to cut the policy rate by 25 basis points during the February 2024 meeting, decreasing the benchmark rate from 11.25% to 11.00%. Banxico has recently decided to hold the policy rate.

The Central Bank of Brazil (Banco Central do Brasil) cut the rate by 25 basis points to 10.50% during its latest meeting on May 8. This followed six consecutive cuts of 50 basis points that had taken the rate from 13.75% in July 2023 to 10.75% in March 2024.

Peru and Colombia started in October and December 2023, respectively.

Q: How do these moves compare with our forecast?

We had forecast that central banks' quick response to inflation would pave the way for relatively "early" rate cuts in many of these economies from the second half of 2023 onward. This has happened, with variations in the amount of cumulative easing to date reflecting a range of factors including different starting points, reaction functions, inflation dynamics and currency risks.

Q: Have these countries achieved their inflation targets? If not, how close are they to target?

In Mexico and Colombia, the annual headline inflation rates are well above the targeted bands, while in Chile, the rate is right on the upper bound of its targeted band. In Brazil and Peru, inflation is relatively under control but not at target. The major supply shocks that drove inflation in the last two years - high oil prices, supply chain disruptions and high international food prices - have vanished. This has helped the disinflation process but was not enough to bring the desired price stability. S&P Global Market Intelligence expects inflation to decline in 2025 in the LatAm 5 countries, as pent-up demand, or postponed demand, for services fades away.

Q: Are central banks in the region heading toward a neutral monetary policy?

Monetary authorities in the LatAm 5 are moving toward a less restrictive monetary stance. A neutral monetary policy is one that neither stimulates (or accelerates) nor restricts (or reduces) economic growth. A neutral rate of interest would be present when the economy is at full employment and has stable inflation.

Brazil and Chile have taken sizable steps in moving away from very restrictive monetary policies and toward neutrality. We estimate that if inflation expectations were well anchored, Brazil's central bank could slash the rate by another 300 basis points, while Chile's central bank could cut the rate by another 200 basis points.

In Mexico, a similar story will happen. However, Banxico will have additional constraints based on what the US Federal Reserve does. The Mexican central bank pays close attention so as not to reduce significantly the spread between US and Mexican interest rates to avoid capital outflows.

In our view, Mexico and Colombia have more space to reduce interest rates, although this may have to wait until inflation is more controlled. Peru also has space to further reduce the policy rate to reach its neutrality.

Q: Will we see rates going back to pre-pandemic levels?

Policy rates could fall below estimated neutral levels if inflation rates drop below target for a sustained period. But inflation undershoots are likely to be less common than in the pre-pandemic years due to structural changes: reduced labor supply, reshoring, trade tensions and expansionary fiscal policies.

Another important reason central banks in the region will not reduce policy rates to historical low levels is that in the developed economies, and mainly in the US, central banks will not go back either to the almost zero policy rates prevailing at the end of the previous decade. So, to keep relatively attractive interest rates and to avoid capital outflows and the depreciation of local currencies, central banks in Latin America will have to maintain the relative spread.

Listen to our podcast episode on the remarkable growth of Guyana's economy

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.