Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — May 10, 2022

Russia's invasion of Ukraine on 24 February has precipitated very sizeable refugee movements in Central and Eastern Europe. It has highlighted how traditional drivers, including conflicts and major economic shocks, remain a central factor behind migration.

The lifting of travel restrictions in West Africa after the coronavirus disease 2019 (COVID-19) pandemic will generate increased irregular labor migration towards Europe in 2022. Food and energy prices and higher international borrowing costs are putting adverse pressure on local living conditions. Earning potential encourages labor flows into net recipient industrialized countries, especially from West African countries dependent on remittances.

The EU is likely to continue reinforcing existing partnerships with African countries to fight people smuggling and curb irregular migration flows. EU and individual European countries will probably gradually expand programs for legal migration from African countries over the next two to five years. This is indicated by the Asylum, Migration and Integration Fund (AMIF) having a budget of EUR9.9 billion for 2021-27 to support legal migration from outside the EU. This approach is likely to provide a framework for the partial regulation of migration inflows to Europe.

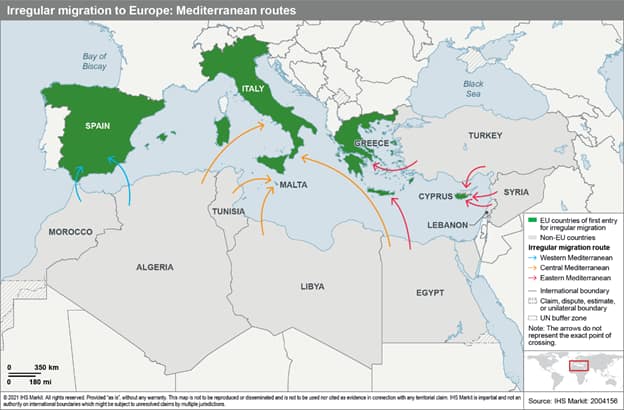

The EU refugee resettlement framework is likely to continue to operate on a voluntary basis in the two-year outlook. This implies continued pressure on refugee centers in the countries of first entry in Europe such as Italy, Spain, and Malta, and encourages illegal migrant crossings further into Western Europe. A major point of contention is likely to be an agreement between the EU - particularly its member state France - and the UK on policies tackling the issue of irregular migration via the La Manche/English Channel against the background of the new post-Brexit rules and the ongoing lack of common migration policy among EU member states. This indicates the likelihood of continuing delays to cargo at and around ports (Dover in the UK and Calais and Dunkirk in France) due to the occasional presence of stranded migrants, anti-migrant protests, and enhanced security checks, particularly if migrants are found hiding in containers.

Irregular migration is likely to continue to feed into both formal and informal employment in the EU. The EU AMIF was designed to fund labor-market integration programs. The implementation of efforts to increase formal employment is likely to generate sectoral and regional disparities across Italy, Spain, and France. For instance, in May 2020, Italy introduced a regularization program for undocumented migrants in the agriculture and care and domestic work sectors. Results have been underwhelming, with only around 38,000 residence permits issued by October 2021 versus about 230,000 applications, owing to complicated procedures. Sectors such as construction and tourism have been left out of the program altogether.

Read more of our coverage on migration:

Russia's invasion of Ukraine: The migration outlook

Listen to our podcast on migration:

Irregular migration

Posted 10 May 2022 by Blanka Kolenikova, Associate Director, Europe & CIS, Country Risk, S&P Global Market Intelligence and

John Raines, Principal Global Risks Adviser and Head of North America, Economics & Country Risk, S&P Global Market Intelligence and

Jose Sevilla-Macip, Senior Research Analyst, Latin America Country Risk, S&P Global Market Intelligence and

Petya Barzilska, Sr. Research Analyst II, Europe & CIS Country Risk, S&P Global Market Intelligence

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.