Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jan 20, 2023

Mexican President Andrés Manuel López Obrador (AMLO) hosted US President Joe Biden and Canadian Prime Minister Justin Trudeau in Mexico City between Jan. 9 and 11 for the North American Leaders' Summit. The main issues on the agenda and the resulting pledges were all on regional supply chains, migration, and security co-operation.

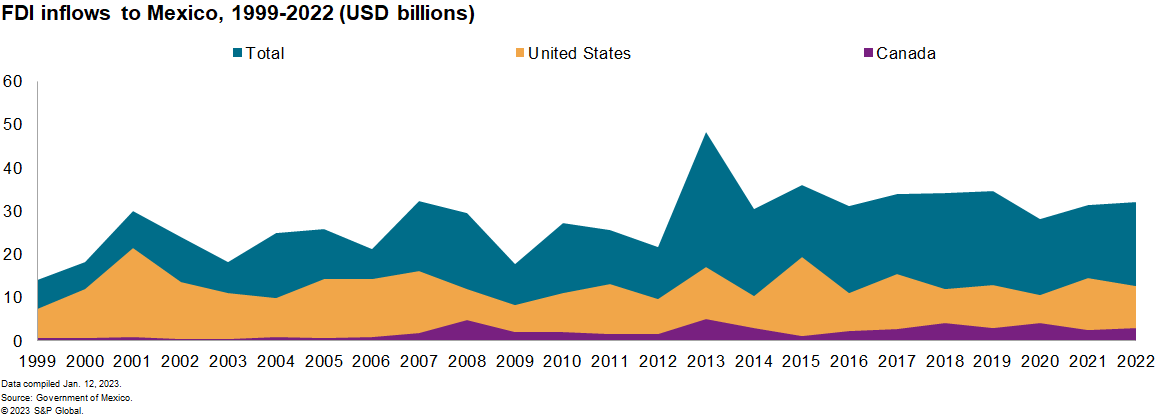

The focus on semiconductors and critical minerals during supply chain discussions emphasized the nearshoring opportunities for Mexico. During the summit, the three countries committed jointly to map critical mineral resources across North America and study the future needs of the advanced manufacturing sector in the region, particularly for semiconductor production.

The countries also announced a forthcoming trilateral semiconductor industry forum during the first half of 2023 to boost investment in the segment within the region. This alignment is likely to boost Mexico's potential role in nearshoring, benefitting from companies in these sectors relocating their operations closer to the US market (listen to our podcast episode Mexico's nearshoring potential).

$35 billion impact

Nearshoring could generate a USD35-billion increase in US-bound Mexican exports, according to estimates from the Inter-American Development Bank (IDB). Mexican foreign minister Marcelo Ebrard stated that Mexico's goal is for the three countries to substitute at least 25% of Asian imports with products manufactured in North America in the following years.

Mexico's strengths in attracting investment for the semiconductor industry are currently limited to the testing and packaging stages of the supply chain. The North American countries agreed to develop the North American Student Mobility Project to increase the formation of specialized talent for the industries. If this occurs, the program should deepen Mexico's talent pool, helping over time to attract investment for all stages of advanced manufacturing supply chains. This will be a long-term process extending beyond the five-year outlook.

The materialization of these opportunities depends on a favorable resolution of the ongoing energy dispute between Mexico and the US and Canada. The summit itself represented the latest in a series of positive indicators during the last six months, suggesting a resolution to the dispute before reaching an arbitration panel is likely.

Greater alignment

The summit also produced pledges on other issues, like migration and security, both of which show an increasing alignment from Mexico to US priorities. We believe such alignment is likely to remain for the rest of AMLO's term, set to end in late 2024.

Ahead of the summit, the US and Mexico reached an agreement to handle the rising number of migrants from Venezuela, Nicaragua, Haiti, and Cuba arriving illegally in the US through Mexico: The total number rose 147% year-on-year during January-November 2022. Mexico has pledged to host up to 30,000 migrants from these countries deported by US authorities, while the US has committed to grant the same number of visas to nationals of the countries mentioned.

As part of the summit's deliverables, the US and Mexico committed to the establishment of a migration center in southern Mexico, which should enhance Mexico's role in deterring northbound irregular flows. AMLO maintained his rhetorical requests for increased US funding to address the root causes of migration in Central America, yet the two initiatives indicate that his policy actions remain aligned with US priorities on the issue.

Fentanyl was the other priority issue on Biden's agenda for the US-Mexico bilateral talks. As with migration, Mexico undertook significant action ahead of the summit in terms of fentanyl trafficking: the Army arrested senior Sinaloa cartel member Ovidio Guzmán on Jan. 5. The Sinaloa cartel is Mexico's top fentanyl manufacturer and exporter.

Under AMLO, Mexico has sought to use bilateral co-operation mechanisms to boost its efforts to address arms trafficking, target cartels' financial infrastructure, and limit the involvement of US security agencies in Mexico. However, the summit's deliverables on security co-operation focused mostly on fentanyl, indicating AMLO's willingness to align Mexican anti-drug policies with US priorities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.