Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 14, 2023

By Chris Rogers

Mexico has been a leader in reshoring of manufacturing both out of the US and away from mainland China. There's plenty of evidence of reshoring over the past five years, but success in the future is by no means guaranteed given stiff competition from other countries including Vietnam.

New cars, different computers: Reshoring on the agenda

Mexico has been well established as a center of integrated manufacturing supply chains, particularly around assembly, for the North American market. A process that started with the creation of NAFTA in 1994 was renewed with the reformation of NAFTA as USMCA in 2020.

Mexico's existing strengths are focused on assembly. The leading incumbent export industry is the automotive sector, which accounted for 29.1% of exports in 2022. Exports of computers, mostly servers, accounted for a further 8.4% and other consumer electricals and electronics a further 9.5%.

The challenge for the Mexican government and industry is to ensure the country maintains its position as a new round of reshoring investments gets underway.

Mexico has a number of attractions from a reshoring perspective as corporations look to maximize shareholder value by reducing risk and cutting costs.

Mexico is notable in already having free trade agreements, which cover 96% of its exports by value in 2022, our data shows. That's dominated by the USMCA area with the US and Canada, which accounted for 79% of exports, while deals with the EU and EFTA cover another 10%.

Electronics, autos, steel and beer: Evidence for reshoring to Mexico

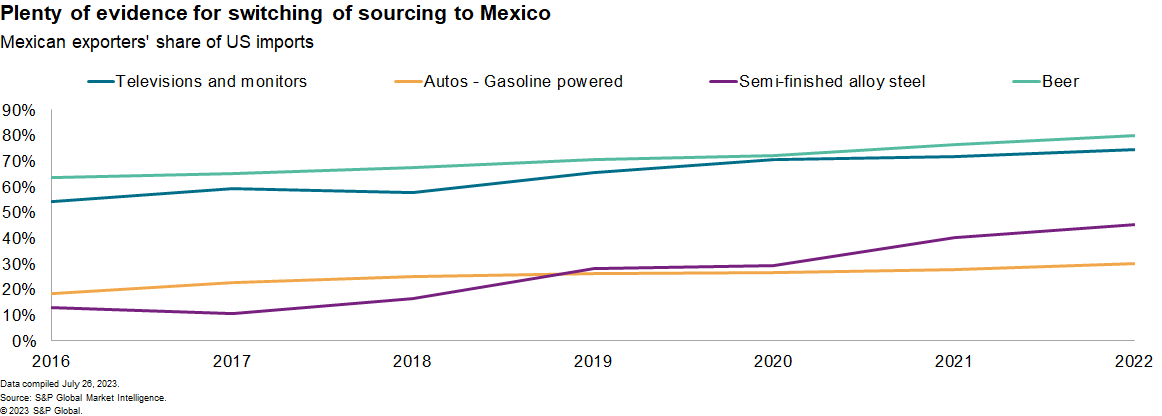

The simplest way to detect reshoring is through a shift in the share of imports for a given product in a given country — for example the share of US imports accounted for by shipments from Mexico.

The share of US television imports coming from Mexico rose to 74.7% in 2022 from 54.1% in 2016, according to our data. In the case of computer servers, the share of US imports from Mexico rose to 79.3% in the past 12 months from 77.2% in 2016.

In the case of gasoline-powered autos, the Mexican share of US imports rose to 30.3% in the past 12 months from 18.6% in 2016.

Stricter rules-of-origin for autos under the revised USMCA trade deal may be causing firms to reorganize their supply chains. Additionally, the shift to electric vehicle supply chains may lead to consolidation among suppliers of ICE components.

The steel industry has been beset globally by a wide range of trade protectionism. Mexico has managed to avoid many US tariffs, and its share of US imports of semi-articulated truck trailers increased to 87.2% in the 12 months to May 31, 2023, from 70.5% in 2016.

It's not all about tariffs though. Changing consumer tastes helped Mexico's share of US beer imports bubble up to 80.2% in the 12 months to May 31, 2023, from 63.7% in 2016.

Cheaper versus nearer: Mexico versus Vietnam as reshoring centers

As already indicated, the most recent period of flight of sourcing away from mainland China has helped Vietnam as well as Mexico.

Exporters may have moved to Vietnam for its potential economies of scale and scope as a center for reshoring from mainland China to all countries globally, whereas Mexico has tended to be focused on the US.

The US-mainland China trade war has benefited both Vietnam and Mexico. Mexico's share of US imports of the products covered by Section 301 tariffs imposed by the Trump administration on imports from mainland China rose to 17.2% in the 12 months to May 31, 2023, from 15.5% in 2016. Vietnam's share increased to 3.8% from 1.9%.

Looking ahead, a challenge for suppliers looking to set up manufacturing in Mexico is labor cost competitiveness. Our data shows Mexican manufacturing labor compensation was just 84% of mainland China's, yet Vietnamese compensation is still just 59% of the level of that in Mexico.

Mexico also has higher operational risk scores across a wide range of categories versus mainland China and Vietnam.

Finally, being nearer to customer markets is not always a guarantee of delivery on time or with lower risks. Indeed, Mexico's cargo and transport risk scores are much higher than those of Vietnam or mainland China.

For more information, listen to our podcast series on nearshoring

Sign up for our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.