Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jul 26, 2022

Mexico is particularly well placed to benefit from companies relocating their operations closer to their main destination markets (nearshoring), a response to recent supply chain shocks from the Russia-Ukraine conflict to China's dynamic COVID containment policy. Given Mexico's strong interdependence with the US economy, materialization of the nearshoring potential across key sectors including semiconductor manufacturing and advanced packaging, critical minerals and pharmaceuticals, would have sizeable impacts and significantly improve Mexico's economic standing beyond the five-year outlook.

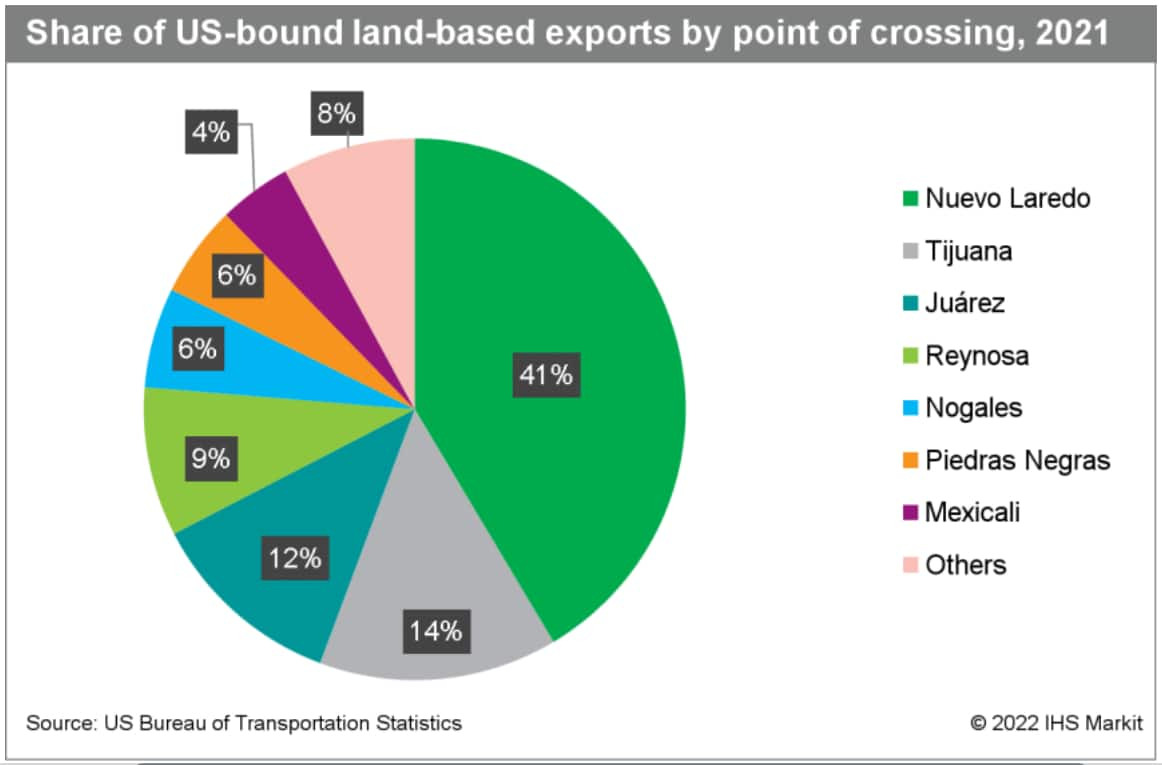

The development of integrated supply chains between Mexico and the US, which cover diverse economic sectors such as manufacturing, automotive, aerospace, agriculture, and textiles, have contributed to Mexico retaining its place as the second largest US trade partner in 2021 (USD661.2 billion) behind Canada's USD664.8 billion and ahead of China's USD657.4 billion. As the two countries share a land border, this has allowed bilateral trade to avoid dislocation from the container and port-related disruptions that have affected global seaborne trade over the past year as almost 88% of US-bound Mexican exports are currently transported by road to the US.

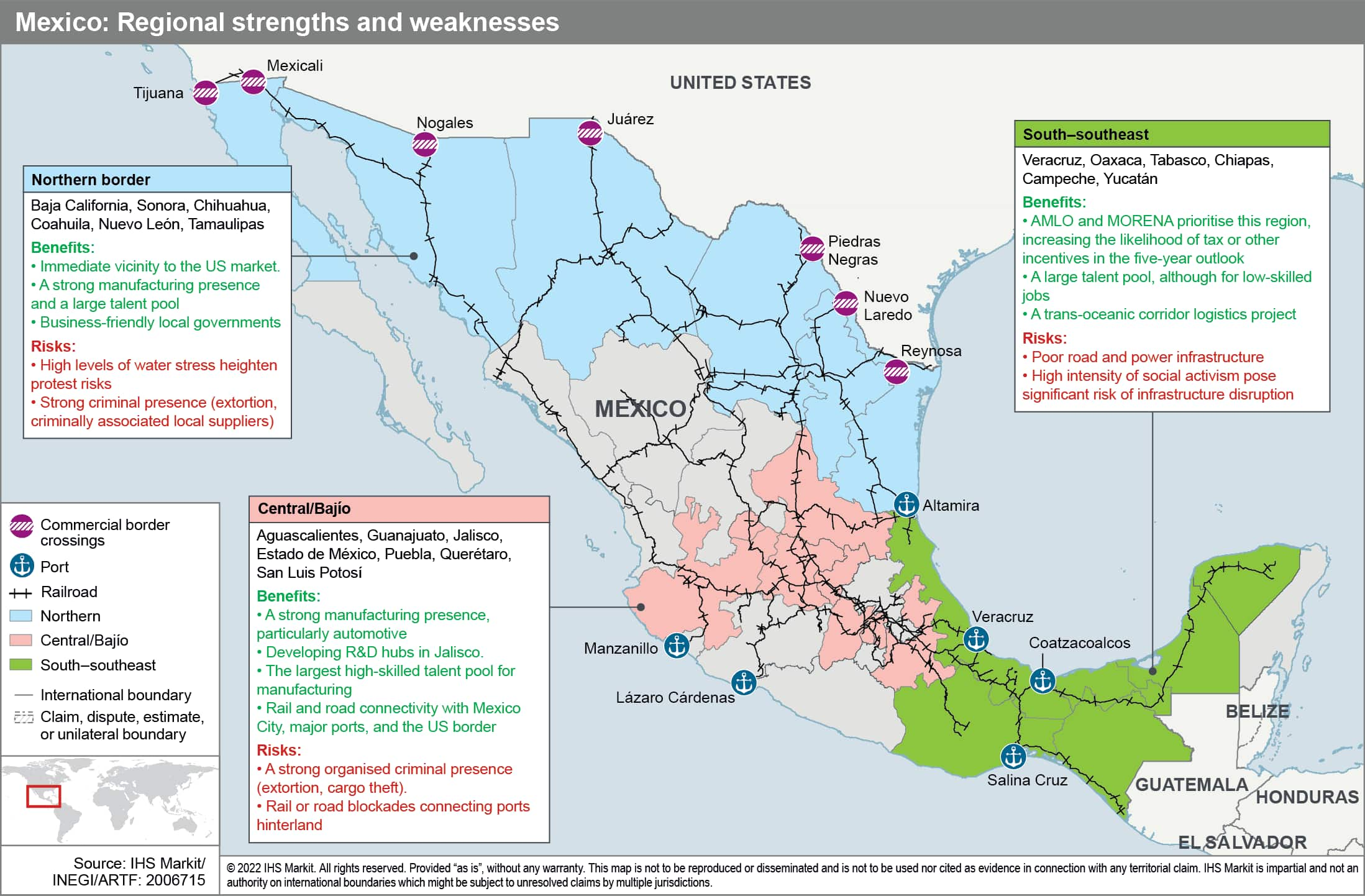

Companies relocating to Mexico in the five-year outlook, however, are still likely to face security-related risks, particularly road cargo theft and extortion. Reported cases of extortion rose by 28% year on year (y/y) nationwide during the first half of 2022, with manufacturing hubs Guanajuato and Nuevo León reporting the greatest increase in incidence. The states of Mexico and Puebla, both part of the Central/Bajío region, account for roughly 70% of all incidents of road cargo theft, whereas automotive components account for more than one-third of all stolen rail cargo. Although criminal hotspots are likely to vary during the next decade in response to security force deployments and regional criminal dynamics, national levels of criminal activity are likely to remain elevated.

Balancing Mexico's strengths and its inherent operational risks, the incentives for nearshoring to Mexico are likely to remain high for companies serving the US market, reflecting US President Joe Biden's supply chain resilience strategy, which aims at securing reliable suppliers in four strategic sectors: 1) semiconductor manufacturing and advanced packaging; 2) high-capacity batteries; 3) critical minerals and rare earth elements; and 4) pharmaceuticals and active pharmaceutical ingredients (API).

Besides Mexico, the US has considered more than a dozen countries, including Canada, India, and the UK as strategic partners for supply chain resilience. Out of those, Mexico is one of only two countries in located in the Western hemisphere (alongside Canada) and its geographical advantage should become increasingly relevant if US security concerns in the East and Southeast Asian Pacific rim deteriorate over the next decade.

Snapshot - Critical minerals

As of 2020, the US Department of Defense identified 58 strategic and critical minerals for which the country was import-reliant.

Mexico has opportunities to carve out a bigger, and more profitable, role for itself as the US seeks to shore up its supplies of these minerals:

Potential headwinds include:

If AMLO's MORENA party retains power beyond 2024, the policy direction for lithium will almost certainly remain on its current state-oriented path. Although opportunities for international companies directly to mine lithium in Mexico would remain closed, there are still lithium-related opportunities at other stages of the high-capacity batteries supply chain. Roughly, this supply chain has five stages:

Beyond the five-year outlook, as Mexico becomes a lithium producer (even if a state-owned company mines and refines the metal), incentives for high-capacity battery manufacturers and end-use product manufacturers to build a domestic supply chain to source the US market are highly likely to increase.

Posted 26 July 2022 by Emily Crowley, Head of Research, Pricing and Purchasing, S&P Global Market Intelligence and

Jose Sevilla-Macip, Senior Research Analyst, Latin America Country Risk, S&P Global Market Intelligence and

Rafael Amiel, Director, Latin America & Caribbean Economics, S&P Global Market Intelligence

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.