Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

WHITEPAPER — Oct 23, 2023

Deceptive shipping practices began to emerge as a topic of interest following the US Treasury Department Office of Foreign Assets Control's guidance on Deceptive Shipping Practices (2020). The guidance, at the time, highlighted seven practices that were pertinent in subterfuge shipping activities. Subterfuge shipping has always been an issue; however, this proverbial game of cat and mouse has continued to escalate in terms of the complexity of tactics used to circumvent these regulations, as well as the industry tools used to identify and combat them.

These tactics, historically used in activities related to Venezuela, Iran, Syria and North Korea have since also been employed in the shipping of Russian oil; many of which have evolved beyond the original scope. The formal sanctions placed against Russia are unparalleled, so the need for robust compliance frameworks and tools to carry out proper due diligence has never been higher.

The issue of vessel ownership itself and the need within industry to highlight and identify ultimate beneficial owners (UBOs) have widely been discussed and remains problematic owing to the complicated nature of vessel ownership.

This paper seeks to identify the key organizational movements observed within the global fleet, providing insight into possible behaviors and links used in subterfuge shipping.

This section will cover multiple areas of interest identified within our companies database.

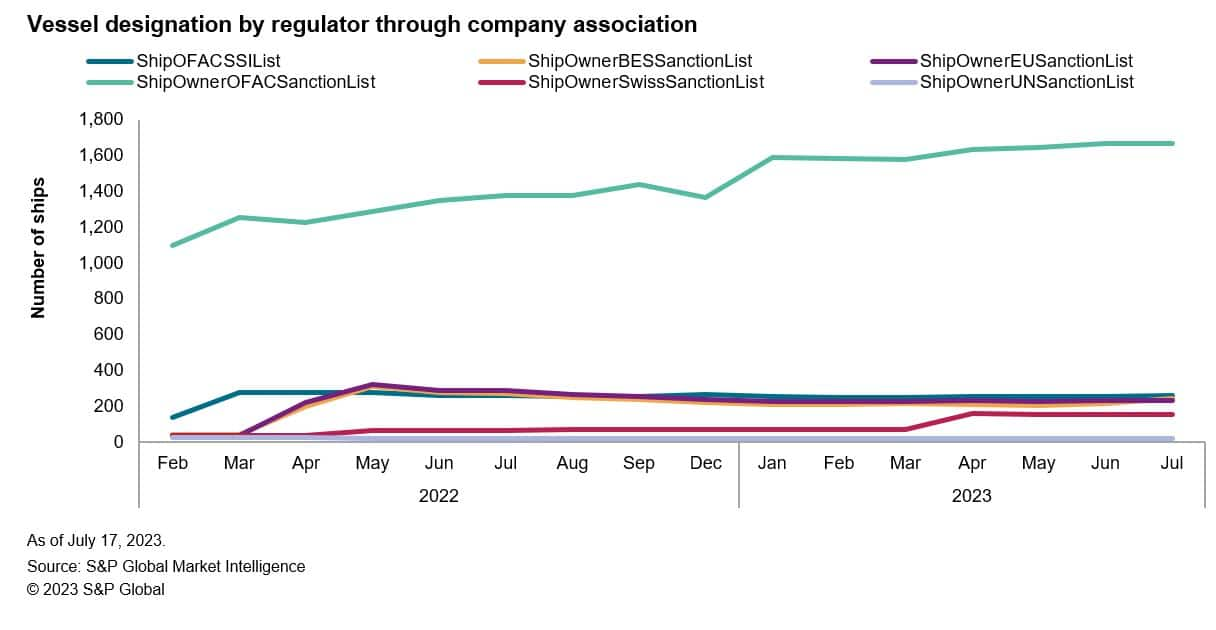

The sanctions landscape against Russia has escalated considerably since the initial sanctions of February 2022. Individual regulatory bodies have now gone through several rounds (with the European Union now on its 11th round) to restrict economic activity.

This has been felt rather strongly within the maritime domain, with a number of assets and entities being directly/indirectly targeted. The US, UK, EU and Switzerland are the most assertive in their designations, although different approaches are taken by these.

The link between entities and assets is key to better understanding and establishing possible sanctions risks. A direct contrast analysis of assets and entities shows that OFAC now currently has more than 700 vessels designated, with just under 200 maritime entities; however, when cross analyzing the underlying fleets relating to these entities, this shows more than 1,600 ships as of July 17, 2023.

Previous analysis conducted in April 2023 with a focus on Russian-affiliated entities showed a spike of 864 newly established maritime companies with an association or relationship to Russia; however, this rise in new companies being founded and incorporated was first seen in first half 2020, and continued through 2021.

Click here to download the full complimentary paper which includes the analysis of parent and care links, conflicting physical address of registration and single ship fleets.

Subscribe to our complimentary Global Risk & Maritime quarterly newsletter, or listen to Maritime and Trade Talk podcast for the latest insight and opinion on trends shaping the shipping industry from trusted shipping experts.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

How can our products help you?