Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 01, 2019

Manufacturing recession signalled by UK September PMI

- Manufacturing PMI signals longest downturn since 2009, though Brexit-related stockpiling helps ease rate of decline

- Jobs cut at sharpest rate since early-2013

- Prices rise at slowest pace since 2016

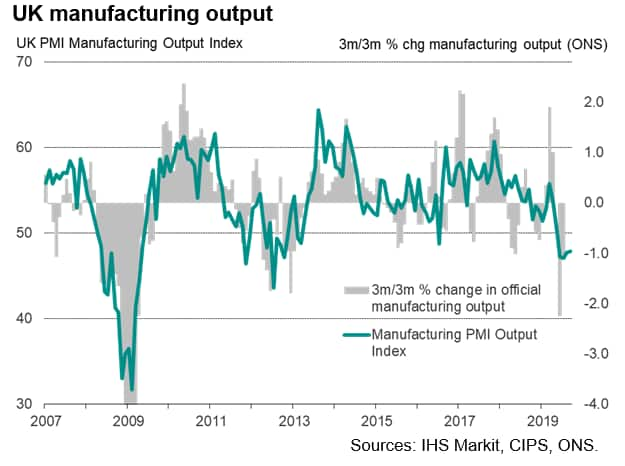

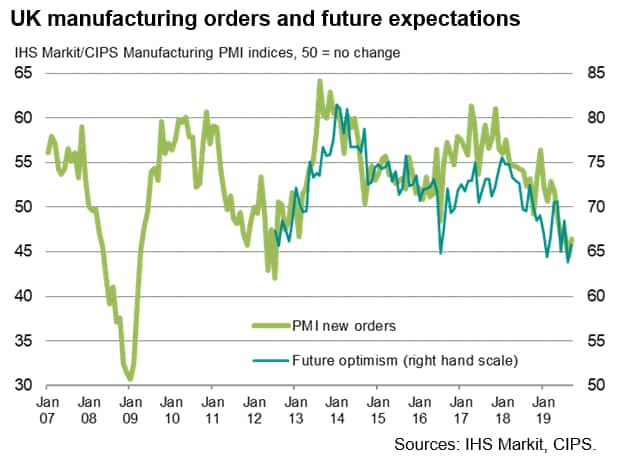

UK manufacturing conditions deteriorated for a fifth successive month in September, with further marked falls in output and new orders causing firms to cut jobs at the fastest pace for over six-and-a-half years. The headline IHS Markit/CIPS UK Manufacturing PMI® rose from 47.4 in August to 48.3 in September, but by remaining below the neutral 50.0 level indicated a fifth straight month of deteriorating business conditions. This represents the longest spell of decline since 2009.

Limited boost from Brexit preparations

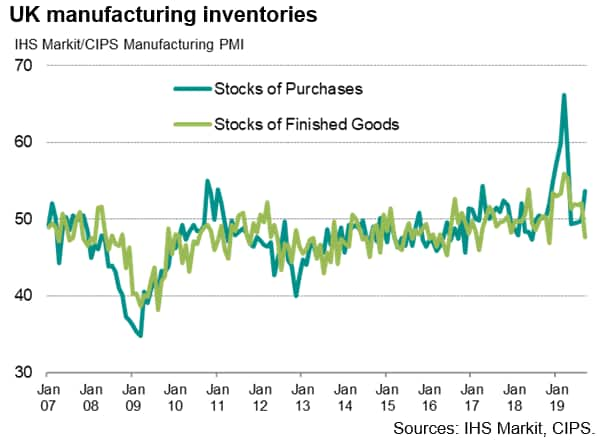

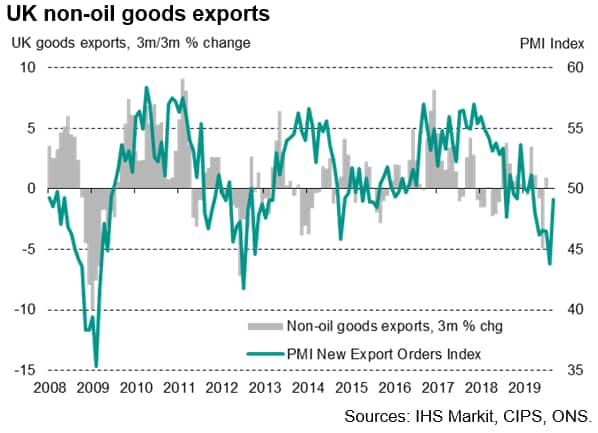

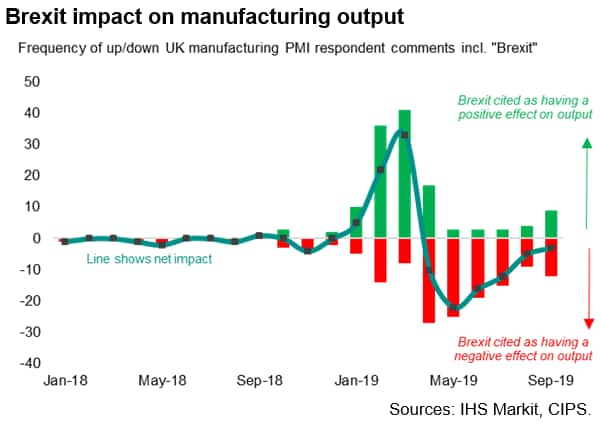

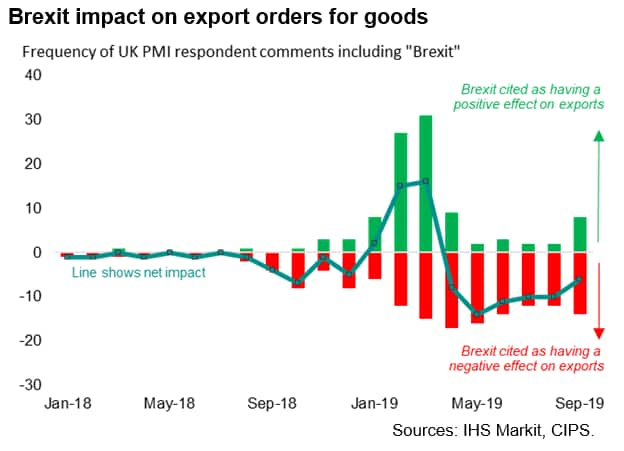

Output fell for a fourth month in a row in response to a fifth successive monthly drop in new orders. While both rates of decline eased, mainly in response to a marked slowing in the rate of loss of exports, some of the easing reflected pre-Brexit preparations, suggesting the underlying trend remained weaker than suggested by the headline numbers. The prospect of possible supply disruptions in the event of a no-deal Brexit on 31st October, resulted in stockpiling by firms and their customers - especially those in the EU.

Stocks of raw material inventories consequently rose sharply after four months of marginal declines, albeit with the rise falling far short of the increases seen earlier in the year ahead of the original Brexit date of 31st March.

Similarly, the number of companies reporting that Brexit had boosted output and exports rose to the highest since April, yet also remained well below numbers seen earlier in the year. Moreover, despite the uptick in Brexit-related activity, Brexit was still reported to have had a net detrimental effect on both output and export orders.

As such, the survey data suggest that the economy is unlikely to see a repeat of the strong Brexit-related surge in manufacturing activity that was recorded in the first quarter, and which helped boost GDP.

Third quarter recession fears

The survey data therefore indicate that, despite the slight easing in the rate of decline in September, manufacturing output likely fell in the third quarter, dropping at a rate commensurate with the official gauge of output dropping by 0.8% compared to the prior three months. Coming on the heels of a 2.3% fall in output in the second quarter, such a decline would indicate a recession for manufacturing.

Job losses hit six-and-a-half-year high

In addition to current order books and output contracting, September also saw ongoing subdued optimism about future production. Sentiment about growth in the year ahead remained among the lowest since comparable data were first available in 2012, often reflecting concerns over Brexit and slower economic growth both at home and abroad.

Employment consequently fell for the eighth time so far this year, with the rate of job losses accelerating to the fastest since February 2013.

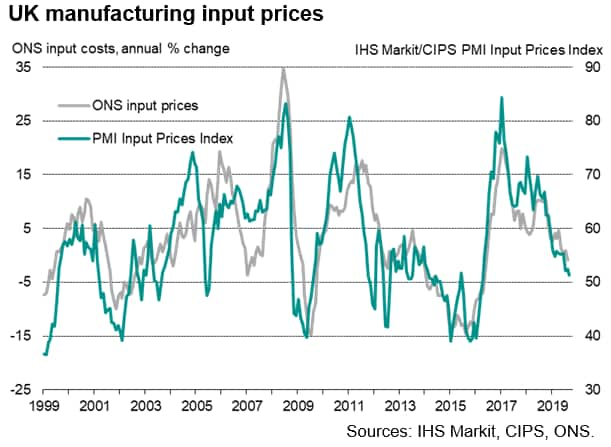

Price pressures lowest since 2016

September also saw a further easing of price pressures in the manufacturing economy. Average raw material input prices rose only modestly, showing the smallest increase since April 2016, while average factory gate selling prices rose at the weakest rate since June 2016. An inflationary impact of higher import costs from the pound's relative weakness continued to be reported, but costs were often reported to have been subdued by lower global commodity prices, linked in turn to the cooling of global demand.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-recession-signalled-by-uk-september-pmi-011019.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-recession-signalled-by-uk-september-pmi-011019.html&text=Manufacturing+recession+signalled+by+UK+September+PMI+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-recession-signalled-by-uk-september-pmi-011019.html","enabled":true},{"name":"email","url":"?subject=Manufacturing recession signalled by UK September PMI | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-recession-signalled-by-uk-september-pmi-011019.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Manufacturing+recession+signalled+by+UK+September+PMI+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-recession-signalled-by-uk-september-pmi-011019.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}