Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Apr 02, 2024

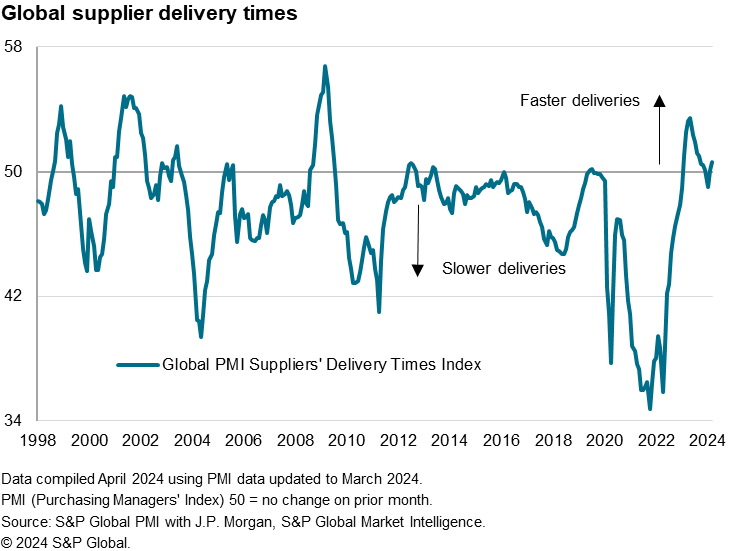

Average supplier delivery times quickened slightly in March, according to the latest global PMI surveys, pointing to a further alleviation of supply disruptions emanating from the Red Sea crisis. The improvement in supply chains is good news for inflation, as companies reported an associated easing of supply-related global cost pressures during the month.

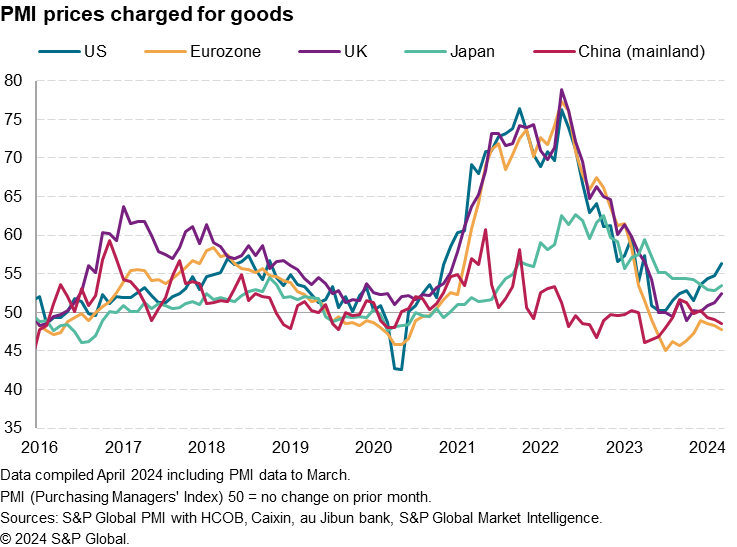

However, prices continued to rise at an increased rate for consumer goods, hinting at further upward pressures on global consumer price inflation in the months ahead, in turn likely to be associated with resurgent demand. There were also some noteworthy geographical price divergences, with a marked upturn in goods price inflation in the US contrasting with falling prices in the eurozone and mainland China.

The Global Manufacturing PMI, sponsored by JPMorgan and compiled by S&P Global, showed the time taken for factories to receive goods from their supplier shortened on average in March.

Although only modest, the second successive monthly improvement in supplier delivery times is notable in signalling an easing of supply constraints after the Red Sea related disruptions seen at the start of the year. January saw delivery times lengthen globally for the first time in a year, blamed by many manufacturers on ships being re-routed around Africa to avoid Yemen-based Houthi militant group attacks on ships heading to the Suez Canal. (Note that the vast majority of data were collected prior to the Baltimore bridge collapse.)

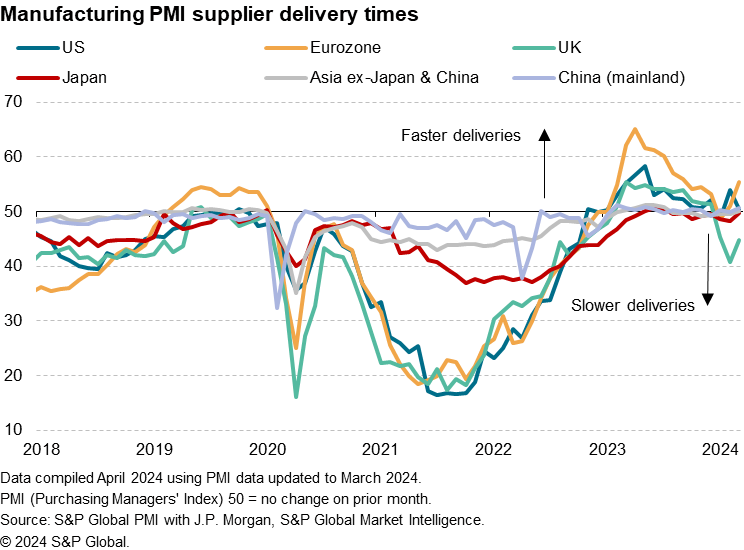

The UK had been the most adversely affected by the Red Sea disruptions so far this year, though even here the extent of the delays eased compared to February. Eurozone supplier delivery times meanwhile improved to the greatest extent in six months while US, Japanese and mainland China's delivery times were broadly unchanged during the month.

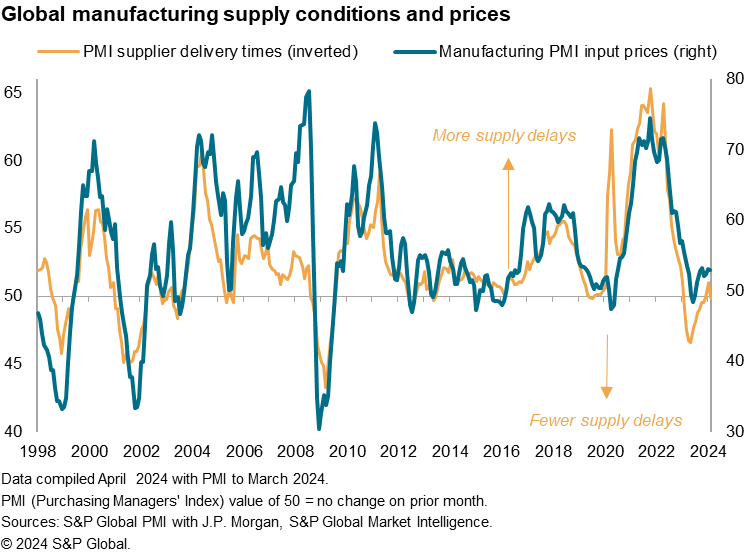

The improvement to supplier lead times is a relief in terms of the global inflation outlook, as supply delays tend to be associated with upward pressure on manufacturers' input prices.

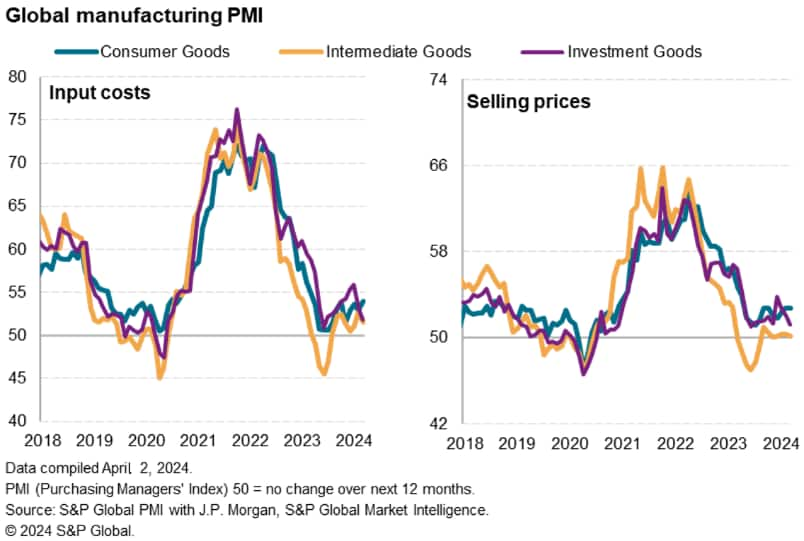

Although average input costs nevertheless rose globally for an eighth successive month in March, after three months of falling prices in mid-2023, the rate of inflation moderated slightly.

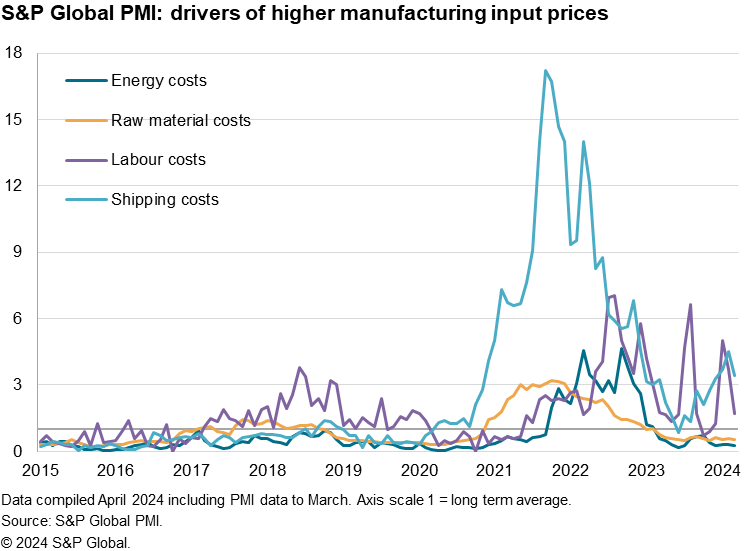

While companies reported that the main upward pressure on selling prices continued to come from a recent resurgence in shipping and wage costs, both factors eased in March. Energy and raw material price factors meanwhile remained below their long-run averages.

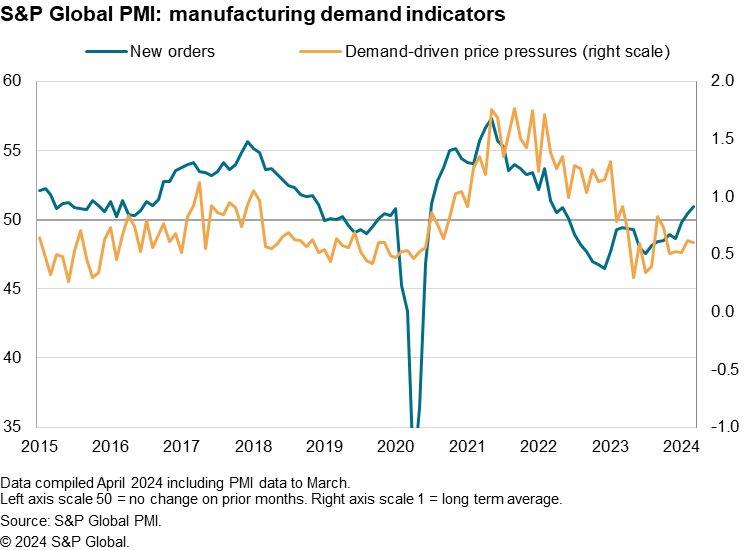

However, just as supply-side inflation factors have eased, we may see some resurgent demand-pull inflation. With new orders growth picking up worldwide in March to its joint-fastest in two-years, it is likely that we will see some firming of demand-led pricing power in the coming months if the order book situation continues to improve.

Furthermore, the impact on global consumer price inflation may be somewhat greater than signalled by the headline manufacturing price gauges. In terms of product type, consumer goods producers reported both the steepest growth of input costs and selling price inflation in March of the major product groups monitored, with the former notably inching up to a 12-month high.

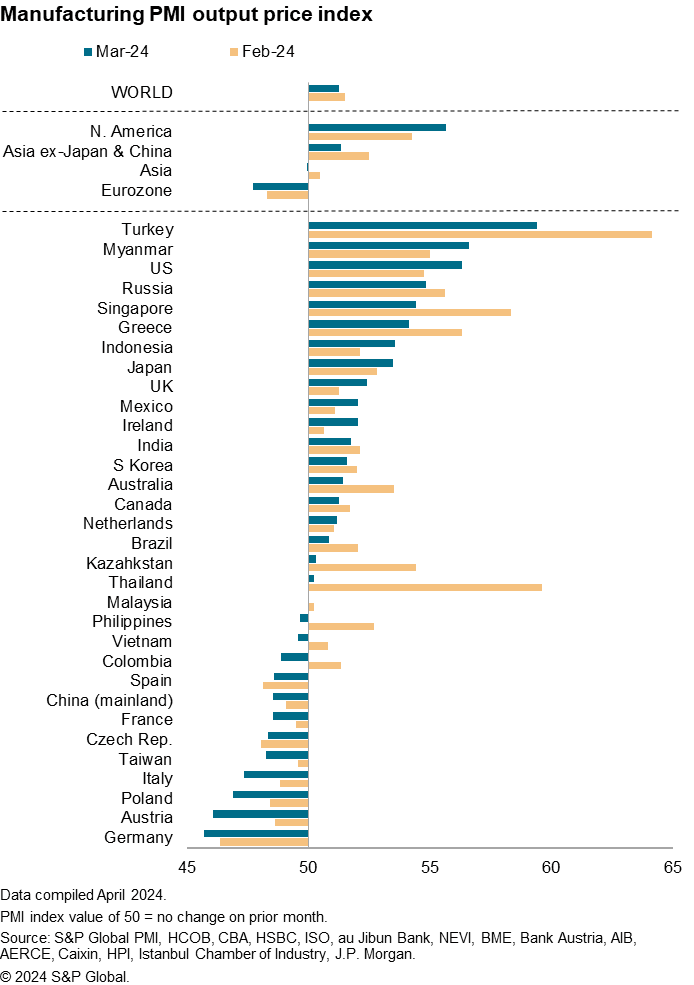

There are also some important geographical divergences to note. After Turkey and Myanmar, the steepest rise in manufacturers' selling prices was seen in the US, where the rate of inflation accelerated for a fourth consecutive month in March to reach an 11-month high, importantly running well above the pre-pandemic average.

Selling price inflation also notably accelerated in Japan, often linked to the pass-through of higher import prices amid a weakened yen, as well as in the UK amid the ongoing supply constraints. In contrast, prices fell at increased rates in both the eurozone - led by Germany - and mainland China.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.