Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jul 02, 2024

By Ronel Oberholzer and Thea Fourie

Learn more about our data and insights

Kenya experienced above-average rainfall during the "long rains" season in March, April and May 2024, resulting in widespread flooding and damage to infrastructure. The devastating floods have caused significant disruptions to various sectors, including agriculture, transportation, and retail. The negative impact of the 2024 floods on Kenya's overall GDP appears likely to be higher than the 2018 floods, since Nairobi - the largest county in Kenya - had been affected by the recent floods whereas this was not the case in 2018. We expect Kenya's economic growth to be lower by 0.3 percentage points compared to the baseline in 2024.

Effects vary by county

Our detailed regional analysis shows that the magnitude of the disruption to Kenya's aggregate national GDP depends on the flood-affected counties' contribution to Kenya's overall GDP and the composition of those counties' industries.

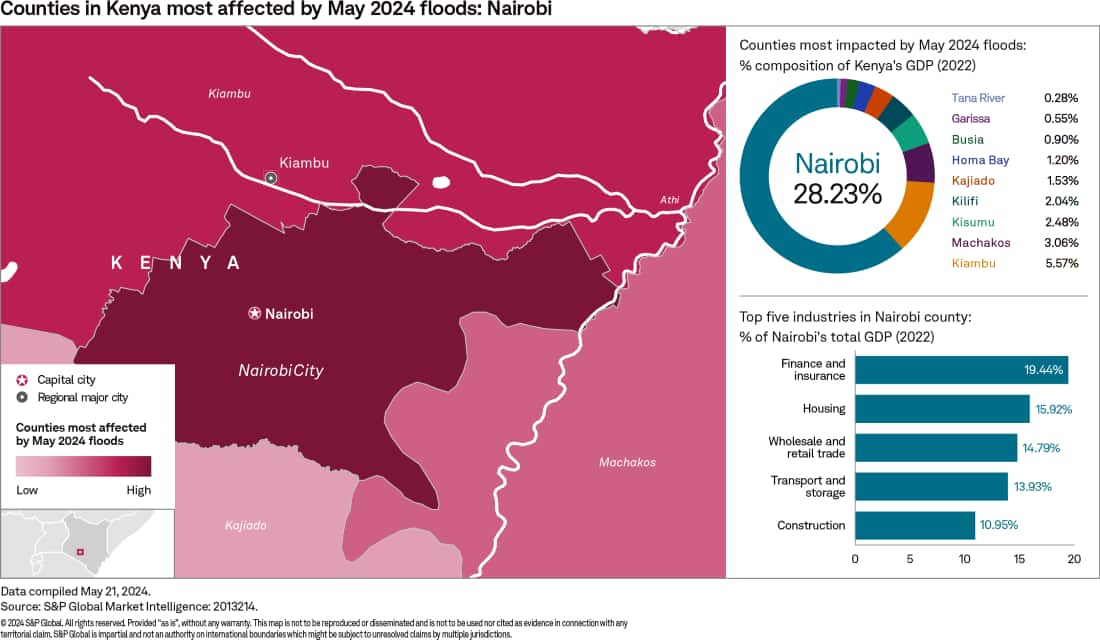

Nairobi is the largest county in Kenya, contributing 28.3% to Kenya's overall GDP, according to our Regional Explorer data. The top five industries in Nairobi, in terms of their percentage contribution to the county's GDP, include finance and insurance, housing, wholesale and retail trade, transport and storage, and construction.

We forecast that the resumption of service-related economic activity in Nairobi is likely to be much faster than in other flood-impacted counties, where economic activity is dominated primarily by the agricultural sector. Still, temporary disruptions to Nairobi's economic activity, such as the closure of rail cargo services between Nairobi and Mombasa, cancelling of satellite commuter train services, and retail sales disruptions due to road infrastructure disruptions, are expected to reduce Kenya's overall economic growth performance.

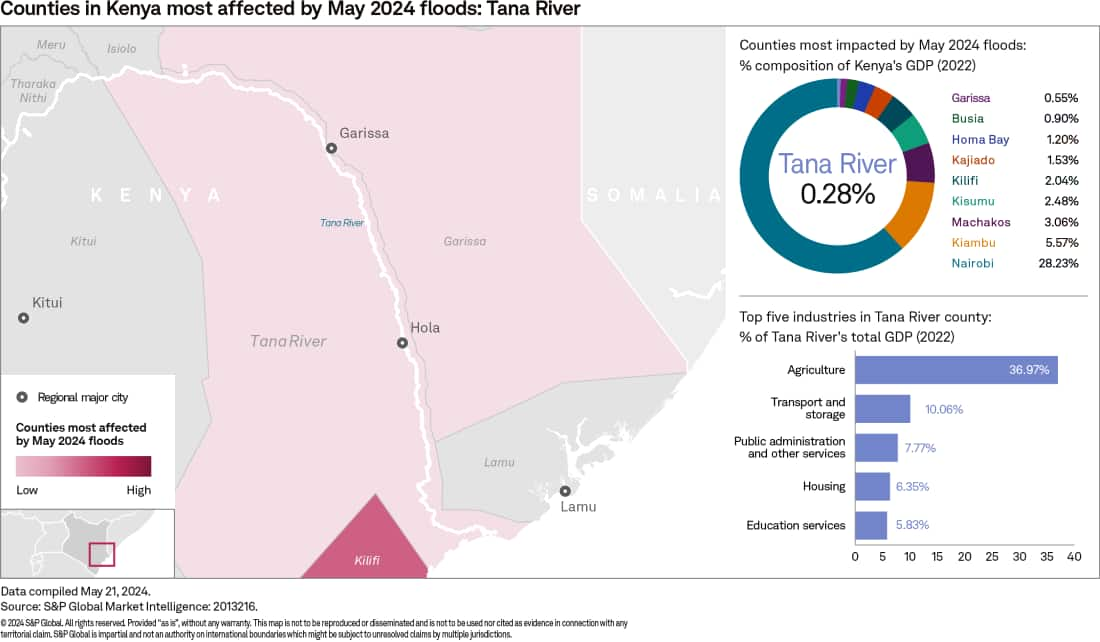

For other, much-smaller flood-impacted counties such as Garissa and Tana River, our Regional Explorer data shows that the agricultural sector accounts for over 30% of local GDP. In Kisumu county, economic activity is more diversified, encompassing transport and storage, agricultural production, and manufacturing.

The speed and efficiency of government mitigation programs will be a major indicator of the overall impact on these counties, as in previous flood years. Such programs include providing immediate relief and assistance to affected individuals and businesses, as well as implementing long-term strategies to enhance resilience. By providing targeted interventions, the government can help communities and businesses recover more effectively and minimize the long-term economic consequences of the floods.

Kenya's current-account balance

The growth in imports because of the floods will lead to overshoot on our prior estimate of Kenya's current-account deficit of 5.6% of GDP in 2024. This will be due to the increased demand for imported goods associated with investments as the government's infrastructure rehabilitation program gains momentum. Higher food imports also are likely given the disruptions in the domestic food supply chain caused by the floods.

We predict that exports of goods, particularly tea, will remain resilient. Tea plantations in Kenya are located primarily in highland areas. As a result, tea production is more vulnerable to adverse temperature fluctuations and insufficient rainfall or droughts than to floods.

The increase in flood-related imports may be partly offset by expanded remittances if expatriates provide additional financial support to households facing financial difficulties.

The widening current-account deficit threatens to put pressure on the Kenyan shilling in the second half of 2024, particularly in a stronger US dollar environment. In turn, this is likely to result in a slower pace of monetary easing by the Central Bank of Kenya. We had forecast the central bank's policy rate at 10% at end-2024, compared with the current level of 13%. However, the marginal increase in price pressures and greater need to defend the currency now make the policy rate likely to end 2024 at around 11%.

Kenya's fiscal position

The 2024 floods are likely to have significant adverse implications for Kenya's already strained fiscal position during fiscal years 2023/24 and 2024/25. The closure of rail cargo services and disruptions to retail sales have directly affected revenue generation. Additionally, the economic slowdown caused by the floods has led to reduced business activity and lower tax revenues.

The Kenyan Treasury projects revenue collection for the fiscal year (FY) ending in June 2024 will be 9.7% below target. To address this, the government has proposed spending cuts through a supplementary budget. Development spending will bear the brunt of these cuts. Implementing these cuts may require careful consideration to ensure that essential services and programs are not compromised.

Addressing the challenges in revenue collection is crucial for the government to maintain fiscal stability and meet its budgetary obligations. Kenya's fiscal position already was under pressure with recurring expenses consuming about 90% of revenue. Such financial constraints have already led to the cancellation of a US$1.3-billion road contract and a hold on new road projects until existing ones are completed.

It will require proactive measures to enhance revenue generation, such as exploring alternative sources of income and implementing effective tax collection strategies. Previous tax-raising measures have not always resulted in the expected revenue increase, and public opposition to new tax measures could restrict revenue collection.

Targeted strategies for recovery

By recognizing the diverse economic activities in flood-impacted counties, policymakers and stakeholders can develop targeted strategies to address the specific challenges faced by each sector. This includes providing financial support, infrastructure rehabilitation, and facilitating access to markets and resources.

Through a comprehensive understanding of the economic landscape in flood-impacted areas, Kenya can implement effective measures to support the recovery and growth of key industries, ensuring a more resilient and sustainable economy.

Listen to our podcast episode on South Africa's elections

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.