Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 05, 2019

January melt-up

Research Signals - January 2019

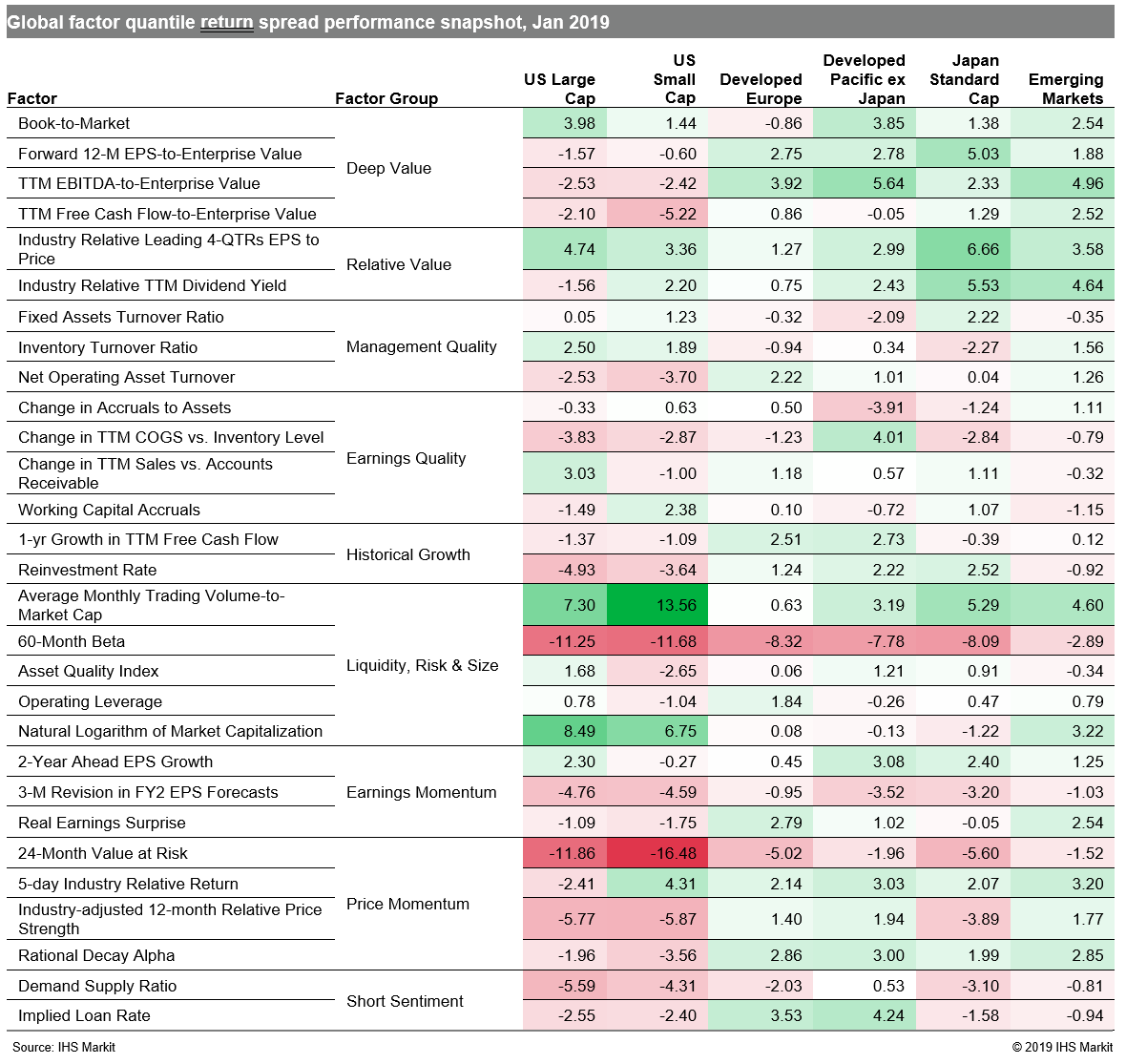

Contrary to the bitter cold temperatures that gripped a large swath of the US in January as the polar vortex sent frigid Arctic air southward, warming thoughts of patience from the Federal Reserve and other central banks and improving US-China trade developments sent stocks soaring in the first trading month of the year. In turn, high risk stocks heated up, resulting in negative performance from 60-Month Beta and 24-Month Value at Risk across all our coverage universes, reversing December's trends (Table 1). Investors must now wait and see if January's thawing of the December stock market chill will continue, while the global manufacturing sector slowed closer to stagnation, according to the January J.P.Morgan Global Manufacturing PMI which fell to its lowest reading since August 2016.

- US: High risk names outperformed, dragging down performance of 60-Month Beta and 24-Month Value at Risk, which both recorded significant double-digit negative spreads across large and small caps alik

- Developed Europe: 60-Month Beta was the weakest performing factor across our entire factor library, as investors took on more risk while also taking advantage of the market's attractive valuations, lifting performance of factors such as TTM EBITDA-to-Enterprise Value

- Developed Pacific: Valuation signals outperformed in Japan, as captured by factors such as Forward 12-M EPS-to-Enterprise Value and Industry Relative TTM Dividend Yield, at the expense of Price Momentum measures including Industry-adjusted 12-month Relative Price Strength

- Emerging markets: Following suit with our other coverage universes, short-term price reversal measures dominated factor performance, as demonstrated by 5-day Industry Relative Return

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjanuary-meltup.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjanuary-meltup.html&text=January+melt-up+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjanuary-meltup.html","enabled":true},{"name":"email","url":"?subject=January melt-up | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjanuary-meltup.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=January+melt-up+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjanuary-meltup.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}