Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 01, 2018

Indonesia manufacturing PMI points to softer demand conditions at start of Q4

- Manufacturing PMI Index at 50.5 in October, down marginally from 50.7 in September

- New business fall for first time in nine months

- Cost inflation surges, driven by weak rupiah

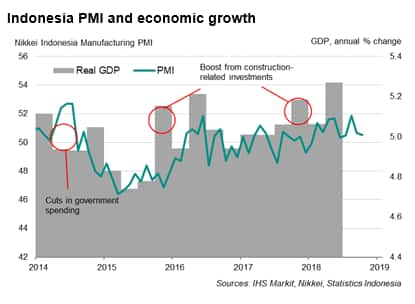

The latest PMI survey data indicated that the Indonesian manufacturing sector grew at a slower rate in October. The survey also brought signs of softening demand from not just external sources but also domestic, which bodes ill for business activity in coming months. Inflation pressures meanwhile intensified, largely driven by a weak rupiah.

Softer end to 2018?

The seasonally adjusted Nikkei Indonesia Manufacturing PMI™ fell slightly to 50.5 in October, down from 50.7 in September, signalling only a very slight improvement in the health of the factory sector. The latest reading was below the average seen over the first nine months of 2018.

Factory output rose modestly, but manufacturing orders fell (albeit only marginally) for the first time since January, with new export orders declining further.

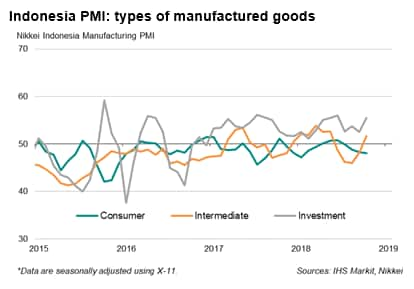

Analysis of output by types of manufactured goods indicated that a decline in the production of consumer goods was compensated by growth in output of intermediate goods (comprising supplies of inputs to other companies) and capital goods (such as plant and machinery).

However, October saw the first monthly decline in new orders since January, calling into question if Indonesia's manufacturing sector would end the year on a disappointing note. Export sales meanwhile fell further, continuing the decline for nearly a year.

While near-term risks seem tilted to the downside, the longer-term outlook appears more positive. Companies' expectations of future output continued to rise from June's low, reaching the highest for five months in October. Improved optimism boosted hiring, with jobs growth recorded for a fifth consecutive month.

Weak rupiah fuels inflation pressures

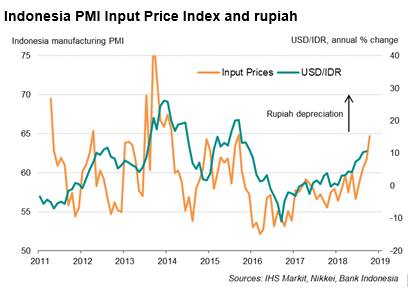

Price pressures meanwhile rose to a three-year high in October. Input cost inflation surged to the highest since early 2014 (a period of dramatic rupiah depreciation after the Fed announced plans to wind down its bond purchases). The rupiah has so far weakened 12% against the US dollar since the start of the year, albeit having shown signs of stability in recent weeks. Besides a weak exchange rate, higher global commodity prices also added to manufacturers' cost burdens.

Sharp cost increases led firms to raise factory gate prices at the fastest rate seen since late 2015.

Further rate hikes in store

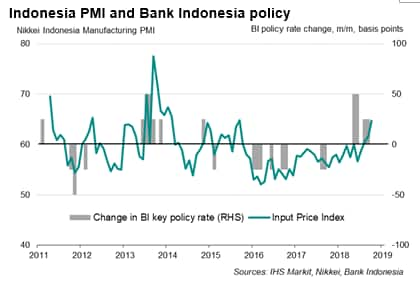

The pause in Bank Indonesia's monetary policy tightening during the October meeting is not seen as a signal that the central bank is turning away from its hawkish stance. Policymakers remain concerned that the rupiah remains vulnerable to financial market volatility ahead of a widely expected Fed hike in December and ongoing concerns about emerging markets. However, though the situation has become one of balancing risks: while the PMI price gauges largely supported the case for rate hikes, the survey also suggests that softening demand conditions may limit the extent to which the central bank can tighten policy before higher rates start to hurt business activity.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findonesia-pmi-points-to-softer-demand-conditions.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findonesia-pmi-points-to-softer-demand-conditions.html&text=Indonesia+manufacturing+PMI+points+to+softer+demand+conditions+at+start+of+Q4+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findonesia-pmi-points-to-softer-demand-conditions.html","enabled":true},{"name":"email","url":"?subject=Indonesia manufacturing PMI points to softer demand conditions at start of Q4 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findonesia-pmi-points-to-softer-demand-conditions.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Indonesia+manufacturing+PMI+points+to+softer+demand+conditions+at+start+of+Q4+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findonesia-pmi-points-to-softer-demand-conditions.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}