Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 09, 2018

Inditex dividend on sale

- We foresee 10% dividend growth for FY18 despite recent downwards revisions

- Fundamentals remain strong, amongst best in class in profitability and sales growth

- Our forecast reflects a payout of 70% with potential upside in the coming years

Inditex’s shares have plummeted in the last ten months, weighed on by fears over a slowdown in earnings and an ailing apparel sector across Europe. Despite this negative sentiment, we remain confident in Inditex’s dividend prospects and our forecasting growth of 10% CAGR in the next four years.

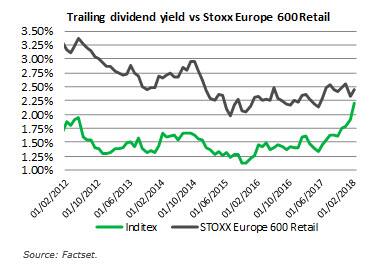

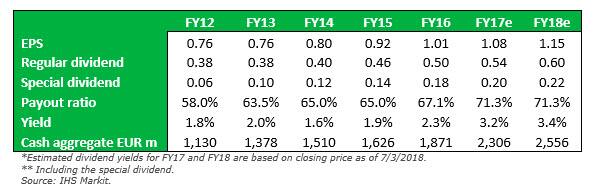

We are forecasting the firm to announce a regular dividend of €0.54 and a special dividend of €0.20 next week. This implies a forward yield slightly above 3%, its highest level since the financial crisis. Not only does the firm have an unbroken pattern of increasing its dividend since its IPO, it also has a very solid balance sheet and reported leading margin at Q3.

Should earnings disappoint, we consider the lower level of the dividend to be €0.73. We see more risk of upside surprise to our forecast, possibly reaching towards €0.77. This is because its online sales have potential to grow further without cannibalizing its physical store business model.

Fundamentals

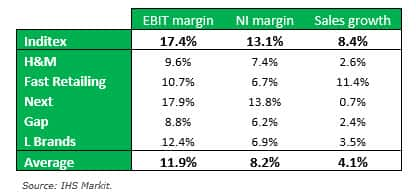

Delving into the fundamentals, we analysed the recent trend in profitability which shows slightly tighter operating margin, from 19.5% in FY13 to the current 17.4% reported on the 9M17 results. Despite the aforementioned trend, we should take into account that Inditex has been impacted by adverse currency exposures (EUR against USD, CNY and TRY) that dragged down its results by around 2-3% on sales in the past nine months. The company is still showing healthier margins and higher growth rate than its peers:

Sustainability

We remain our high confidence in the long term based on:

- Estimates are positive showing around 10% CAGR on sales despite the adverse currency swings; on Q317 impacted negatively on sales by 2.6%. Inditex is pushing its online sales which now represent around 2% of the overall revenues, nonetheless this is expected to soar in the coming years (13% boost in online sales during November and December of 2017).

- It holds a significant stock of cash which could push further dividends in the next years. Net cash position stood at €6b in Q317 (+24% year-on-year) which covers approximately 3 years of dividend payments. Brokers’ estimates show c.14% CAGR in net cash position for the next four years.

- Inditex shows healthy dividend growth driven by an increase in sales and virtually unchanged operating margins. Some industry peers have reduced payments (e.g. Next) and others have kept flat dividends despite dimmer fundamentals: H&M’s current EBIT margin stands at 9.6% ─ down from 16.9% in FY14 ─ whilst pushing the payout ratio from 80% in FY14 to the current 100%.

Conclusion

Ahead of the FY17 results presentation, which will be held on 14th March before market opening, we consider Inditex to be able to keep pushing shareholder remuneration further (+10% LFL estimated), supported by solid fundamentals. However, we also highlight the potential upside for the next years from the current c.70% payout to around 75-80% due to the estimated upward trend on sales and an increasing net cash position.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finditex-dividend-on-sale.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finditex-dividend-on-sale.html&text=Inditex+dividend+on+sale","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finditex-dividend-on-sale.html","enabled":true},{"name":"email","url":"?subject=Inditex dividend on sale&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finditex-dividend-on-sale.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Inditex+dividend+on+sale http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finditex-dividend-on-sale.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}