Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jul 28, 2023

By Chris Rogers and Deepa Kumar

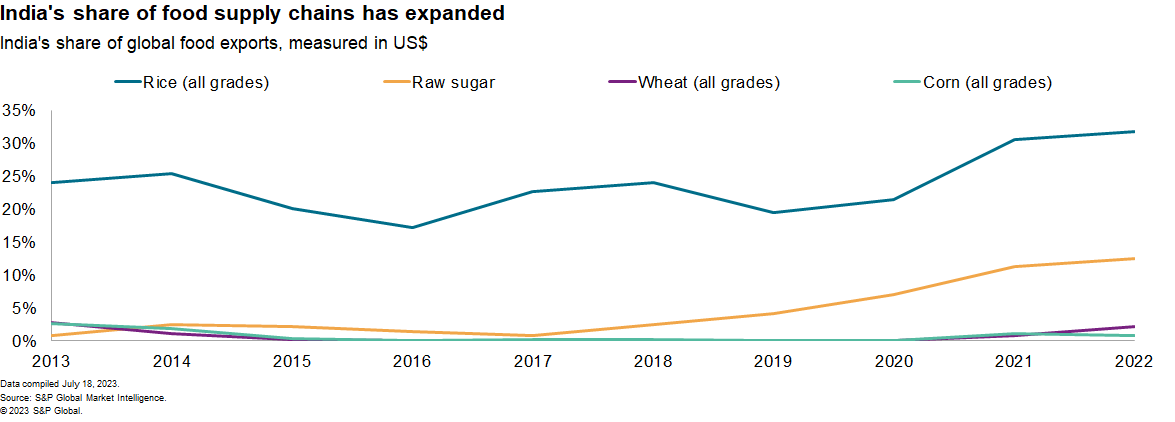

The Indian government has banned exports of non-basmati rice grades to tackle domestic food price inflation. India accounted for 32% of all rice exports in 2022 compared with 24% in 2013 as the government sought to boost export supplies.

The export controls may spread to other foodstuff. A similar ban last year does not appear to have affected exports, though this time the government may not issue as many exemptions.

The likelihood of an average monsoon season and resulting modest rice harvest is leading economists to upgrade their outlook for inflation for 2023 and 2024, putting pressure on the government to control living expenses. The emergent El Nino weather conditions may be a challenge for winter and spring production both in India and overseas.

The Modi government's policy platform is focused on seeking re-election in parliamentary elections scheduled for the second quarter of 2024 — the government, therefore, is unlikely to risk domestic instability stemming from food shortages and increasing food prices.

Listen to our podcast episode on India's global ambitions

Consumer price inflation in India reached 4.81% in June, led by a surge in food costs. Global market prices for rice have increased over the past year, with prices for delivery into the US, Thailand and Vietnam up by between 27% and 34% in July 2023 versus February 2022.

Global cereal supply chains more broadly are under pressure as a result of Russia's suspension of the Black Sea Grain Initiative. That raises the prospect both of substitution from other cereals to rice due to lower supply and the potential for the Indian government to extend its restrictions beyond rice to include wheat and sugar.

Growing market share: India's position in global food trade

India's importance for global food supply chains has expanded over time, measured by its share of global trade in foodstuffs. The Indian government has sought to prioritize an increased Indian share of global food supply chains as part of its geopolitical strategy.

The share of global exports of rice (of all grades) accounted for by India reached 31.8% in 2022. That made it the largest supplier nation ahead of Thailand's 14.2% share. India's share has increased from 24.0%, 10 years earlier.

There's a similar pattern for raw sugar, where India's share reached 12.4% in 2022 from an average 1.5% in the 2013 to 2017 period. Brazil was the number one supplier during that period, with a 36.2% share in 2022.

Spoonful, not sackful: Last year's export restrictions had little effect

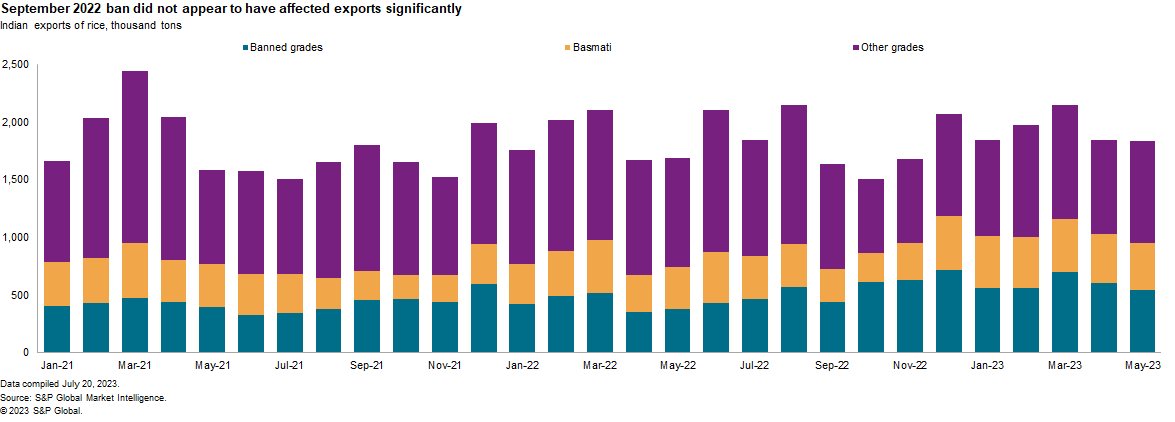

This year's export restrictions may have a bigger impact than the 2022 controls did. Market Intelligence data shows the rice grades affected by the ban accounted for 30.1% of India's 22.7 million metric tons of rice exported in the 12 months to May 31.

India's rice exports also do not appear to have fallen significantly in response to the September 2022 export ban, with a drop of just 4% in exports of the grades affected that month versus a year earlier.

A key difference between India's approach to food export controls following its September 2022 decision to ban non-basmati rice and its current decision would be reduced political bandwidth for considering exemptions.

If the new ban is effective, it will mostly affect lower-income countries. The largest destination markets for the banned rice grades in the first five months of 2023 were Kenya (518,000 metric tons, or 17.5% of the total), Benin (9.0%) and Togo (7.1%).

Learn more about our country risk and supply chain data and insights

Subscribe to our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.