Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jul 08, 2024

Nearly a half century of labor peace on the US East and Gulf coasts has been thrown into doubt with negotiations canceled on June 10 by the International Longshoremen's Association (ILA) as the clock ticks down to the expiration of the current contract on Sept. 30.

Unlike West Coast dockworkers, who worked for more than a year in 2022 and 2023 without a contract as a new deal was negotiated, the ILA says it will not work if no contract is in place — a possibility some longtime management sources contacted by the Journal of Commerce say they are taking seriously.

The union has thus ratcheted up pressure on the ocean carriers that dominate the United States Maritime Alliance (USMX), the employer group, to agree to robust wage increases the union feels it's entitled to given the all-time high profits earned by container lines during the pandemic.

Although the ILA's rationale for calling off future talks was its allegation that APM Terminals in Mobile utilized technology in violation of the current contract, a charge APMT rejected, the fate of the negotiations will hang on wages.

"The union views this current Master Contract negotiations with (USMX) as a pivotal moment for them, knowing that the member companies who employ ILA labor have made massive profits in recent years, while failing to reward the workforce responsible for these gains," the ILA said in a statement on June 12.

"When negotiations resume, the union expects to demand salaries and other benefits for ILA members that are as lucrative as the profits of USMX member companies," the union said. "The threat of a coast-wide strike on Oct. 1, 2024, is becoming more likely."

Such words are a sharp departure from the low-key, business-like approach to prior East and Gulf coast negotiations, and thus unfamiliar to shippers trying to weigh the risks.

Shippers who have come to trust labor to keep the peace at ports such as Houston, Savannah, Virginia and New York-New Jersey, among others, are now forced to consider alternative gateways such as Los Angeles-Long Beach.

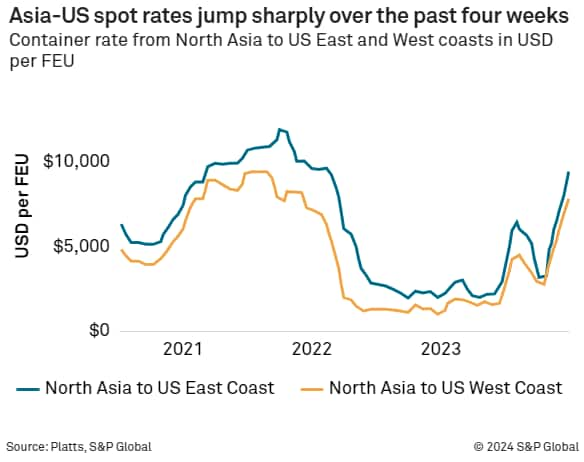

But West Coast routing options are limited by the current surge in import volumes combined with inadequate vessel and container equipment capacity, which has led to spot rates in the eastbound trans-Pacific to triple to over $7,000 per 40-foot container since mid-April.

Presidential politics in the mix

The paradigm is a new one. As of earlier this year, it was understood that the ILA wage levels would be benchmarked off the increase obtained by the International Longshore and Warehouse Union (ILWU) in its negotiations concluded last year.

But the position of the ILA now is an implicit rejection of that construct; the 32% wage increase obtained by the ILWU was far lower than the doubling of wage levels the union was seeking before it accepted a lower increase after intervention by the Biden administration.

That scenario is unlikely to be repeated on the East and Gulf coasts. It's an open question whether President Joe Biden will be able to exert the same level of influence on the ILA. For example, as an unabashedly pro-union president — the first president to walk on a picket line — it would be almost inconceivable for him to force the ILA back to work through a Taft-Hartley injunction, which was last used by George W. Bush in 2002.

The ILA endorsed Biden in March of 2020, but has yet to issue an endorsement in the current race, even though it has traditionally backed Democratic candidates. ILA President Harold Daggett met with former president Donald Trump earlier this year.

It's possible to envision how events could unfold. In the last weeks of the presidential campaign, Biden will not want to see a strike affecting the 43% of US imports that move through East and Gulf coast ports.

Biden's personal intervention in port congestion issues during the pandemic showed the political liability he faces from clogged up ports and its association in the popular imagination with inflation, one of his chief liabilities.

The ILA would point the finger at the carriers for holding up the negotiations, an argument that Biden would likely be receptive to given that he had no problem blaming carriers for the pandemic disruption (remember "I'd like to pop them"?). Carriers will be hard pressed to respond convincingly given that high rates and profits have reappeared over the past eight weeks.

Moreover, when interacting with US longshore labor, ocean carriers over many years have capitulated to union demands based on a desire to keep cargo, ships and other assets flowing, leading to the six-figure incomes enjoyed by full-time dockworkers.

One thing is clear: The risks associated with East and Gulf ports have gone up exponentially.

*This article was published on June 18, 2024 by the Journal Of Commerce

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly Insights Newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

How can our products help you?