Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 14, 2018

IHS Markit US PMI surveys indicate price pressures at highest since mid-2011

- IHS Markit PMI survey data indicate steady economic growth and solid job gain in April

- Expansion accompanied by highest price pressures since June 2011

IHS Markit's PMI surveys indicate that the US economy started the second quarter on a solid footing, commensurate with a robust increase in GDP. However, the surveys also point to accelerating inflationary pressures.

Steady solid growth

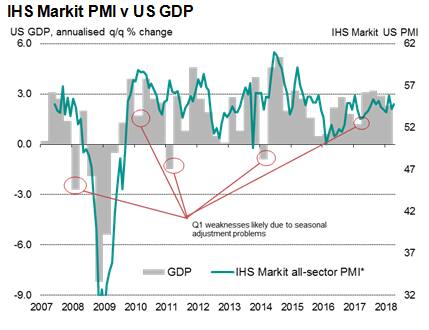

IHS Markit produces two PMI surveys in the US: a manufacturing survey is accompanied by a sister survey of private sector services companies. Weighted together, the two polls provide accurate insights into economic growth, employment and price trends. In recent months, the surveys have pointed to annualized GDP growth of approximately 2.5% in the first quarter of 2018, with a slight uptick in the pace of growth signaled in April.

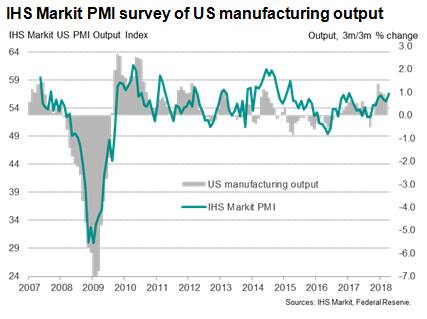

The PMI survey's output index has advantages for investors over GDP: it's available monthly and provides an accurate guide to the underlying trend and turning points in the economy (importantly, avoiding some of the volatility in GDP data caused by residual seasonality). The IHS Markit data have also provided more reliable indications of manufacturing output and GDP growth than other surveys, including those conducted by the ISM.

Likewise, the surveys' employment indicators have been indicating monthly non-farm payroll growth of just over 200,000 on average so far this year.

Turning points

The more interesting development, however, has been in terms of prices, especially with eyes focusing on the pace of policy tightening at the Fed.

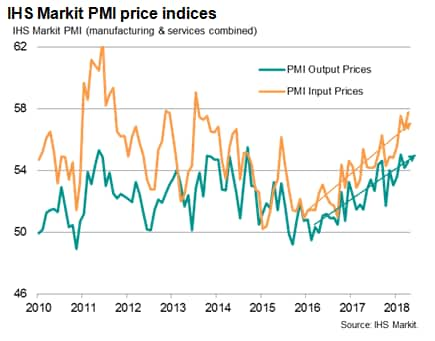

The surveys cover both input costs and selling prices for goods and services. Input costs across the two sectors rose in April at a rate not seen since July 2013. Average selling prices meanwhile showed the third-largest rise since September 2014.

In addition, the manufacturing PMI suppliers' delivery times index acts as a particularly useful advance guide to changing price pressures, indicating the development of either buyers' or sellers' markets.

For example, busier suppliers mean longer delivery times, which in turn mean suppliers have more pricing power as demand exceeds supply.

April saw supplier delays reach the highest since February 2014, suggesting suppliers will have more scope to hike prices for goods heading to factories.

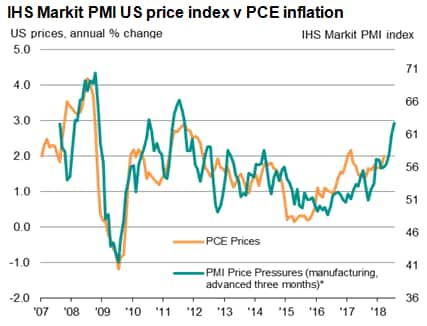

To gauge consumer price developments, a useful construct is an index based on both input costs and suppliers' delivery times. This "price pressures" index exhibits a 77% correlation with CPI inflation, and a 78% correlation with inflation as measured by the annual change in official PCE prices. In April, this price pressures gauge rose to its highest since June 2011.

Equally useful is the manufacturing input price index, which exhibits a 79% correlation with both PCE and CPI inflation with a lead of one month.

Comparisons of the IHS Markit price gauges clearly signaled a rise in PCE inflation above 2.0% in April, and suggest the rate of inflation has further to climb.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

Email: chris.williamson@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-us-pmi-surveys-indicate-price-pressures.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-us-pmi-surveys-indicate-price-pressures.html&text=S%26P+Global+US+PMI+surveys+indicate+price+pressures+at+highest+since+mid-2011+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-us-pmi-surveys-indicate-price-pressures.html","enabled":true},{"name":"email","url":"?subject=S&P Global US PMI surveys indicate price pressures at highest since mid-2011 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-us-pmi-surveys-indicate-price-pressures.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+Global+US+PMI+surveys+indicate+price+pressures+at+highest+since+mid-2011+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-us-pmi-surveys-indicate-price-pressures.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}