Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

COMMENTARY

Jan 16, 2020

IHS Markit Fair Value Case Study

Tokyo Stock Exchange Holiday

December 31, 2019 - January 5, 2020

IHS Markit Fair Value in Review

The Tokyo Stock Exchange was closed from December 31st through

January 5th to celebrate the New Year. In the absence of readily

available quotes, IHS Markit provided fair value prices for

Japanese securities during this holiday. Using fair value pricing

ensures that long-term investors in the fund benefit from the most

accurate share price possible.

On January 4, 2020, a top Iranian commander was killed during U.S.

airstrikes, thus escalating U.S./Middle East tensions and leading

to a slump across the global markets. Since Japan markets were

closed during this time, they could not react to this event, but

our multifactor fair valuation model successfully captured these

events for the Japanese stocks.

IHS Markit Fair Value Results

Throughout the Tokyo stock exchange holiday, IHS Markit continued

to provide fair value prices, calculated using patent-pending

multi-factor methodology, for 3000+ Japanese securities. Global,

regional, sector, and entity specific factors were used to indicate

macro and micro level risks. The most common input factors in the

IHS Markit Japanese fair valuation models included:

• iShares MSCI Japan ETF

• S&P Futures

• Nikkei Futures

• Sector ETFs

• Japanese ADRs

• Currency JPY.USD

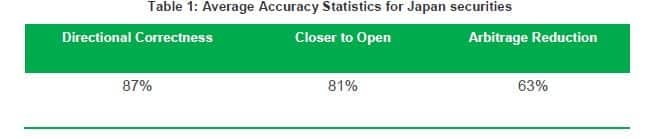

Table 1 highlights average directional correctness, closer to open

and arbitrage reduction for IHS Markit's Japanese universe

respectively during the exchange holiday. These metrics are defined

in the appendix on page five. The table indicates that the fair

value prices of 2300+ Japanese securities (81%) were closer to the

open price when Japan resumed trading on January 6, 2020.

Japan's Nikkei 225 Index in Aggregate

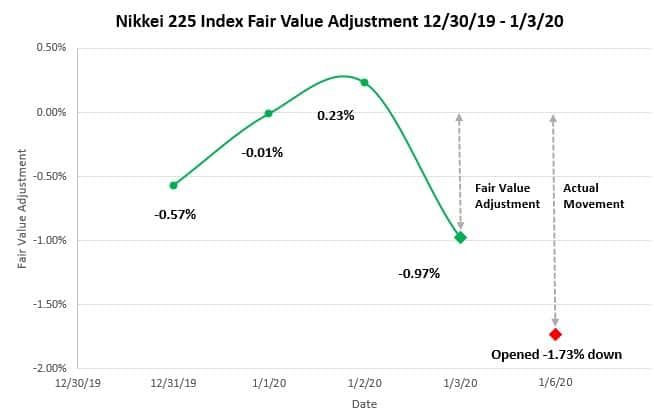

On December 31, 2019, a pro- Iranian militia stormed the U.S.

embassy in Iraq, drastically escalating an already tense

relationship between the two nations. As seen in the chart below,

global factors contributed to an aggregate decrease of -0.57% in

our fair valuation of the Nikkei 225.

In the two days following the incident, the protestors dispersed,

and world markets readjusted, causing our fair valuation of the

Nikkei 225 to increase back above the December 31st close.

Things changed on January 3, 2020 when Qasem Soleimani, Iran's most

influential military figure, was killed in an air raid. The markets

were swift to respond and our last fair valuation of the Nikkei 225

saw a nearly 1% drop from last close.

The chart below tracks the fair value adjustment of the Nikkei 225

throughout the closure.

Chart 1: Nikkei 225 Fair Value Adjustment Large cap with

significant movement

Large cap with

significant movement

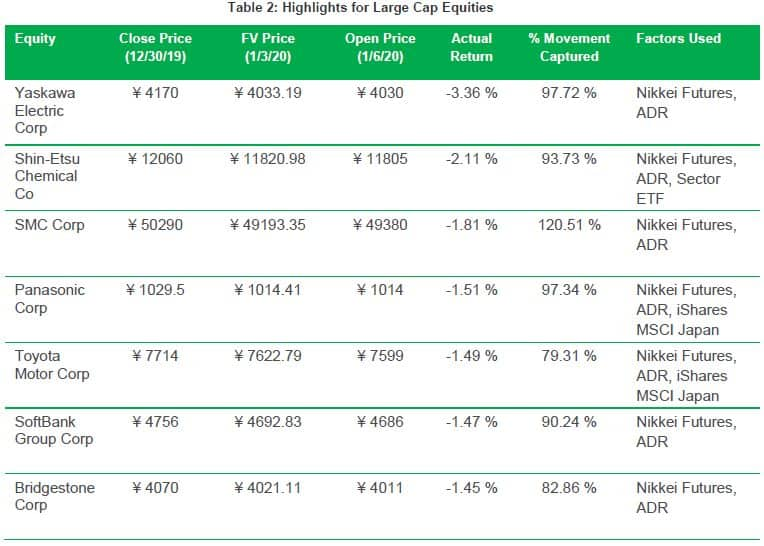

The majority of the Japanese stocks opened down after the

New Year's holiday. Table 2 outlines how IHS Markit's Fair Value

captured a significant amount of holiday movement in some of the

largest Japanese securities in terms of market cap.

IHS Markit's Fair Value service helps clients meet their regulatory

and compliance requirements by providing daily fair value

adjustment factors and prices for over 150,000 equity and fixed

income securities. We provide security-level as well as

aggregate-level fair value adjustment factors across global hourly

snaps with the ability to add custom snap times tailored to client

requests. Visit our product

page or contact:

MK-FixedIncomePricingBusinessDevelopment@ihsmarkit.com to learn

more.

.............................................................................................................................................................................

Appendix

Directional Correctness: occurs when a

fair value price is in the same direction (+, -) as the actual

overnight return of the underlying security. The values present in

the document are the proportion of securities within a group that

were directionally correct.

Closer to Open: whether a fair value price is

closer to the next day open than the previous close. The values

present in the document are the proportion of securities within a

group that were closer to open.

Arbitrage Reduction: the amount of the movement in

the underlying security that we captured using our Fair Value

price. These values can be positive or negative, with 100% being

full capture. For tables 1 and 2, the values are the average

arbitrage reduction across the group.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-fair-value-case-study.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-fair-value-case-study.html&text=S%26P+Global+Fair+Value+Case+Study+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-fair-value-case-study.html","enabled":true},{"name":"email","url":"?subject=S&P Global Fair Value Case Study | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-fair-value-case-study.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+Global+Fair+Value+Case+Study+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-fair-value-case-study.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}