Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 15, 2019

IHS Markit European GDP Nowcasts Update 15th August 2019: Nowcasts suggest economic weakness has stretched into third quarter

In July 2019 we introduced two nowcasting models for the eurozone and the UK. The models utilise a range of data widely used to track economic developments and provide timely estimations of quarterly GDP growth.

As the datasets include information provided from business surveys, official statistics offices and the financial markets, there is a steady flow of new data available to us during a quarterly nowcasting cycle. With our model frameworks comfortably able to incorporate this new information in a statistically efficient manner, this calls for regular, real-time, nowcast updates which we present in this new report.

Alongside the nowcasts for the eurozone and the UK, we have also been able to extend our coverage to include updates for France, Germany and Italy.

Summary: 15th August 2019

Following the release of second quarter GDP estimates for the major European countries, we have updated our judgement-free nowcasts for the third quarter.

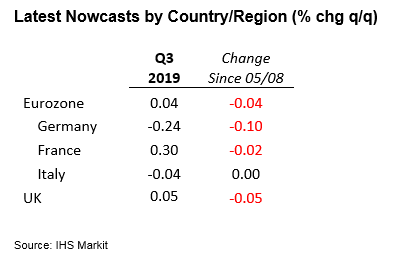

While there has been little in terms of Q3 data since our last update (5th August), second quarter GDP figures have shown that growth momentum across Europe has hit a bump in the road. Whether this is the beginning of a slower growth phase for the continent remains to be seen; however, with the exception of Italy, all nowcasts have been downwardly revised.

Starting with the eurozone, the model predicts that the economy will lose further steam in the third quarter, projecting a 0.04% q/q expansion (previously 0.09% q/q). The downgrade in our estimate was steered by negative industrial production data for June, while the signal from the July PMI surveys suggest that this weakness has persisted into the third quarter.

The largest change was with Germany, where our nowcast for the third quarter was downwardly revised by 0.1 percentage points to -0.24%q/q. Again, strong headwinds to German manufacturers remain at large. Export demand and industrial output are projected to struggle through the third quarter by our model. Meanwhile, the July services PMI survey showed signs of weaker services activity growth. As a result, our Q3 estimate suggests that the underlying trajectory of the German economy is clearly skewed to the downside.

The remaining euro area countries, France and Italy, saw little change. A modest expansion of 0.30% q/q is projected for France for Q3, marginally lower than the previous growth forecast (0.32% q/q). For Italy, our third quarter nowcast is unchanged at -0.04% q/q. While political risk has flared up once again, we await August PMI data for signs of an economic impact.

Across the channel, our nowcast rightfully picked up the contraction seen in the second quarter for the UK, although the unwinding of Brexit stockpiling, which manifested itself through a sharp quarter-on-quarter drop in imports, meant our nowcast was slightly higher than the official outturn. The prospects for Q3 seem little-improved based on our latest nowcast, which is projecting a sluggish expansion of 0.05% q/q in Q3 (previously 0.1% q/q).

Joe Hayes, Economist, IHS Markit

Tel: +44 1491 461006

joseph.hayes@ihsmarkit.com

Paul Smith, Director, IHS Markit

Tel: +44 1491 461038

paul.smith@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-european-gdp-nowcasts-suggest-economic-weakness-has-stretched-into-q3-aug19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-european-gdp-nowcasts-suggest-economic-weakness-has-stretched-into-q3-aug19.html&text=S%26P+Global+European+GDP+Nowcasts+Update+15th+August+2019%3a+Nowcasts+suggest+economic+weakness+has+stretched+into+third+quarter+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-european-gdp-nowcasts-suggest-economic-weakness-has-stretched-into-q3-aug19.html","enabled":true},{"name":"email","url":"?subject=S&P Global European GDP Nowcasts Update 15th August 2019: Nowcasts suggest economic weakness has stretched into third quarter | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-european-gdp-nowcasts-suggest-economic-weakness-has-stretched-into-q3-aug19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+Global+European+GDP+Nowcasts+Update+15th+August+2019%3a+Nowcasts+suggest+economic+weakness+has+stretched+into+third+quarter+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-european-gdp-nowcasts-suggest-economic-weakness-has-stretched-into-q3-aug19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}