Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 22, 2019

IHS Markit European GDP Nowcasts

In July 2019 we introduced two nowcasting models for the eurozone and the UK. The models utilise a range of data widely used to track economic developments and provide timely estimations of quarterly GDP growth.

As the datasets include information provided from business surveys, official statistics offices and the financial markets, there is a steady flow of new data available to us during a quarterly nowcasting cycle. With our model frameworks comfortably able to incorporate this new information in a statistically efficient manner, this calls for regular, real-time, nowcast updates which we present in this new report.

Alongside the nowcasts for the eurozone and the UK, we have also been able to extend our coverage to include updates for France, Germany and Italy.

Summary: 22nd August 2019

Today's flash August PMI data for the euro area provide a timely opportunity to update our nowcasting models for the third quarter of 2019.

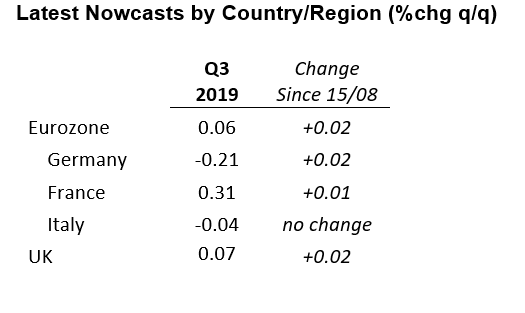

PMI data generally came in a little firmer-than-expected when compared to model predictions, the net effect being slightly firmer nowcasts for the euro area, Germany and France when compared to last week.

There nonetheless remains notable divergences across the region, with Germany (-0.21%) still expected to record a contraction in economic output, compared to solid growth seen in France (+0.31%).

Differences continue to primarily reflect relative exposures to global trade flows, with German manufacturers enduring another torrid month in terms of output and order books according to the August PMI figures. Notably, German flash PMI data provide signs of spillover into domestic markets: although the services sector continued to record solid growth, this was achieved via a solid reduction in backlogs of work as new business growth hit its lowest level since the start of the year. Moreover, overall business expectations for the next year have turned negative for the first time since October 2014. Whilst we await official production data for July (available mid-September) for greater clarity, our modelling continues to suggest Germany is in technical recession.

Based on the current newsflow, euro area growth is subsequently likely to be minimal at best in the third quarter - just +0.06%, according to the latest estimate, a slight improvement on last week's +0.04% q/q.

With little in the way of new data available for Italy, the third quarter nowcast remains unmoved at -0.04% q/q. Given recent political developments, interest will surely be raised for the August PMI data due for release at the start of September.

Finally, there is little cheer over in the UK, with growth here also forecast to be minimal at just +0.07% q/q. Given the recent gyrations in the official GDP data following the build-up - and then unwinding - of stocks in the first half of the year due to the proposed departure from the EU in March, nowcast uncertainty nonetheless remains elevated.

Joe Hayes, Economist, IHS Markit

Tel: +44 1491 461006

joseph.hayes@ihsmarkit.com

Paul Smith, Director, IHS Markit

Tel: +44 1491 461038

paul.smith@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-european-gdp-nowcasts-220819.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-european-gdp-nowcasts-220819.html&text=S%26P+Global+European+GDP+Nowcasts+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-european-gdp-nowcasts-220819.html","enabled":true},{"name":"email","url":"?subject=S&P Global European GDP Nowcasts | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-european-gdp-nowcasts-220819.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+Global+European+GDP+Nowcasts+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-european-gdp-nowcasts-220819.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}