Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 30, 2020

IHS Markit Daily Global Market Summary 30 April

The torrent of economic and earnings releases coupled with a tepid reaction to the outcome of today's ECB meeting led to a sell-off in global equity markets. European credit closed modestly lower, while US credit started off weaker, but both CDX IG/HY ended unchanged on the day. European equity markets declined the most on the day, while the region's benchmark government bonds generally closed higher.

Americas

- US initial claims for unemployment insurance, at 3,839,000 in the week ended 25 April, remained at historically high levels, although below the all-time high of 6,867,000 in the week ended 28 March. In the last six weeks, 27.883 million people (not seasonally adjusted) have filed for unemployment benefits—17.1% of the entire civilian labor force. (IHS Markit Economist Akshat Goel)

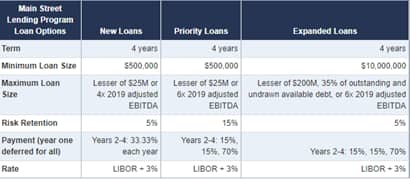

- The Federal Reserve Board announced it is expanding the scope

and eligibility for the Main Street Lending Program. Businesses

with up to 15,000 employees or up to $5 billion in annual revenue

are now eligible, compared to the initial program terms, which were

for companies with up to 10,000 employees and $2.5 billion in

revenue. Two of the changes that stood out were the (1) 15%

retention requirements for the Priority Loans versus 5% for the

other programs and (2) the loan rate being changed from a range of

SOFR +200-400bps to a standard +300bps spread benchmarked to either

1mo or 3mo LIBOR. Here is summary of the programs' options (Federal

Reserve):

- US equity markets closed lower today; Russell 2000 -3.7%, DJIA -1.2%, S&P 500 -0.9%, and Nasdaq -0.3%. The S&P 500 was -1.6% at its lowest point at 12:30pm ET, which coincided with the day's 10yr US govt bond's peak price.

- Amazon warned that keeping workers healthy and products moving could cost an additional $4 billion or more in the next quarter, wiping out any gain from a jump in sales as the coronavirus pandemic puts stresses on its vast network. The company reported record first-quarter net sales of $75.5 billion, which beat the Street's estimates, even while its operating expenses increased significantly to $71.5 billion, up from $55.3 billion a year ago. (FT)

- Results from three late-stage trials investigating the safety and efficacy of Gilead Sciences' (US) broad spectrum antiviral remdesivir were released on 29 April, providing an optimistic yet cautious outlook on the leading coronavirus disease 2019 (COVID-19) treatment. It remains to be seen whether the development will facilitate licensing deal agreements that could expand remdesivir access to the rest of the world. Pricing and manufacturing capacity will likely play a large role in this process. In March, Chinese firm BrightGene announced that it had started mass production of remdesivir with the aim of securing a licensing deal with Gilead. The company was quickly reprimanded by the Shanghai Stock Exchange over the claims, given that it was not granted authorization by China's drug regulator or authorization from Gilead before commencing production. The drug is patented globally, but compulsory licensing could pose challenges if mutual agreements fail. (IHS Markit Life Science's Margaret Labban)

- 10yr US govt bonds closed +2bps/0.64% yield, but yields rallied to as low as 0.58% at 12:30pm ET before selling off 6bps by the close.

- US personal income decreased 2.0% in March and real personal consumption expenditures (PCE) fell by 7.3%. The personal saving rate shot up from 8.0% to 13.1%, the highest since 1981. Within goods, the leading contributor to the decrease in real PCE was spending on motor vehicles and parts (down 26.2%). Partially offsetting the decreases in many goods categories was an increase in spending for food and beverages purchased for off-premises consumption (up 19.1%). Spending on recreational services (down 29.7%), food services and accommodations (down 25.9%) and healthcare (down 16.2%) showed among the most severe declines within services. (IHS Markit Economists James Bohnaker and David Deull)

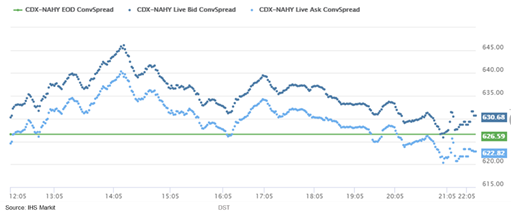

- IHS Markit's CDX-NAIG closed unchanged/87bps; CDX-NAHY was as

low as +16bps at 9:11am ET, but tightened during the remainder of

the day to close unchanged/627bps

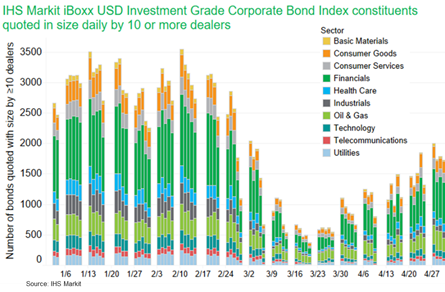

- The below chart indicates the number of constituents of IHS

Markit's iBoxx USD Liquid Investment Grade index that are quoted in

size (≥$1 million) by 10 or more dealers daily this year. The chart

highlights the drop off in liquidity in March, which began to

recover on 30 March. Data shows that conditions continue to improve

but are still far from the 2020 peak levels reported in

mid-February.

- Tesla has reported making a profit for a third consecutive quarter and a revenue increase of 31.8% year on year (y/y) in the first quarter. With the Model Y being in production and the company's Shanghai plant online, Tesla's Model 3 and Y deliveries jumped 49.8% y/y in the first quarter. The electric vehicle (EV) manufacturer's automotive revenue was assisted by receiving USD354 million from the sale of regulatory credits. Tesla's first-quarter results benefited from a comparison with a previous quarter when it had only one plant and three models in production, instead of two and four respectively in first quarter 2020. Tesla's ability to report a profitable first quarter was also assisted by an increased sale of regulatory credits, although excluding those credits, the company still reported an automotive gross margin of 20%. Tesla stated it has the capacity installed to exceed 500,000 vehicle deliveries in 2020, although the uncertainty over ramping operations back up in the US is ongoing. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Frozen foods have surged in popularity as a result of the COVID-19 crisis and according to a new survey from the American Frozen Foods Institute (AFFI) the trend is likely to continue after the pandemic subsides. According to the survey, sales of frozen foods remain strong even after an unprecedented, 94% panic-buying surge in mid-March. For April, frozen foods purchases maintained a 30% to 35% increase compared to purchases in the same month last year. More importantly, 7% of the consumers who bought frozen food in that period were buyers who said they never or rarely bought frozen food before the pandemic - a change the survey categorizes as an "important win" for the frozen foods industry. (IHS Markit Agribusiness' Margarita Raycheva)

- Crude oil closed +25.1%/$18.84 per barrel.

- The initial impacts of the COVID-19 containment efforts and the rapid drop of energy prices sent Dow's earnings and revenue lower in the first quarter. The company reported first-quarter net income from continuing operations of $258 million, down 24% year-on-year (YOY). Net sales of $9.8 billion were down 11% YOY due mainly to the impact of lower global energy prices. Reported operating earnings were 59 cts/share, down 40% YOY and 1 ct above consensus estimates. The company also plans to cut expenses by $350 million in 2020 and reduce its capital expenditure target to $1.25 billion, down from previous estimates of $1.5-$1.75 billion, representing a $750-million reduction versus 2019 levels.

- In a press release, ConocoPhillips reported first-quarter 2020 loss of $1.7 billion, compared with first-quarter 2019 earnings of $1.8 billion. The decrease in earnings reflected a change in Cenovus Energy equity market value, lower realized prices and price-driven non-cash impairments, the company said. (IHS Markit Upstream Companies and Transaction's Karan Bhagani)

Europe/Middle East/ Africa

- The first-quarter Eurozone GDP contraction of 3.8% quarter on quarter (q/q) was the biggest since the inception of the eurozone in 1999 (see first chart below) and a little larger than market consensus expectations (-3.5% q/q). The prior record q/q contraction was 3.2% in the first quarter of 2009 amid the global financial crisis. The latest batch of activity data in the eurozone is again exceptionally weak, but the worst of the news is yet to come. The lockdowns have generally been in place across member states for a larger proportion of the second quarter than the first and in some cases were made more stringent only from mid- to late-March onwards. (IHS Markit Economist Ken Wattret)

- The European Central Bank's (ECB) key announcements following today's policy meeting included:

- A further easing of the terms applied to targeted longer-term refinancing operations (TLTRO III). The interest rate during the period from June 2020 to June 2021 will be 50 basis points below the average interest rate on main refinancing operations (currently at zero).

- The introduction of a new series of non-targeted pandemic emergency longer-term refinancing operations (PELTROs) aimed at preserving the smooth functioning of money markets by providing an effective liquidity backstop.

- The Governing Council expecting the key ECB interest rates to remain "at their present or lower levels" until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2%. (IHS Markit Economist Ken Wattret)

- According to Federal Statistical Office (FSO) data, German real retail sales excluding cars declined by 5.6% month on month (m/m; seasonally and calendar adjusted) in March, following average increases of around 1% in January-February and a generally upward tendency since November 2019. Major categories of the price-adjusted y/y data for March (total -2.8% y/y) reveal the largest divergences between food (8.9%) and non-food sales (-10.1%) ever measured. Among non-food sales, internet and mail orders (up by 13.4% y/y) and pharmaceutical and cosmetic goods (up by 7.0%) understandably escaped the declines elsewhere. Declines were most extreme for textiles and shoes at -52.6% and sales at general department stores at -30.5% y/y. The two remaining broad categories, 'specialty stores such as for toys, books, jewelry' and 'furniture/household goods/DIY' posted declines of around -18% y/y. (IHS Markit Economist Timo Klein)

- Daimler has posted a net profit of EUR168 million (USD182.9 million) in the first quarter of 2020, a decline of almost 13 times from EUR2.149 billion in the first quarter of 2019. According to a company statement, this figure was generated from revenue of EUR37.2 billion, down 6% from EUR39.7 billion in the first quarter of 2019. (IHS Markit AutoIntelligence's Tim Urquhart)

- BASF's first-quarter group earnings before interest and tax (EBIT) before special items was down 6% to €1.64 billion ($1.78 billion). The company beat average analysts' projections of €1.47 billion. Net income in the quarter was down 37% to €885 million. BASF late on Wednesday pulled its outlook for 2020 of €60-63 billion sales and €4.2-4.8 billion EBIT, saying it is impossible to estimate the duration and severity of the pandemic. The company provided an update on some of its capital expenditure (capex) projects and said the timeline of some might be changed. It emphasized, however, that the company's strategic investments in battery materials in Europe and the establishment of a fully integrated petrochemical complex in China remain a priority. CEO Martin Brudermüller said the company was reviewing its investment projects and would reduce capex to about €2.8 billion ($3.0 billion) in 2020. "Initially, we had budgeted €3.4 billion for this year. However, I clearly want to emphasize that we are fully committed to our long-term growth projects in Asia and our expansion in battery materials."

- France's GDP declined 5.8% quarter on quarter (q/q) during the first quarter, according to seasonally adjusted 'flash' figures released by the National Institute of Statistics and Economic Studies (Institut national de la statistique et des études économiques: INSEE). The quarterly contraction during the first quarter was the largest since the series started to be collected in 1949. As a reference, the largest q/q decline since the 2008-09 global financial crisis had been -1.6% q/q during the first quarter of 2019. The previous record contraction was -5.3% q/q during the second quarter of 1968, when the economy was hit by student protests and general strikes. France's GDP had already contracted by 0.1% q/q during the last three months of 2019. The first-quarter figures are extraordinarily dire, but the contraction in activity during the second quarter will be even greater. (IHS Markit Economist Diego Iscaro)

- Michelin has announced that its revenues during the first quarter fell by 8.3% year on year (y/y). The company said in a statement that for the three months ending 31 March, its sales retreated from EUR5,809 million to EUR5,327 million. It stated that passenger car and light truck tire markets dropped 15% y/y globally after automakers suspended production and consumers went into isolation, while the truck tire markets fell by 17% y/y. However, added that there has been some resilience amongst customers of specialty tires, including certain mining markets and the Replacement agricultural tire markets showed some signs of resilience. (IHS Markit AutoIntelligence's Ian Fletcher)

- According to the national statistical office, the Spanish economic upturn ended abruptly in the first quarter of 2020. Specifically, real GDP is estimated to have shrunk by a record 5.2% quarter on quarter (q/q) in the first quarter, the first drop since the second half of 2013. In annual terms, the economy was down by 4.1% year on year (y/y) in the first quarter, down dramatically, from a 2.0% gain in 2019. In the April forecast update, we anticipate a deep recession in 2020, the first since the third quarter of 2013. The number of foreign visitors to Spain will remain very low during the remainder of this year. Spain's sizeable tourism sector, which accounted for 14.6% of GDP in 2018 (source: World Travel and Tourism Council or (WTTC) and employed 3.4 million workers in the same year. Foreign visitors spent EUR68.4 billion (USD82.1 billion) in Spain, or 16.6% of total exports. The WTTC estimated that Spain received 85 million foreign visitors in 2019. (IHS Markit Economist Raj Badiani)

- The ISTAT estimates that the Italian economy shrunk by 4.7% quarter on quarter (q/q) in early 2020. This implies Italy is now in a technical recession (defined as two successive quarters of q/q decline) after contracting by 0.3% q/q in the fourth quarter of 2019. IHS Markit believe social distancing measures remaining intact into April will trigger a sharper GDP drop in the second quarter. In IHS Markit's April forecast update, we anticipate Italy will remain in deep recession during the first half of 2020 before growth returns in the remainder of this year. Our current baseline assumes that the national lockdown will be extended into May, with the restrictions being eased gradually from the middle of the month. Therefore, we expect the economy to contract by 6.0% during 2020 (revised down from the previous forecast of 3.5% drop). (IHS Markit Economist Raj Badiani)

- Passenger car production in the UK fell by 37.6% year on year (y/y) during March due to coronavirus disease 2019 (COVID-19) virus-related stoppages. According to the latest data published by the Society of Motor Manufacturers and Traders (SMMT), output this month slipped from 126,195 units to 78,767 units. Of this total, production destined for export markets retreated by 37.8% y/y to 61,798 units, as those for domestic sale contracted by 36.8% y/y to 16,969. (IHS Markit AutoIntelligence's Ian Fletcher)

- Brent Crude closed +9.3%/$26.48 per barrel.

- Dirty tanker freight rates have fallen significantly in the past few days on the back of the OPEC+ output cut and a narrowing of the contango amid reluctance from banks to fund risky trading strategies, according to market sources. Rates on the busy very large crude carrier (VLCC) Middle East to China route have almost halved to Worldscale (WS) 116.25 points on Wednesday, which works out to a time charter equivalent (TCE) of $126,266/day, data from the Baltic exchange showed. This compares with a high of WS 212.71 on April 1 as tankers were snapped up for use as floaters and long-haul voyages as oil prices tumbled. Ship brokers said that there are now more tankers chasing after fewer cargoes, which suggest further falls to rates are likely probably after the holidays in Singapore on Friday and in the UK on Monday. (Commodities at Sea's Rajendran Ramasamy)

- Saudi Arabia's budget and the central bank's foreign reserves have deteriorated already despite the impact of the oil price and the COVID-19 crisis not yet being fully reflected. Saudi Arabia's central government budget posted a deficit equal to SAR34.1 billion (USD9.1 billion) in the first quarter of 2020, the budget performance report of the Saudi finance ministry showed. Total revenues declined by 21.7% on the year, while spending went up by 4.0%. The first quarter of 2019 had seen a SAR27.8-billion surplus. The budget ratio will balloon in 2020 to around 15% of GDP as revenues drop further, and the finance ministry will try to support economic activity to the extent possible. (IHS Markit Sovereign Risk's Ralf Wiegert

- Shell reported first quarter 2020 loss of $24 million, down from income of $6,001 million in the first quarter 2019. Adjusted earnings, which are on a current cost of supply (CCS) basis excluding special items, were $2,860 million, down 46% from $5,301 million a year ago, reflecting lower realized oil, gas and LNG prices, weaker realized refining and chemicals margins as well as lower sales volumes, partly offset by favorable movements in deferred tax positions and lower operating expenses, the company said. Chemical earnings excluded identified items were $148 million, down 67% from $451 million a year ago. The decrease reflected weaker realized base chemicals and intermediates margins as well as higher operating expenses, the company said. (IHS Markit Upstream Companies and Transaction's Karan Bhagani)

- UK offshore drilling contractor Valaris reported a net loss attributable of USD3.01 billion for first quarter 2020 compared to a net loss of USD216 million in fourth quarter 2019. First quarter 2020 results included a non-cash asset impairment charge of $2.55 billion to adjust the book value of a number of floating rigs to salvage value. The company is taking steps to manage its cost base and preserve liquidity, including stacking uncontracted rigs, removing units from the fleet and lowering operating costs for contracted rigs. The company is evaluating various alternatives to address its capital structure and annual interest costs, including a comprehensive debt restructuring. (IHS Markit Upstream Costs and Technology's Matthew Donovan)

- South Africa from 1 May 2020 will shift national corona virus alert from Level 5 (most severe) to level 4 (with some relaxation from hard lockdown). Under the level 4 nationwide restrictions, full coal production at the South African mines will be possible for strip mines while production level at underground mines will be restricted to 50pc. Coal stocks at the RBCT terminal are calculated at around 5.5mt and have increased significantly in the last three weeks. Anything above 6.5mt makes it very difficult to operate the terminal optimally. In order to avoid building up of coal stockpiles at RBCT the railings to the terminal are analyzed to have slowed down to around 1.0-1.2mt/week. (IHS Markit Commodities at Sea's Rahul Kapoor and Pranay Shukla)

- IHS Markit iTraxx Europe investment grade CDS index closed lower at +3bps/81bps and iTraxx-Xover high yield index also lower at +15bps/493bps.

- 10yr European govt bonds closed higher across the region, except for Italy +1bp; Spain -8bps, France -7bps, and UK -6bps.

- 10yr German bunds closed significantly higher today at -10bps/-0.59% yield and Germany's DAX closed 2.2% lower.

- European equity markets closed lower across the region, with many markets opening with a slight gain before steadily selling off for the rest of the day; UK -3.5%, Italy/France -2.1%, and Spain -1.9%.

Asia-Pacific

- Japan's retail sales fell by 4.5% month on month (m/m) in March following four consecutive months of increases. The weakness reflected declines in inbound tourists and self-restriction in response to the government's request for the first half of March, particularly affecting sales in general merchandise (down 12.2% m/m), fabrics apparel and accessories (down 16.7% m/m), and fuel (down 9.5% m/m). The figures for retail sales suggest even milder restriction measures in March had a major negative effect on demand for non-necessities. Retail sales are likely to decline further in the coming months because stricter restriction measures in response to a state of emergency announced in April, which is likely to extend for a month. (IHS Markit Economist Harumi Taguchi)

- Japan's Index of Industrial Production (IIP) fell by 3.7% month on month (m/m) in March for the second consecutive month of decline. The steepest m/m drop in manufacturers' shipments (down 5.0% m/m) since April 2014 (just after the previous consumption tax increase) led inventory to increase by 1.9% m/m, and the index of inventory ratio surged by 8.5% m/m. The contraction of production was narrower than IHS Markit had expected, and the IIP for the first quarter of 2020 marginally rose at 0.8%. However, a 0.5% quarter-on-quarter (q/q) drop in shipments of capital goods (excluding transport equipment) following a 7.0% decrease in the fourth quarter of 2019 suggests a continued decline in private capital expenditure in the first quarter of 2020. (IHS Markit Economist Harumi Taguchi)

- Japanese vehicle production, including passenger vehicles, trucks, and buses, totaled 769,161 units during February, according to figures released by the Japan Automobile Manufacturers Association (JAMA). This represented a decline of 11.0% compared with the corresponding month of last year. Japanese production is expected to fall further in 2020 now that the consumption tax rise has been implemented. <span/>(IHS Markit AutoIntelligence's Tarik Arora

- Mitsubishi Motors Corporation (MMC) expects to post a net loss of JPY26 billion (USD241 million) during the financial year that ended 31 March 2020 owing to the impacts of the coronavirus disease 2019 (COVID-19) virus pandemic. The automaker earlier projected a net income of JPY5 billion and now expects net sales of JPY2.27 trillion, down by 7.3% from the previous forecast of JPY2.45 trillion. The operating profit is now forecast at JPY12 billion, down by 60% from the previous forecast of JPY30 billion. Additionally, it is seeking loans worth JPY300 billion (USD2.8 billion) from both domestic and foreign lenders to tide over the COVID-19 virus crisis. (IHS Markit AutoIntelligence's Tarik Arora)

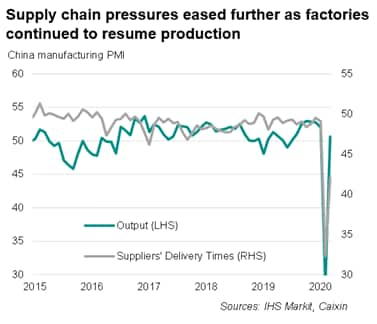

- The Caixin headline manufacturing PMI for mainland China,

compiled by IHS Markit, fell from 50.1 in March to 49.4 in April,

indicating that operating conditions of the sector had deteriorated

from the prior month. While factory production rose modestly after

a survey record decline in February as increasing numbers of

factories resumed work, growth mostly came from working through

backlogs of previously placed orders, many of which had been placed

prior to the COVID-19 lockdowns. Supply chains remained under

pressure at the start of the second quarter, but the rate at which

delivery times lengthened slowed notably and was modest overall

compared to the record number of delays seen in February. (IHS

Markit Economist Bernard Aw)

- China's official manufacturing purchasing managers' index (PMI) came in at 50.8 in April, down from 52 recorded in March. PMI declined across all sub-index, except improvement in supplier's delivery time, showing the recovery in logistics. The headline decline was led by a slump in new export orders and imports, which fell by 12.9 and 4.5 percentage points respectively from a month ago, thanks to the global economic recession. Global economic recession will be the main headwind for China's economic recovery in the second and third quarter with exports and related manufacturing bearing the brunt. (IHS Markit Economist Yating Xu)

- Asian spot toluene prices in May are unlikely to revisit the lows reached in April as more cities around the world ease lockdowns and economic activities gradually resume, trade sources said Thursday. Spot toluene has lost more than 50% of its value since February. As of April 29, the average April price for toluene was at $289.70/mt FOB Korea, down 28.3% from March and 51.3% from February, IHS Markit Chemical data showed. Accompanying the price decline has been a dwindling in the number of daily bids or offers in open trade. Demand for toluene has fallen with gasoline consumption after countries raced to close borders and enforce lockdowns to slow the spread of COVID-19. The hit to fuel demand has forced refiners worldwide to cut runs while vessels laden with crude oil, jet fuel and gasoline anchor along the shores of Singapore, northwestern Europe and California as onshore tanks fill up. (IHS Markit Market Advisory Service's Trisha Huang)

- APAC equity markets closed higher across the region, but generally on the lower side of the day's range; India +3.1%, Australia +2.4%, Japan +2.1%, China +1.3%, KOSPI 0.7%, and Hang Sang +0.3%.

In light of current events, IHS Markit is offering complimentary access for qualified market participants to our historical cross asset coverage of global fixed income pricing and liquidity data, as well as OTC Derivatives data via the Price Viewer web-based data portal.

Please contact data.delivery@ihsmarkit.com today for your complimentary access.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-daily-financial-market-summary-30-april.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-daily-financial-market-summary-30-april.html&text=S%26P+Global+Daily+Global+Market+Summary+30+April+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-daily-financial-market-summary-30-april.html","enabled":true},{"name":"email","url":"?subject=S&P Global Daily Global Market Summary 30 April | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-daily-financial-market-summary-30-april.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+Global+Daily+Global+Market+Summary+30+April+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-daily-financial-market-summary-30-april.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}