Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

SPECIAL REPORTS

Apr 22, 2020

How to prioritize today and plan for the future

While the impetus may change, an all-too-common outcome among participants during times of unprecedented market dislocation is a sense of "what should we have done to be better prepared?" Nobody can forecast the unknown, but having a dogged approach to information awareness, control and access is a must in today's landscape. This includes asking ourselves difficult questions and challenging status quo. Even if we do have plans, processes and platforms in place, it is essential that we continually reassess their efficacy and impact based on dynamic circumstances.

Whether it's heading into an unexpected crisis or stress testing business continuity and disaster recovery protocols, we at IHS Markit strive to put ourselves in our clients' shoes. Guided by this principle, in alliance with our internal subject matter experts and industry-leading clients, we have assembled three recommendations to help you assess and prepare for the journey ahead.

1. Understand what's in place today and prioritize future needs

In today's world, where data is king and global events are adding to uncertainty, it is important for private market investors to focus on downside protection and risk mitigation for both short-term and long-term returns. Traditionally, firms have focused on prioritizing business continuity, ensuring remote access to systems, real-time data access and delivering investor reporting in a consistent manner, but that is no longer enough. We currently live in a world where facts, resources and circumstances change daily and we need to adapt and make well-informed decisions, quickly, to ensure maximum stability for not only investors, but also for portfolio companies. With the US Labor Department reporting a record high 6.65 million new unemployment insurance claims for March 2020, one cannot sit back and rely on traditional cadences and processes.

With new business activity significantly slowed for the foreseeable future, portfolio monitoring has taken center-stage. Our clients are focused on downside protection, risk mitigation, liquidity preservation, expense management, resource redeployment, personnel actions and the impact these measures have on the health and viability of their investment portfolios. Additionally, our clients are constantly communicating real-time with portfolio companies and providing transparency to investors so they can also make well-informed decisions.

Below are just some of the questions our clients have been focused on to be proactive and prepared as portfolio changes develop:

- What industries is the portfolio exposed to and where,

if any, are there concentrations?

- Which portfolio company business models have the largest risk and what is being done to mitigate such risk?

- How much liquidity do we have in our Fund(s)?

- Supply chain and client risks?

- Has the liquidity profile been impacted by the global pandemic? If so, what is the magnitude? And what plans are in motion to amend, improve or manage through the situation?

- How much liquidity do we have at each portfolio company? How much revolver availability? How much cash do they have on hand?

- How many months of runway does that provide? Have expense management measures been put in place to improve the liquidity profile?

- Which reporting and/or financial covenants might be breached?

- What is the potential of a MAC or payment default?

- How will revenue and EBITDA be impacted at each

portfolio company?

- How much have revenue and EBITDA been impacted due to COVID-19 and what is the revenue impact outlook for the next month, quarter, remainder of the year?

- Where do we have recurring sources of revenue?

- What strategic initiatives do we need to stop/shelve?

- What expense management measures have been implemented and are being explored?

- How can we protect portfolio company

employees?

- How many contractors and hourly employees?

- Do hiring freezes, furloughs or incentive restructurings need to be enacted?

- What subsidies or assistance can be provided to at risk employees?

- Should we create long term relief funds?

- How can we contribute to a solution? Do we have a bigger role to play?

- Which portfolio companies are going to need more

capital and what is the magnitude and anticipated use of such

capital?

- Do we have availability to do follow on investments?

- Will it be debt or equity?

These are among the questions that prudent and proactive portfolio managers need to be addressing regularly with their portfolio companies and communicating internally, to investment committees and investors, respectively, to make timely and informed decisions as they navigate through the evolving impact of COVID-19. Those who are not actively engaged with their portfolio companies will be opening themselves up to unplanned risk. If you are not asking the above questions, start now; time is of the essence.

2. Highlight Gaps in Internal and External Processes

Disparate Excel spreadsheets, emails, memos, shared drives and sticky notes are just some of the tools that firms have utilized to organize their workflows and data. These legacy processes are outdated and inefficient without a centralized platform to manage, unify and combine these diverse data sets. Otherwise, one will quickly find themselves inundated and frozen in a data quagmire.

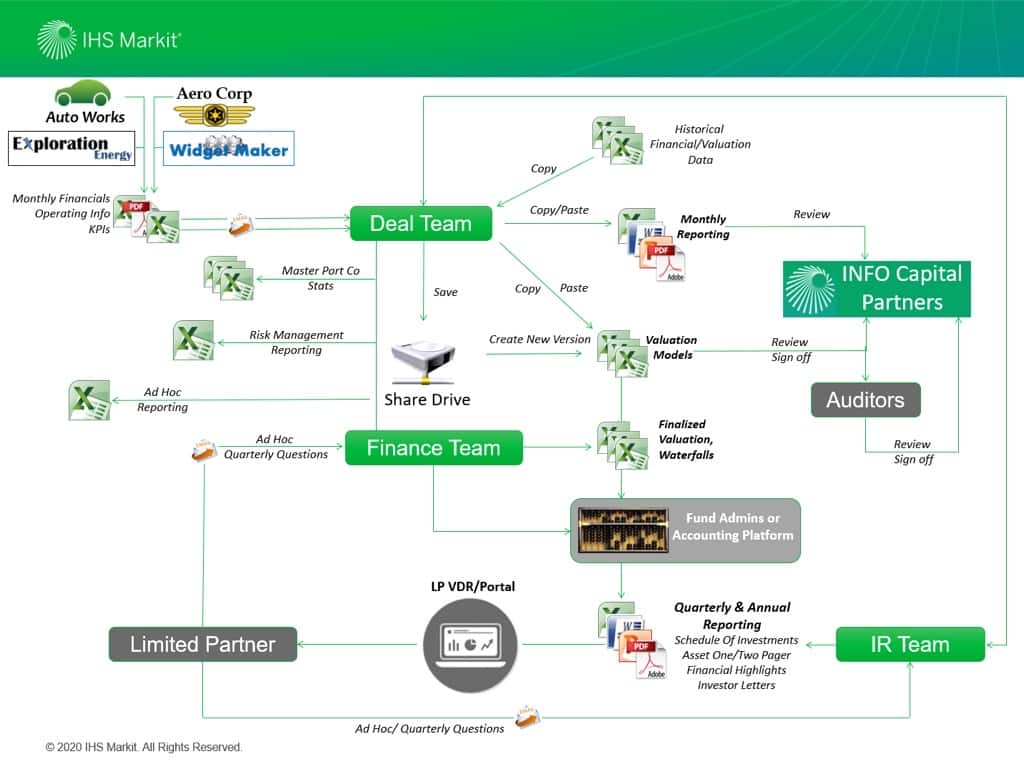

One of the ways we help our clients is through developing an operating model to outline their workflows and processes around data collection, valuations and reporting. This includes identifying third-party partners, such as valuation service providers, auditors, consultants, fund administrators and software providers. Everyone seems to know their own process, but it isn't until it's laid out visually that clients can see where the glaringly obvious gaps reside.

Through this process mapping exercise, multiple gaps and inefficiencies that need to be addressed will likely surface. While this may seem challenging and daunting, know that you are not alone. Most firms have only recently prioritized process improvements, focusing on efficiency and scalability to properly position themselves for major market shifting events.

Gaps may start internally, but they never stop there. Third-party resources and partners must be reviewed regularly, as an extension of the process outlined above.

3. Assemble a scalable action plan

Firms need data collection platforms and processes in place to ensure that when volatility strikes, they are prepared and well-informed to make the best decisions for their investments and investors. As part of your action plan, take a closer look at your partners. While many technology start-ups are emerging, they may not be positioned for long-term resiliency.

Looking back to the financial crisis in 2008, the firms that bounced back the fastest, and generated the biggest returns, are those that were prepared with their data and processes. This enabled timely, well-informed decisions about how they could deploy capital in existing portfolios and quickly move to investing in new opportunities created by market dislocation.

Our clients today have gathered and organized all their data, historical and active, into a single source of truth providing full transparency into the health of their portfolios. As a result, they have the confidence and the insights necessary to act proactively during these unstable times. Here at IHS Markit, we are laser focused on being a critical, valuable and trusted partner for our clients and together we will be positioned for success for years to come, despite the unexpected.

To learn more about how you can effectively take control of your internal and external processes, please reach out to pcmglobalsales@ihsmarkit.com for assistance.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhow-to-prioritize-today-and-plan-for-future.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhow-to-prioritize-today-and-plan-for-future.html&text=How+to+prioritize+today+and+plan+for+the+future+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhow-to-prioritize-today-and-plan-for-future.html","enabled":true},{"name":"email","url":"?subject=How to prioritize today and plan for the future | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhow-to-prioritize-today-and-plan-for-future.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=How+to+prioritize+today+and+plan+for+the+future+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhow-to-prioritize-today-and-plan-for-future.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}