Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Nov 27, 2023

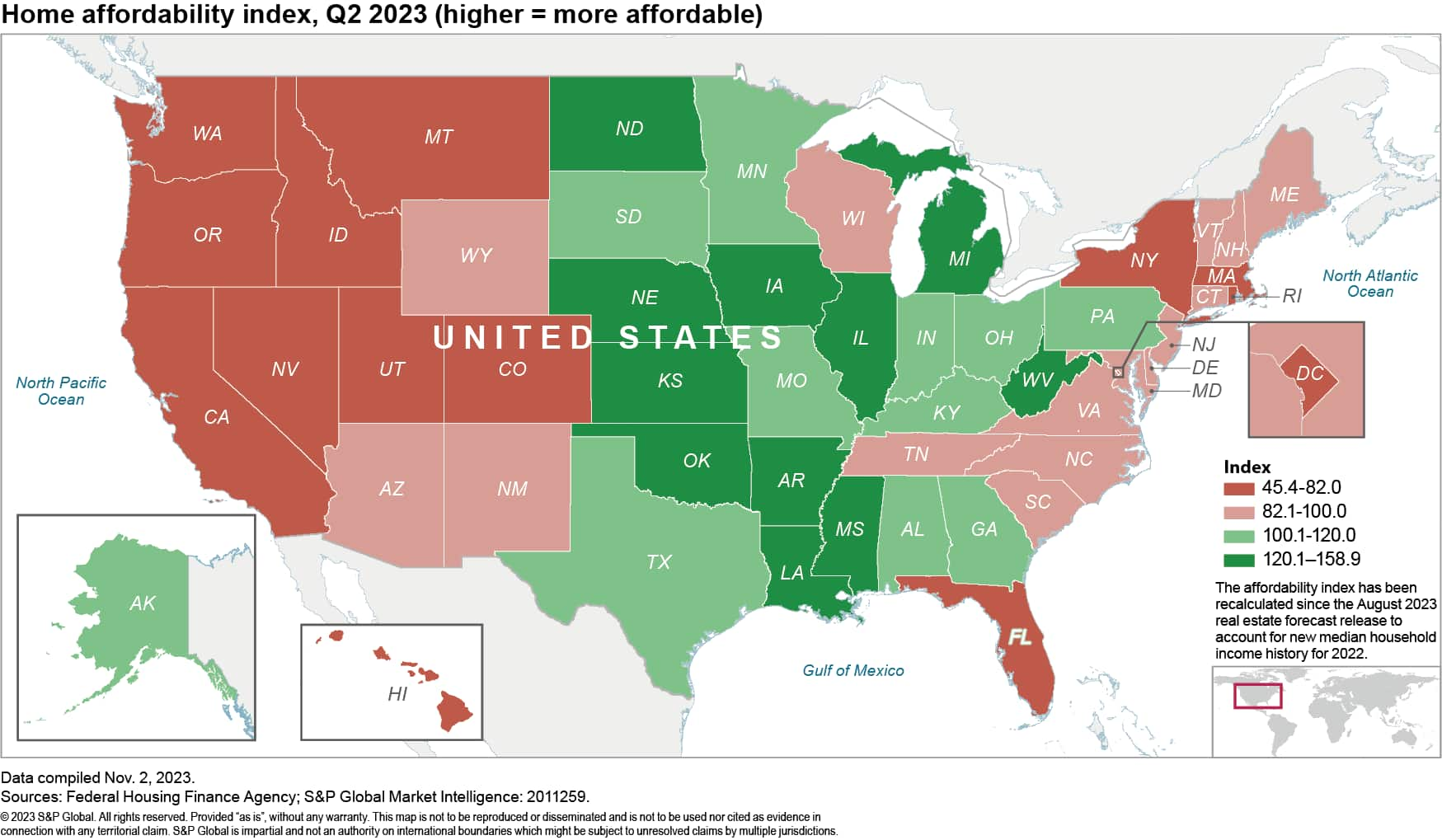

Homes in 29 states are unaffordable to the median household, marking the first time a majority of states have below-average affordability. This crunch is even deeper than that during the subprime housing crisis.

In these 29 states — led by Hawaii, California, and the District of Columbia — the median household cannot afford a median-priced home, according to our home affordability index. While home price growth in many states was somewhat restrained in the early stages of the COVID-19 pandemic by the challenges of a physical move, the availability of remote work in a post-pandemic world sent selling prices surging. In combination with higher borrowing costs, this has made owning a home a difficult proposition for many prospective buyers in 2023.

Worsening affordability has been widespread nationally, with almost all states seeing their affordability index fall between 35% and 45% since the start of the COVID-19 pandemic. This has exacerbated already expensive markets in the Western and Northeast states where housing remains among the most unaffordable. In these regions, unaffordability stems from persistently high demand, low housing stock, high input costs such as expensive land, and stringent building regulations. In California and Hawaii, low property taxes have also disincentivized policies promoting the building of affordable homes.

The central US remains the most affordable, with median earners able to afford a median priced home largely due to cheaper land and lower building costs. Still, the region's affordability has been chipped away at over the last year, with many of these states also seeing index values veer closer to 100, which is the point where the median household has just enough income to afford a median-priced home. Georgia, Minnesota, Missouri and Pennsylvania have all moved closer to the 100 mark this year, with no signs of stopping.

For the first time in the history of our index, dating back to 1999, a majority of states have fallen below a value of 100, meaning that a median-income household has less income than necessary to acquire a mortgage. These least affordable states are led by Hawaii, California, the District of Columbia, Oregon, and Washington. The states where home affordability is most favorable include West Virginia, Mississippi, Iowa, North Dakota and Arkansas. Home price appreciation in these areas has been robust, but affordability has not declined enough to push the median household out of the market. The Great Plains and upper Midwest remain the most affordable areas in the country.

A broader and deeper crunch

The past year's sharp rise in mortgage interest rates has decreased households' ability to own a home in a faster and more wide-reaching manner than even in the run-up to the subprime housing crisis. From 2003 to 2006, housing market affordability was heavily influenced by home price gains rather than large interest rate rises, leading to much more variability in the worsening of affordability across the country. States with less extreme price run-ups and lower levels of speculation and bidding wars going into 2006 saw affordability worsen only 15%-20%. Now, low demand combined with sharply higher interest rates has resulted in virtually all states seeing affordability index drops of 35%-45% since the start of the COVID-19 pandemic. Indeed, states with the highest levels of speculation and the biggest price gains, such as Arizona, Florida and Nevada, saw affordability decline around 40%.

At the national level, our index eroded 40.6% from the fourth quarter of 2019 to the second quarter of 2023, sinking beneath the previous low value reached in 2006. Between 2003 and 2006, inflated home prices resulted in a national dip of 30.9%. Current affordability has eroded to a lower level than in 2006 in 41 states, propelled by the large rise in borrowing costs and the large proportion of existing homeowners reluctant to let go of their super-low-interest-rate mortgages. While the last episode ended with a wave of foreclosures and crashing prices, home prices now will continue to be propped up by a dearth of existing homes entering the market. Only a decline in mortgage rates will have a meaningful easing effect on affordability.

Outlook

In the near term, we do not expect a big correction in affordability. Home prices will keep moving higher in all regions owing to constrained supplies of existing homes. Appreciation in many Western states will slow moving into 2024, but home prices are expected to rise moderately in the Southeast and Midwest. Declining mortgage rates, not expected to begin in earnest until late 2024 and 2025, will provide affordability relief past the near term. Lower rates will enable "lock-in" homeowners to list their homes and move into a new dwelling, in turn helping to improve inventories of existing homes on the market. This housing market relief will not translate into a full reversal of current affordability trends. We expect rising prices to dampen any rebound in affordability coming from lower borrowing costs.

—By James Kelly

Learn more about our economic data and insights

Listen to our podcast episode on the US housing market

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.