Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Oct 12, 2023

By Chris Rogers

The US holiday shopping season is getting underway, including purchases of holiday lights and decorations. Shipments of decorations for the Halloween season had already run ahead of schedule, as previously discussed in Halloween creeps a little closer: Seasonal supply chains accelerate.

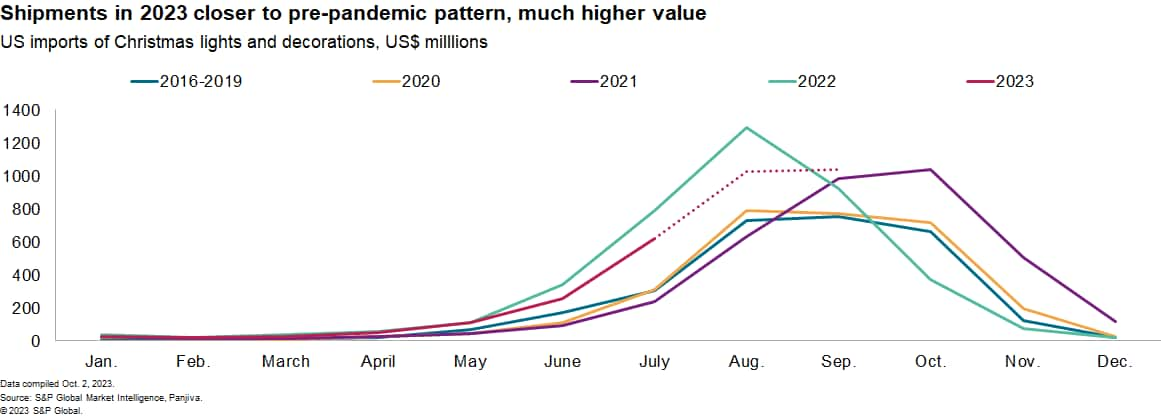

In the case of Christmas decorations, US imports have historically peaked in September and October, our data show. In 2022, we saw an earlier peak in August, which likely reflects firms' attempts to avoid shortfalls linked to logistics network bottlenecks.

This year, the shipping pattern appears similar to prior years, though confirmation will only come with October data. The value of imports — including maritime shipments only for August and September — in the four months to Sept. 30, 2023, are down by 14% year over year yet still 5% above the 2019 level.

Shiny new sources: Reshoring to Cambodia

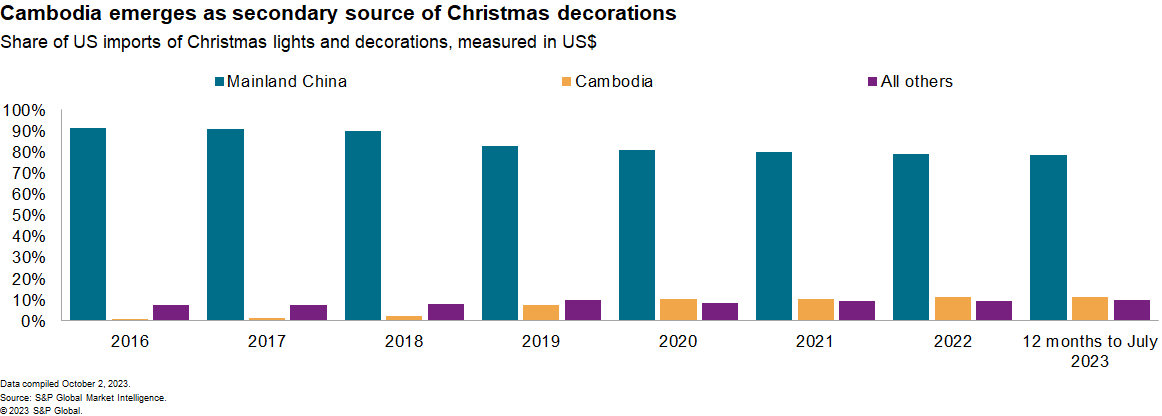

While seasonality appears to be returning to normal, we see evidence of a steady process of reshoring for Christmas decorations.

The share of US imports coming from mainland China fell to 79% in the 12 months to July 31, 2023, compared with 90% in 2018. The main winner has been Cambodia, whose share of imports rose to 11% from 2% over the same period.

A major driver of the shift has been the inclusion of Christmas decorations in Section 301 duties on imports from mainland China including a 25% tariff on lights and a 7.5% tariff on decorations. As outlined in Time, tariffs and tracking: Fourth quarter 2023 supply chain outlook, we see little likelihood of the tariffs being removed in the near term.

The decorative products are also labor intensive. Our estimates show manufacturing labor compensation in Cambodia in 2023 is a fraction of the per-hour wage in mainland China.

The operational risks associated with manufacturing in Cambodia are slightly higher in the aggregate to those of mainland China, our risk scores show. In terms of other Christmas decoration suppliers, Cambodia's operational risk score is similar to that of India and the Philippines and lower than Mexico's. None of those three have more than a 2% share of US imports, however.

US imports of Christmas decorations and lighting from Cambodia are dominated by a handful of importers, our data shows. The top five importers accounted for 68% of imports in the 12 months to Sept. 30, 2023.

Sign up for our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.