Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Apr 09, 2025

By Jingyi Pan

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated that global trade expanded fractionally at the end of the first quarter, ahead of additional tariff announcements in April, ending a nine-month spell of decline.

The seasonally adjusted Global PMI New Export Orders Index, sponsored by JPMorgan and compiled by S&P Global, rose to 50.1 in March, up from 49.7 in February. Posting above the 50.0 neutral mark, the latest reading signalled that trade conditions improved for the first time since last May. Although marginal, the latest data indicated that trade conditions were broadly stable just ahead of the announcement of widespread US tariffs in early April.

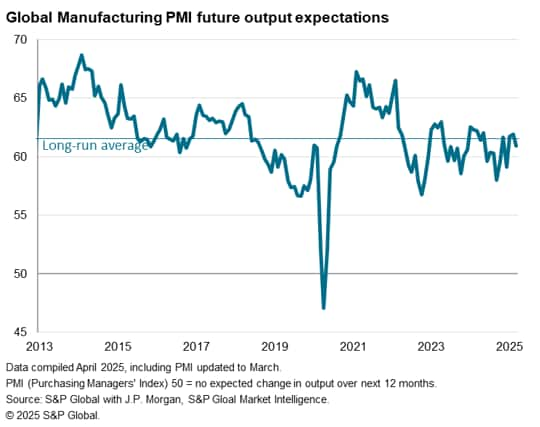

The recent downturn in manufacturing new export orders halted in March, according to the latest PMI data. Rising for a third successive month, the seasonally adjusted manufacturing New Export Orders Index emerged above the 50.0 neutral mark for the first time in ten months to indicate a fractional rise in goods export orders. This was only the third time that manufacturing export orders have increased in just over three years, with global trade having also expanded in April and May of last year. That said, the latest survey period coincided with the anticipation of widespread US tariffs, subsequently announced in early April. Survey respondents noted how a buffering of tariff impact with greater trade of goods had been an important driver of the improvement. As it is, the bigger picture showed overall manufacturing new orders and production softening at the end of the first quarter. Additionally, confidence among global manufacturers also fell, with the optimism sliding to the lowest so far this year and falling further below the long-run average. Concerns over the negative impact from US tariffs and potential retaliation by trade partners dampened sentiment, according to anecdotal evidence.

It must also be highlighted that we have already witnessed some impact from fresh tariffs implemented thus far. On the back of newly implemented tariffs in March, the US saw the highest rise in goods input prices worldwide while North America broadly suffered reductions in goods output. The latest round of announced in April, if sustained, may further affect trade conditions in the coming months, and the early impact from these tariffs will be closely watched with upcoming flash data on April 23rd.

Meanwhile services exports expanded globally for a fifteenth straight month in April, albeit at the slowest pace in the current sequence. The rate of growth was only fractional, matching that recorded for manufacturing. The deceleration of services export growth was largely attributed to a renewed downturn in the consumer services industry, while the contraction in financials exports also deepened as business confidence waned in the face of threatened tariffs.

Detailed sector PMI data listed insurance, commercial & professional services and industrial services as leading the global export expansion, while real estate saw the fastest contraction, followed by two manufacturing sectors - forestry & paper products and resources.

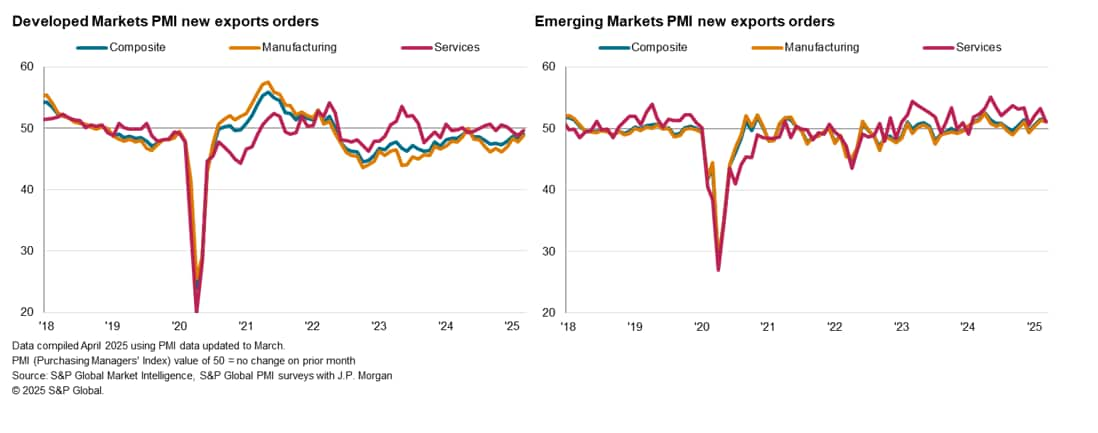

In addition to the convergence in sector trade conditions, the difference in trade conditions between developed and emerging markets narrowed in March.

Developed markets saw the bigger change on an index level for export orders. The rate at which export orders fell softened to a ten-month low with both developed world manufacturing and service sectors recording slower rates of deterioration. Although the goods producing sector continued to register a quicker fall in export orders than services, the latest data marked a fourth successive month in which goods export contraction eased. Moreover, the easing of the trade downturn in manufacturing was key to supporting the revival in global goods trade growth amid a slight deceleration in emerging market goods trade growth in March.

Overall emerging market export business expanded for a third successive month but saw the rate of expansion slow since February. This was attributed to softer rates of growth across both the manufacturing and service sectors, the latter notably having seen export business growth decelerate from a solid pace in February to a mild pace in March. Emerging market goods exports meanwhile posted a third successive month of growth, but with the abovementioned tariff impact looming, April's release will be crucial to gauging whether growth can be sustained.

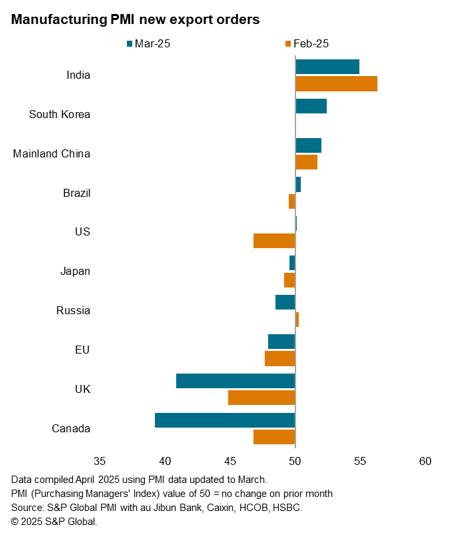

The number of top ten trading economies reporting higher goods exports increased to five in March, the highest proportion seen since last June. Growth was again led by India, albeit with the rate of growth slowing since February to narrow the lead on the next fastest growing exporter in March. Overall, India's manufacturing sector conditions notably improved at a faster pace at the end of the first quarter, contrasting with the trend for its exports.

South Korea emerged second in March, with manufacturing export orders streaming in at the strongest pace since January 2024 amid indications of improvements in sales to key export markets. This was followed closely by mainland China, which maintained a second successive month of rising export orders and at the quickest rate in nearly a year. Marginal improvements in good exports were also observed for Brazil and the US.

On the other hand, Canada recorded the sharpest fall in good trade at the end of Q1 2025. The rate of contraction was the joint-second steepest in the survey history as tariffs were applied to a wide range of goods and services. The UK followed next, likewise with a steep rate of export contraction linked mainly to weaker demand from the US and Europe, though manufacturers also indicated reduced orders from Asian and Middle Eastern economies. More moderate rates of decline were meanwhile noted for the EU, Russia and Japan.

Access the global PMI press releases.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Products & Offerings