Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jun 07, 2024

Global growth surged to a 12-month high in May, according to the worldwide PMI surveys. Accelerating upturns were seen in both developed and emerging markets, led by the US and India respectively alongside signs of improving performances in the eurozone and mainland China. Business expectations also lifted higher alongside improving order books, fueled in part by survey respondents reporting the lowest levels of 'uncertainty' snice 2018.

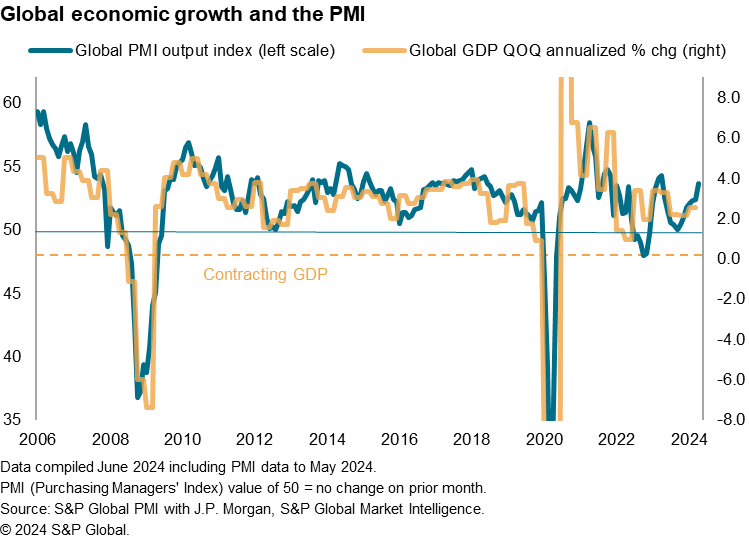

S&P Global Market Intelligence's PMI surveys indicated that global economic growth accelerated for seventh consecutive month in May, hitting a 12-month high. The headline JPMorgan PMI, covering manufacturing and services in over 40 economies, jumped from 52.4 in April to 53.7 in May. At this level, historical comparisons indicate that the PMI is broadly indicative of the global economy growing at an annualized rate of 3.4% midway through the second quarter of 2024, up sharply from the 2.5% growth rate seen in the first quarter of the year.

Among the major developed economies, the fastest growth was recorded in the US during May, where output grew at a pace not beaten since April 2022. US service sector output growth was the sharpest for 25 months and manufacturing production growth hit a 24-month high. The improving US performance was accompanied by a return to growth in Canada for the first time in a year, in turn driven by renewed service sector growth.

The eurozone also reported faster growth, expanding at the sharpest pace for a year as a solid upturn in services activity was accompanied by a moderating downturn in manufacturing. Japan's upturn meanwhile continued to run at the joint-highest seen over the past year, likewise driven by a robust service sector performance alongside a near-steadying of factory output.

The UK bucked the improving developed world trend, though growth cooled only modestly from April's 12-month high to remain among the strongest seen over the past year. The fastest output growth for 25 months helped limit the impact of a sharp slowdown in the UK's service sector.

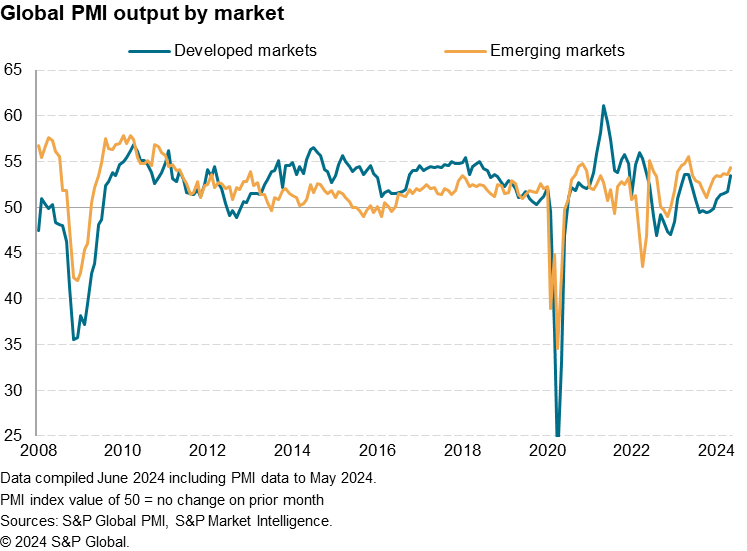

Taken together, the developed world economies tracked by the S&P Global PMIs recorded the strongest output growth since May 2023.

Growth also accelerated across the emerging markets tracked by the PMI, hitting a 12-month high in May but outpacing the developed world by the smallest margin since September 2022.

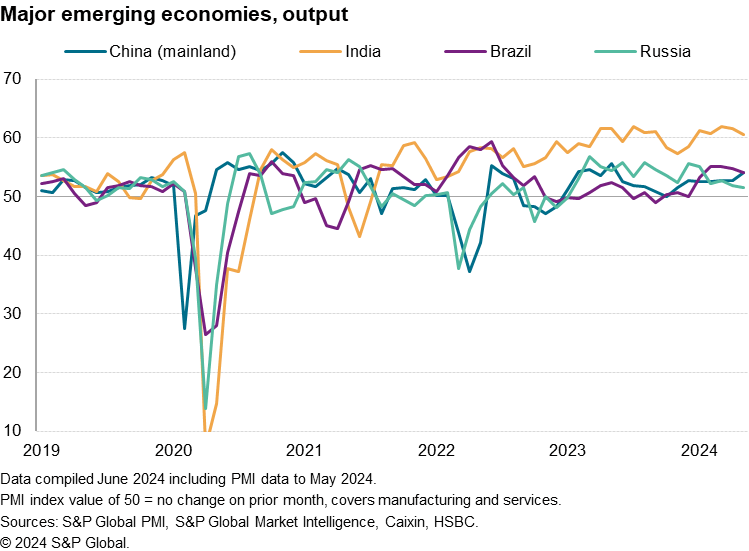

India remained the stand-out performer, despite growth slackening off to a five-month low amid moderating upturns in both manufacturing and services, linked in part to activity being disrupted by the elections.

Growth also slowed in Brazil and Russia, to four- and 16-month lows respectively, though the former continued to show encouragingly solid growth as a faster service sector upturn helped counter a sharp slowdown in manufacturing. Russia's service sector notably contracted, albeit marginally, for the first time since January 2023.

Mainland China was consequently the only one of the four "BRIC" economies to report faster growth in May, with the Caixin PMI produced by S&P Global recording the sharpest expansion since May of last year. Service sector growth hit a ten-month high, but it was manufacturing that reported the stronger upturn, with factory output rising in China at the steepest rate for almost two years.

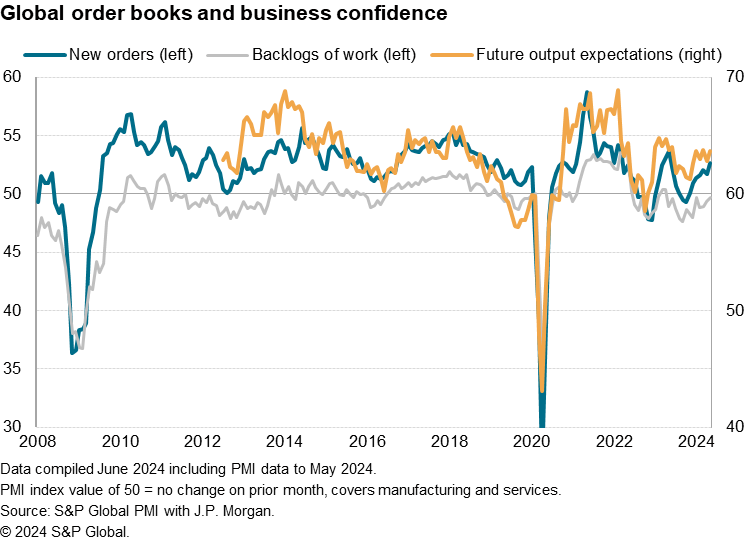

Near-term global prospects also brightened in May. Business expectations about the year ahead lifted higher, continuing to run in a tight but elevated range that has been witnessed since the start of the year.

New order inflows also improved, rising across goods and services globally at the highest rate since May of last year.

The improved order book inflows helped steady the recent decline in backlogs of work, which fell in May at the slowest rate for just over a year.

The near-steadying of backlogs of work is itself a promising sign that companies will take on more staff in coming months, building on the rise seen in May. Employment rose globally in May at the joint-fastest rate seen over the past nine months, albeit at a pace that still lags the pre-pandemic average.

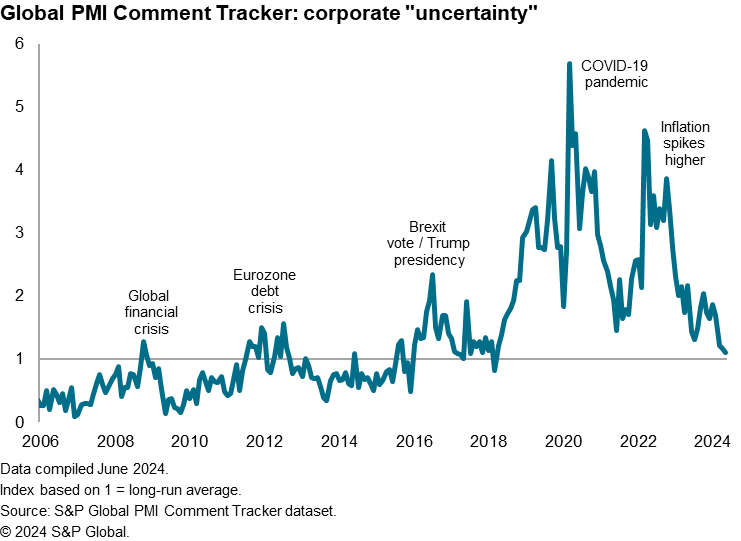

The improvement in business expectations for the year ahead was in turn partly a reflection of fewer companies reporting that they lacked confidence due to uncertainty. Mentions of the word "uncertainty" have dropped globally to the lowest since March 2018, according to analysis of the anecdotal responses provided by PMI respondents worldwide in May.

Lower uncertainty is commonly seen as a required precursor to higher spending and business investments, and therefore bodes well for a sustained - and potentially gathering - economic upturn in the near future.

Access the Global Composite PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.