Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 10, 2025

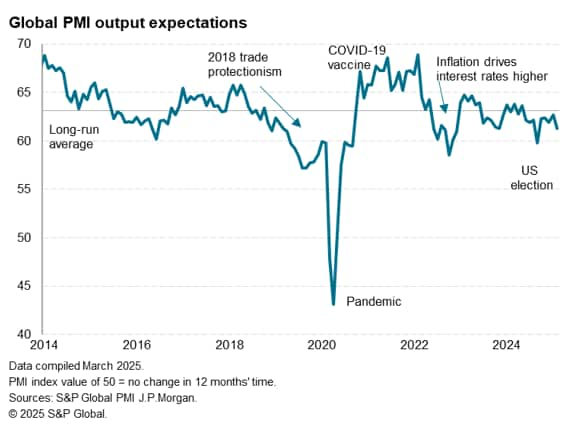

The detailed sector data behind the worldwide PMI surveys produced S&P Global reveal how a manufacturing revival in February has helped offset some of the impact of weakening growth in the larger services economy. Growth has slowed especially sharply in financial services and consumer-facing industries. However, at least some of the upturn in the goods producing sector reflected the front-running of tariffs, hinting that the revival may prove short-lived. Much will depend on the degree to which business confidence can prove resilient in the face of growing geopolitical and economic uncertainty.

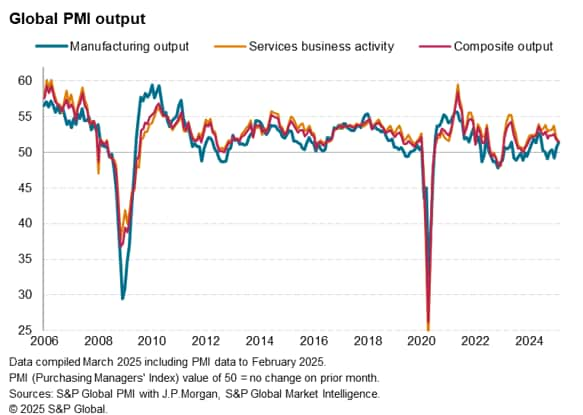

S&P Global Market Intelligence's PMI surveys indicated that the gap in performance between the global services and manufacturing sectors narrowed in February. While manufacturing growth hit the fastest for eight months, services growth waned to a 14-month low. Both rates of expansion were nonetheless only modest. The resulting composite PMI - a GDP-weighted average of the two sectors - fell to its lowest since December 2023, indicating weakened global output growth for a second successive month, as the deteriorating service sector performance overshadowed the upturn in the goods-producing sector.

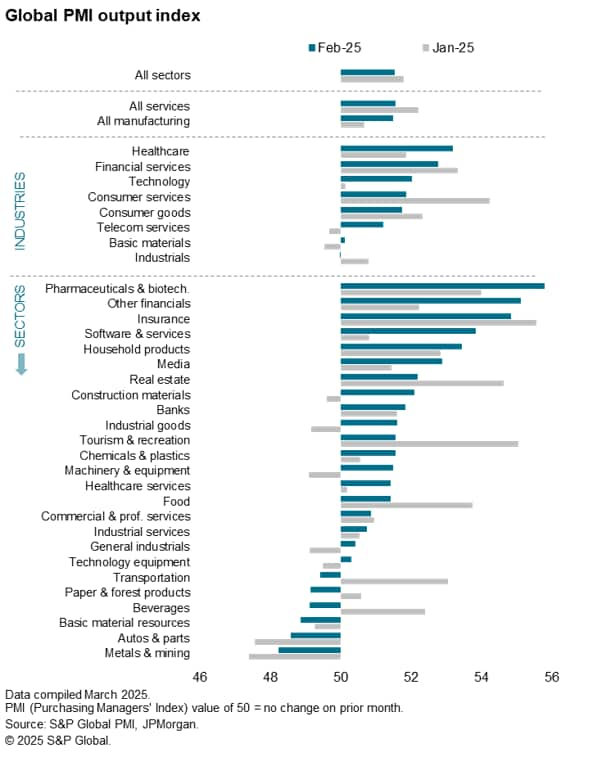

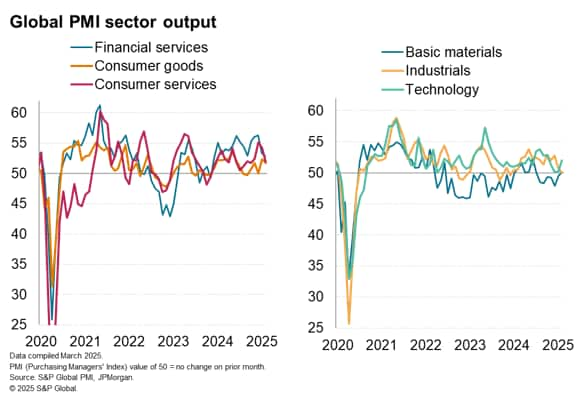

Looking in more detail, by broad industry the fastest growth was recorded for healthcare, followed by financial services, albeit the latter now down to a 14-month low.

Growth rates meanwhile also slowed for consumer goods and services after solid starts to the year. Companies reported concerns over the pace of consumer spending in the months ahead, as well as concerns over inflation and interest rates, with many forecasters anticipating higher rates of both - notably in the US - than previously anticipated.

The worst performing broad sector, however, was industrials, where output failed to grow for the first time in 14 months, while basic materials also broadly stalled.

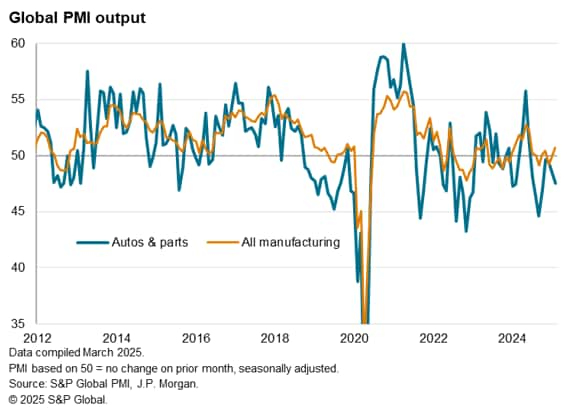

In more detail, the fastest growing sector was pharmaceuticals & biotech, with 'other' (non-banking) financials and insurance also faring especially well. Conversely, metals & mining firms led the global contraction for a third straight month, followed by autos & parts manufacturing, which saw output fall for an eighth straight month.

Transportation notably reported a first fall in activity for 14 months. Timber & paper products also fell into decline, as did beverages. However, with five sectors moving out of expansion - notably including machinery & equipment making and construction materials - the total number of sectors in contraction eased from eight to six between January and February.

A key surprise in the sector data was therefore the improvement in some of these manufacturing sectors, which at face value, appeared at odds with the growing concern over impact of trade protectionism. New orders for machinery and equipment, for example, rose in February for the first time since last June. Orders for construction materials likewise rose for a second month and at the fastest rate for two years.

These two sectors of particular interest as they act as bellwethers of business investment spending, either on kit or premises. This seems odd, given that the survey also showed business confidence sliding in February to one of the lowest seen over the past two years amid increasingly elevated levels of uncertainty. Such an environment is not usually conducive to rising investment spending.

There was instead evidence from the anecdotal information collected on the PMI questionnaires that these manufacturing improvements were often linked to the front-loading of production and sales ahead of tariffs. If so, this upturn could prove short lived. Since these data were collected, the US has announced 25% tariffs on imports from Canada and Mexico, upped tariffs from mainland China by 10% (taking these to 20%), and raised the prospect of more tariffs to come, notably on the EU. China and Canada have already responded with various measures against US goods and services.

With February's PMI data having been collected at a time when the US had postponed the implementation of additional tariffs, March's PMI data will therefore come under particular scrutiny to gauge the extent to which these newly applied protectionist measures may be dampening business activity and sentiment.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Products & Offerings