Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 03, 2021

Global growth accelerates as COVID-19 restrictions ease

- Global PMI at second-highest since August 2018

- Manufacturing reports robust expansion despite supply delays, services impeded by COVID-19

- Consumer services remain hardest hit, financial services boom

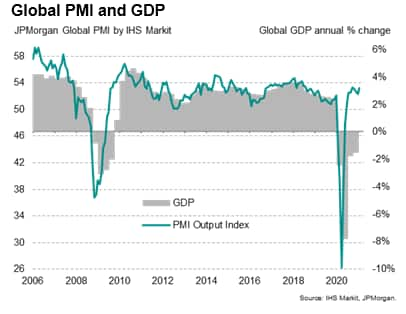

Global economic growth accelerated in February, according to the worldwide PMI surveys conducted by IHS Markit, with growth falling just short of last October's peak to signal the second-strongest expansion since August 2018. The upturn was led by the manufacturing economy, as further efforts to contain the coronavirus disease 2019 (COVID-19) pandemic continued to limit service sector growth, notably for consumer services.

At 53.2, up from 52.3 in January, the JPMorgan Global PMI™ (compiled by IHS Markit) indicated rising output for the eighth straight month as demand continued to revive from the initial impact of COVID-19 lockdowns.

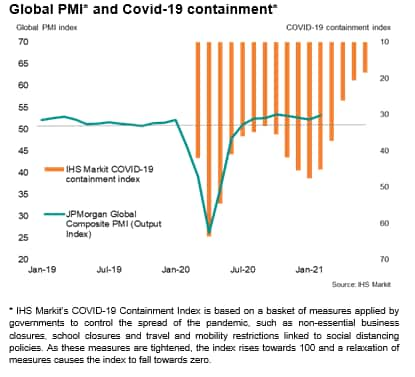

Whereas growth had slowed in the three months to January, primarily reflecting the re-introduction of measures to control further outbreaks of the virus in many countries, February saw restrictions ease on average. IHS Markit's Global COVID-19 Containment Index fell from 48 in January (which had been its highest since last May) to 45 in February.

Consumer services hardest hit but financial services boom

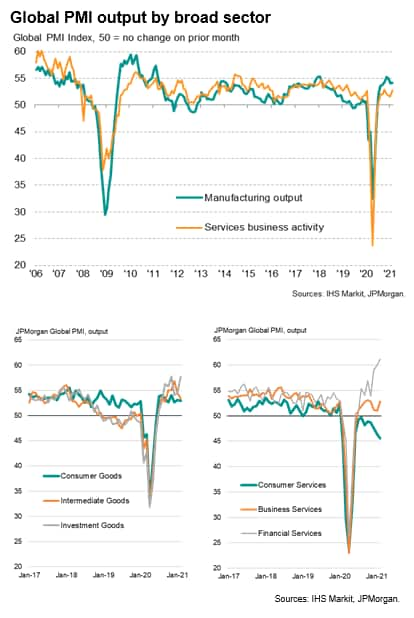

Manufacturing continued to lead the upturn, albeit with the rate of expansion remaining below the peak seen at the end of last year due in part to supply shortages, though still notching up one of the best performances seen over the past decade.

Leading the production upturn was a surge in output of investment goods, such as machinery and equipment, with the rate of increase the second-quickest over the past ten years, pipped only by last November's increase.

The weakest area of manufacturing remained consumer goods, reflecting ongoing retail closures and social distancing measures in many countries, although even here sustained and moderate growth was recorded.

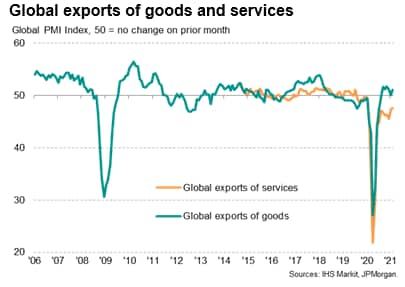

Growth of business activity in the service sector meanwhile lagged behind that of manufacturing again, principally due to an ongoing marked fall in cross-border trade in services (whereas exports of goods continued to rise). Service sector exports continued to be hit by COVID-19 restrictions on travel and tourism in particular.

Consumer services hence suffered by far the worst performance of all the broad sectors in February, with business activity deteriorating at the sharpest rate since last May. In contrast, output of business services and financial services accelerated, the latter notably quickening to the fastest recorded since comparable data were first available in 2009 as growth in recent months has surpassed the prior peak seen in 2012.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-growth-accelerates-as-covid19-restrictions-ease-march21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-growth-accelerates-as-covid19-restrictions-ease-march21.html&text=Global+growth+accelerates+as+COVID-19+restrictions+ease+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-growth-accelerates-as-covid19-restrictions-ease-march21.html","enabled":true},{"name":"email","url":"?subject=Global growth accelerates as COVID-19 restrictions ease | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-growth-accelerates-as-covid19-restrictions-ease-march21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+growth+accelerates+as+COVID-19+restrictions+ease+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-growth-accelerates-as-covid19-restrictions-ease-march21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}