Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Sep 19, 2024

By Ken Wattret

Learn more about our data and insights

The US Federal Reserve started its long-awaited easing cycle with a bang. The initial rate cut of 50 basis points was larger than we had forecast, while the Fed's communication was also more dovish. As a result, we now expect cuts of 25 basis points in both November and December this year, with a series of cuts in 2025-26 returning the policy rate to neutral. Given the size of the Fed's move, along with its signals of more easing to follow, rate cuts elsewhere will become more widespread as concerns of currency depreciation recede.

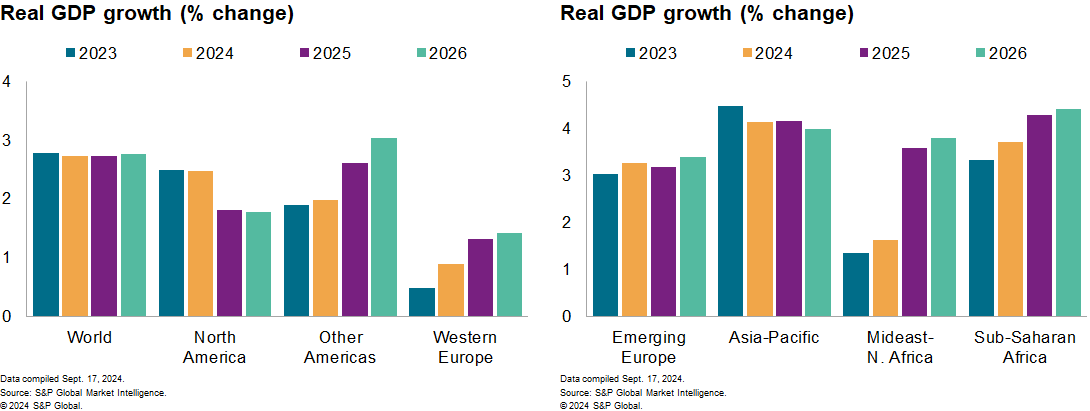

A material pickup in global growth momentum is unlikely in the near term. The broad outline of our growth forecast remains intact, with the US economy transitioning to a period of below-trend growth. In the US and elsewhere, the effects of looser monetary policy on economic activity will also take several quarters to fully permeate. Global growth prospects will also be influenced by a wide range of non-monetary factors, including demographic and productivity trends, fiscal impulses, trade policy, and geopolitical events and risks. Many of these factors are expected to continue to dampen growth in the period ahead.

The Purchasing Managers' IndexTM (PMI®) figures in August signaled continued weakness in manufacturing activity. The global manufacturing output, new orders and employment indexes were all in contraction territory last month. So too was the new export orders index, a bellwether for global trade dynamics, which failed to improve for the fourth straight month. On the positive side, there has been no evidence of significant contagion to the service sector so far. With the national services PMIs generally holding firm in August, the global composite output index improved slightly and remained at a level (52.8) consistent with trend-like global growth.

Global real GDP growth forecasts for 2024 and 2025 are unchanged at 2.7% in our September update. This year's growth forecasts for Brazil particularly, plus the UK and Russia, have been upgraded, primarily owing to stronger-than- expected second-quarter outcomes. The forecasts for mainland China and Canada have been lowered. Global growth rates are forecast to go sideways during the second half of this year, hindered by the renewed weakness in manufacturing and global trade. Growth prospects look most vulnerable in the economies most sensitive to those areas, including many in Western and Emerging Europe.

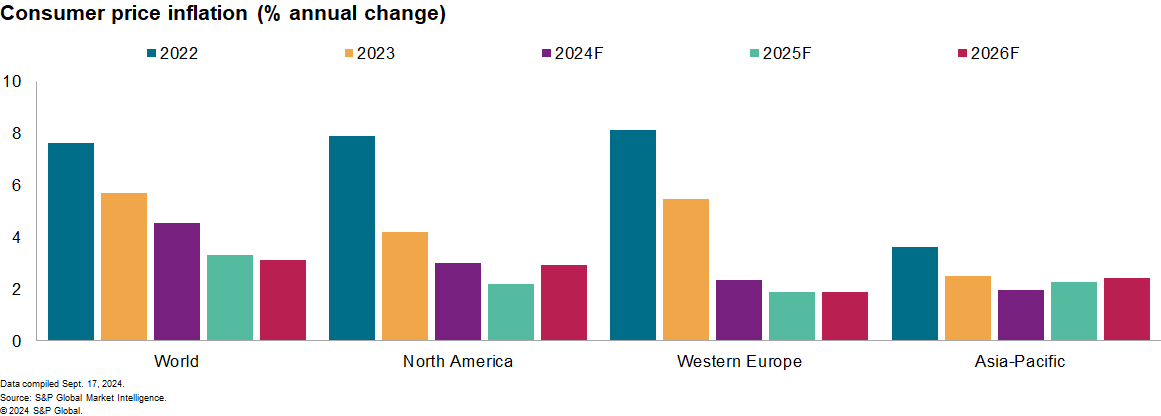

Underlying disinflationary trends have continued. The aggregate consumer price inflation rate for core goods that we calculate for the Group of Five (G5) economies was negative for the fourth successive month in July (at minus 0.3%). Although the inflation rate is bottoming out, measures of supply chain conditions suggest that it is likely to remain subdued over the months ahead. The moderation in container freight costs points to the same conclusion. Services inflation in the G5 economies also continued its gradual decline in July, falling to its lowest level (4.3%) since early 2022. Pricing data from S&P Global's PMIs signal a further moderation.

Further dollar depreciation is expected. The recent narrowing of yield differentials will likely persist. Our measure of the broad, real effective dollar index declined in three of the four months leading up to August. Appreciation against the dollar has been broad-based over this period, with eight of the 11 largest-weighted currencies in our dollar index making significant gains. The yen's rise has been particularly pronounced, owing to its weak starting point and monetary policy divergence. The Mexican peso is a notable exception, with further weakness anticipated.

Hear a senior US economist describe how monetary policy works

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.