Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Mar 15, 2024

By Ken Wattret

Learn more about our economic data and forecasts

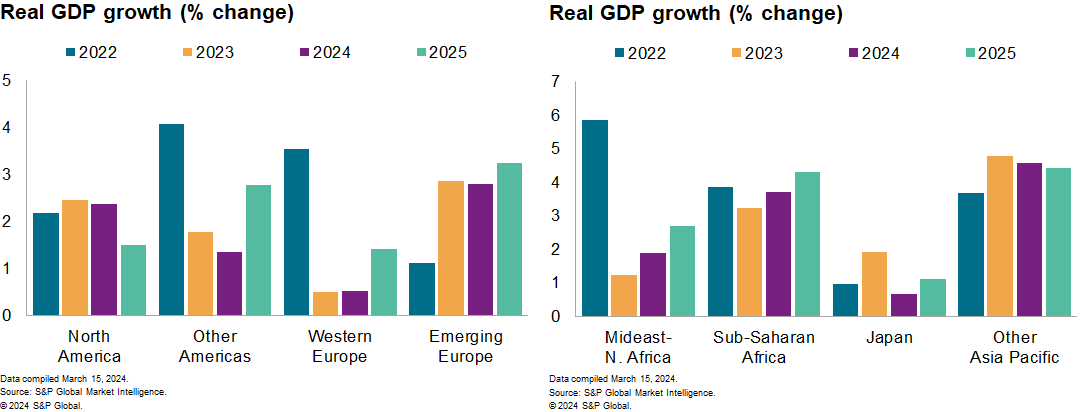

S&P Global Market Intelligence's global growth forecast for 2024 has again been revised upward in March. Annual real GDP growth is now projected at 2.6%, up from 2.3% at the start of the year. The upward revision reflects somewhat higher forecasts for growth in several countries, including the US, the UK, and India. Our global forecast remains above the market consensus expectation (2.4%) as it has been since the beginning of 2023. Our annual global real GDP growth forecast for 2025 is unchanged at 2.6%. Global real GDP growth on a quarter-over-quarter basis likely reached a trough of 0.4% in the final quarter of 2023, with a pickup to 0.8% forecast by the second half of 2024. Support to activity is expected from two key sources: a boost to household real incomes from lower inflation and more accommodative financial conditions.

Global Purchasing Managers' Index (PMI™) data signal a further improvement in economic conditions. The J.P.Morgan Global Composite PMI Output Index compiled by S&P Global improved for the fourth straight month in February, reaching a nine-month high, albeit still below its long-run average. Output indexes for manufacturing and services were both above the expansion level of 50 in February for the first time since mid-2022. The aggregate composite output index for emerging economies continued to outperform its developed economy equivalent. While manufacturing conditions remain relatively subdued — in Western Europe particularly — there have been recent positive signs in the form of a rise in the global PMI's order-to-inventory ratio and improving export orders. The latter is a leading indicator of trends in global trade.

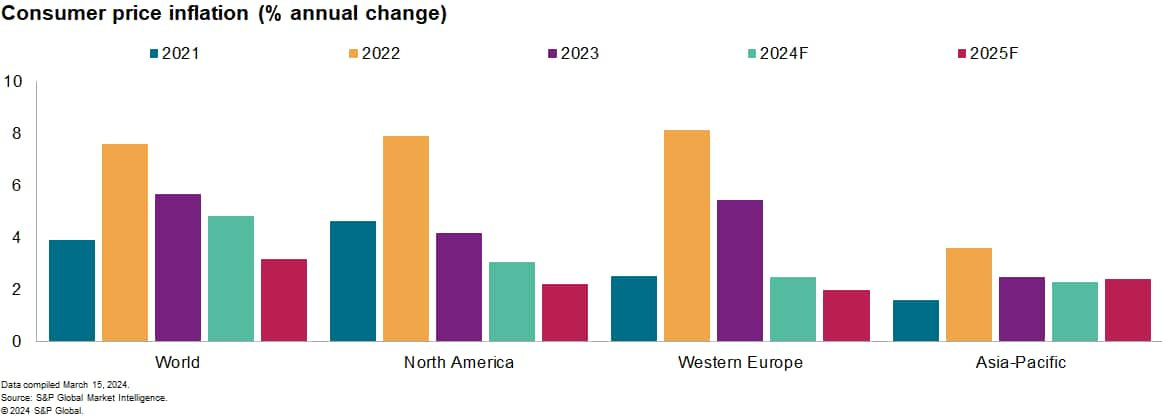

Our forecast for global consumer price inflation in 2024 has been revised slightly upward. At 4.8%, consumer price inflation is still projected to fall from the 2023 annual average of 5.7%, but disinflation has become more uneven in recent months. Global consumer price inflation slipped to 4.4% in January, according to S&P Global Market Intelligence estimates, down by over 4 percentage points from its peak in September 2022 but only marginally below the mid-2023 level. Annualized inflation rates have also picked up somewhat in recent months. Sticky services prices remain a concern, with our measure of consumer price inflation for services in the Group of 5 (G5) economies ticking up to 5% in January, down by only a little over a percentage point from the peak of 2023. We continue to expect a gradual moderation, as wage trackers continue to show a gradual easing of pay pressures. In contrast, our measure of core goods consumer price inflation in the G5 economies continued to fall sharply in January, dropping below 1% after having peaked at over 8% in 2022. PMI data in January and February have shown rather limited effects from the disruptions to shipping routes, which are supportive of our view that the inflationary impact will be relatively contained in the absence of additional major geopolitical shocks.

Our forecast of the initial cut in policy rates by the US Federal Reserve has been pushed back to June. This development reflects continued growth resilience and firmer inflation data. We now expect only 75 basis points (bps) of rate cuts in total in the US during 2024, a little less than current futures market expectations. S&P Global Market Intelligence's forecasts of initial rate cuts from the European Central Bank and the Bank of England in June remain unchanged, with both still forecast to ease by 100 bps this year. Our forecast broadly matches market expectations for the former but is slightly more aggressive for the latter. The US dollar's rebound early in the year has faded since our February forecast update, with the currency losing ground against the yen, euro and pound sterling. Even with the tweaks to our monetary policy forecast, we continue to see the fundamentals favoring a depreciating trend for the dollar.

Discover our top 10 economic predictions for 2024

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.