Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jun 18, 2024

By Ken Wattret

Learn more about our data and insights

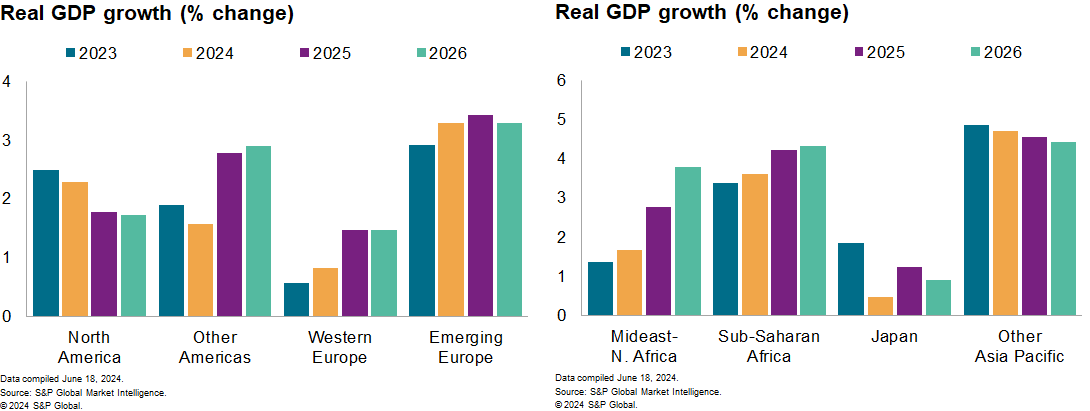

The real GDP growth forecasts for 2024 have been lowered in a few major economies, including the US, Canada, Brazil and Japan. The revisions were relatively minor and reflect surprises and/or revisions to recent activity data, plus idiosyncratic national factors. At the same time, the 2024 real GDP growth forecasts for China, the eurozone, the UK, and Russia were revised upward in the June update, for similar reasons. The net result for global real GDP growth in 2024 is an unchanged 2.7% forecast, albeit after three upward revisions in the four prior months. The 2025 global growth forecast has edged up from 2.7% to 2.8% in the June update, with forecasts for some of the larger countries revised higher, including the US and China, related to policy stimulus. For both years, our global growth forecasts are slightly above market consensus expectations, which have been edging upward in recent months.

May's Purchasing Managers' Index™ (PMI®) figures again showed an improvement in global economic conditions. The composite global output index improved for the seventh successive month in May, recording the biggest month-over-month increase in more than a year. This pushed the index (53.7) above its long-run average (53.2). The global output indexes for services (54.1) and manufacturing (50.9) improved in May. The aggregate composite output index for emerging economies (54.4) remained above its advanced economy equivalent (53.4). Still, the recent outperformance of the latter has narrowed the gap between the two indexes to its lowest level since September 2022. While the export orders subindex of the global manufacturing PMI slipped back in May after a run of increases, it continues to signal a pick-up in global trade growth, which is a key aspect of our near-term global growth forecast.

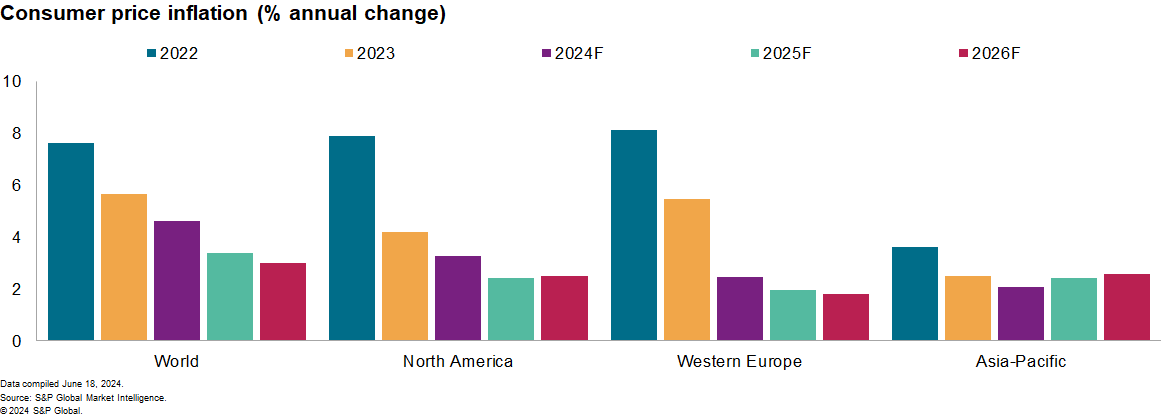

We continue to expect a gradual downward trend in global consumer price index (CPI) inflation in 2024-26, driven by a moderation in underlying price pressures. CPI inflation for core goods in the G5 group of economies turned negative in April, according to S&P Global Market Intelligence estimates. The inflation rate declined for the 12th successive month to negative 0.1%, the lowest since early 2020 during the initial phase of the COVID-19 pandemic. While surveys of businesses' pricing intentions, including from our manufacturing PMIs, point to a levelling off in core goods inflation later this year, services inflation is expected to continue its gradual descent as labor cost pressures ease. The CPI inflation rate for services in the G5 economies edged down to 4.8% in April, according to our estimates, a percentage point and a half below its peak in February 2023. The $86/b assumption for the average Dated Brent crude oil price in 2024 is somewhat lower than in May, reflecting recent downward pressure on prices and contributing to the reduction in the 2024 global CPI inflation forecast from 4.8% to 4.6%.

Monetary policy easing continues to become more widespread amid the US Federal Reserve's inaction. The European Central Bank delivered an initial 25 basis point (bp) cut in its key interest rate in June, in line with our long-standing forecast. Our base case is for further 25-bp cuts in September and December, although recent ECB communications have suggested that the risk is likely skewed toward fewer rather than more cuts than we forecast given still elevated eurozone services inflation and wage growth. The Bank of Canada also delivered an initial 25-bp rate cut in June, a month earlier than forecast, and sounded more confident than the ECB that further improvements in inflation will pave the way for more easing in the months ahead. We forecast two further 25-bp cuts in Canada before year-end. We continue to expect Fed and Bank of England easing cycles to begin during the second half of the year, with rate cuts also forecast to become more widespread across emerging markets.

Listen to our podcast episode on monetary policy pivots

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.