Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jul 15, 2024

By Ken Wattret

Learn more about our data and insights

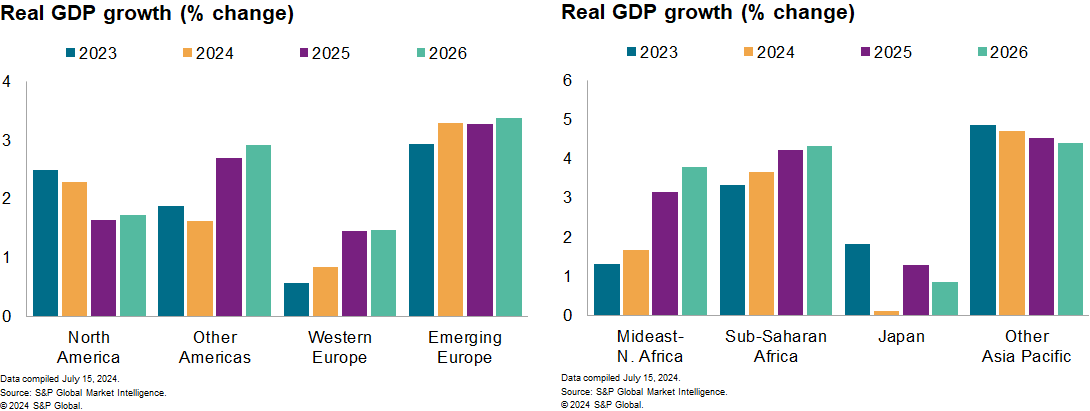

Global growth is being supported by moderating inflation, more accommodative financial conditions and a pickup in global trade. Still, growth rates are not forecast to reach the heights of prior expansions owing to a combination of headwinds including elevated debt burdens, higher interest rates and various geopolitical uncertainties. At the regional and national levels, our forecast narrative remains one of divergent near-term trends. The forecast includes a continuation of the gradual slowdown in the US economy, reflecting factors including tighter bank lending standards, less supportive fiscal policy and the strong dollar. In contrast, economic conditions have been improving in Western Europe, although growth is expected to remain rather tepid.

S&P Global Market Intelligence analysts' forecast of global real GDP growth in 2024 is unchanged at 2.7% in July's update. Downward revisions to our growth forecasts for Canada and Japan have been broadly offset by upward revisions to projections for the UK particularly, as well as for India and Russia. The 2025 global growth forecast has been edged down, from 2.8% to 2.7%, primarily reflecting a weaker US forecast.

June's global Purchasing Managers' IndexTM (PMI®) data showed a mixed picture. The composite global output index lost ground for the first time in eight months. Global manufacturing and services output indexes both weakened, as did the composite aggregates for advanced and emerging economies. Business expectations also fell to the lowest level for seven months, linked to political uncertainty surrounding various elections. Nonetheless, PMI data continued to signal stronger global growth momentum compared with late 2023 and all subsectors reported stable or rising output in June for the first time in three years. Although manufacturing growth dipped, June's rate of expansion was still the second strongest in two years.

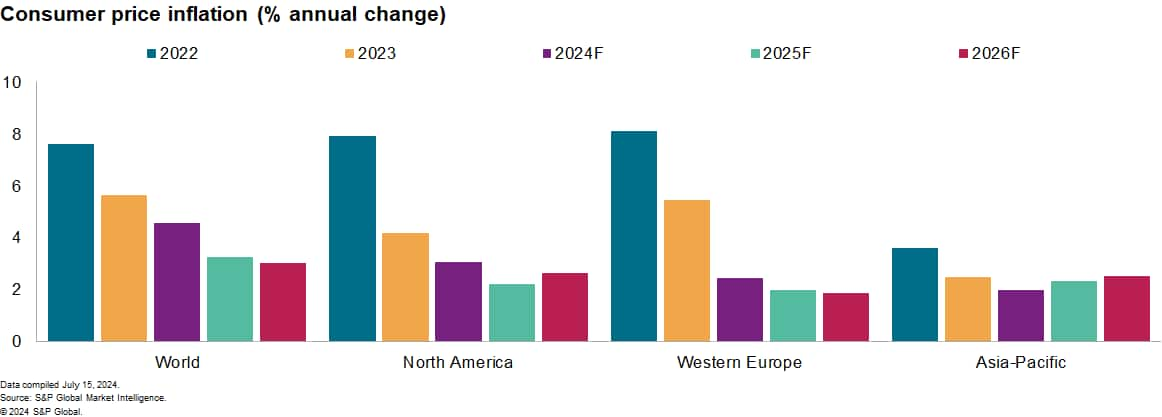

Global consumer price inflation is forecast to continue its gradual decline. From an estimated 4.5% in May, inflation is forecast to decline below 4% in the final quarter of 2024 before settling at around 3% from the second half of 2025. In-house forecasts for Brent crude oil prices in late 2024 and in 2025 have been lowered, which reflect expected excess supply, contributing to the downward revision of the 2025 global consumer price inflation forecast. Underlying price pressures should also continue to ease, in tandem with moderating wage and unit labor cost growth.

Core goods have been the primary source of underlying disinflation to date. This situation reflects weak demand and improving supply conditions, including shortening delivery times. The core goods inflation rate in the Group of Five (G5) economies turned negative in April and May, according to Market Intelligence estimates. However, leading indicators, including our global manufacturing PMI price indexes, suggest the rate will bottom out in mid-2024 before rising gradually in line with higher producer price inflation rates. According to June's PMI data, prices charged by manufacturers rose at the sharpest rate for 15 months.

Upside risks to inflation will need close monitoring given the potential implications for monetary policy. The key upside risks include continued tight labor market conditions, which are keeping labor cost growth rates elevated; adverse weather; disruptions to supply chains; and increased protectionism. The consumer price inflation rate for services in the G5 economies edged down to 4.7% in May, according to our preliminary estimates, still well above the levels historically consistent with central bank inflation targets being met. June's PMI data, however, showed further signs of cooling selling price inflation in the service sectors of most major economies.

Monetary policy easing is forecast to become more widespread from late 2024. The forecast moderation in inflation and the start of the US Federal Reserve's easing cycle should pave the way to more accommodative global financial conditions in 2025-26, supporting economic activity. Our base case remains for an initial US rate cut in December. The chances of a somewhat earlier move have risen given the recent Fed commentary and improving inflation data. At the time of writing, futures markets were fully factoring in a 25-basis-point cut in September and at least two 25-basis-point cuts by year-end. More dovish US policy rate expectations have weakened the dollar, as expected. While various fundamentals factors point to further depreciation, including shifting growth and interest rate differentials, safe-haven flows due to rising uncertainty could interrupt the trend.

A stream of US rate cuts is forecast in 2025-26, but a return to pre-pandemic lows remains unlikely. For advanced economy central banks, we forecast a return to neutral policy rates by 2026, implying levels that are well above their pre-pandemic norms. Policy rates could fall below their estimated neutral levels if inflation rates fall below targets for a sustained period, although we consider this unlikely owing to various structural changes to the global economy.

Listen to our podcast episode on the US macroeconomic outlook

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.