Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 10, 2019

Global economic growth slips to three-year low amid gloomier outlook

The following is an extract from IHS Markit's monthly PMI overview presentation. For the full report please click on the link at the bottom of the article.

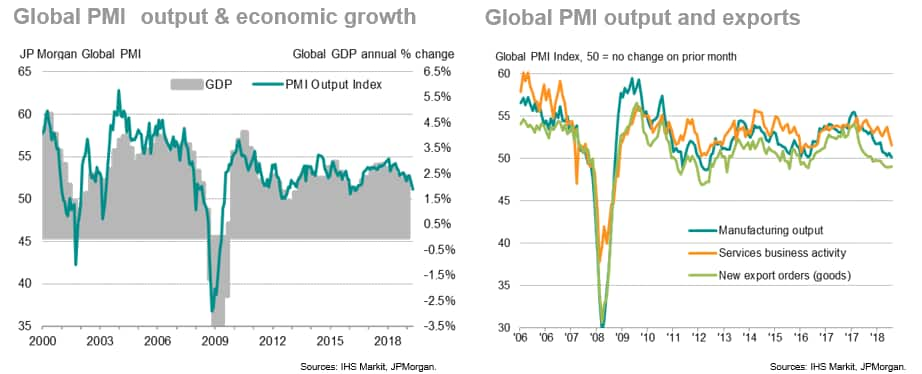

The pace of global economic growth eased to its weakest for three years in May amid an increasingly broad-based slowdown. The JPMorgan Global PMI™, compiled by IHS Markit, fell for a second successive month in May to signal the slowest expansion since June 2016, slipping to 51.2 compared to 52.1 in April. The survey data are indicative of worldwide GDP rising at an annual pace of 2.0% (at market prices) so far in the second quarter, down from 2.4% in the first quarter, dropping to around 1.75% in May alone.

Manufacturing again led the slowdown, with output expanding only slightly to register the sector's worst performance since October 2012. Falling global goods exports, down for a ninth successive month in May, fueled the factory malaise. However, service sector growth also slowed markedly, down to its lowest since August 2016.

Business sentiment about the year ahead meanwhile deteriorated to its lowest since comparable data were first available in 2012.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-growth-slips-to-threeyear-low-100619.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-growth-slips-to-threeyear-low-100619.html&text=Global+economic+growth+slips+to+three+year+low+amid+gloomier+outlook+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-growth-slips-to-threeyear-low-100619.html","enabled":true},{"name":"email","url":"?subject=Global economic growth slips to three year low amid gloomier outlook | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-growth-slips-to-threeyear-low-100619.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+economic+growth+slips+to+three+year+low+amid+gloomier+outlook+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-growth-slips-to-threeyear-low-100619.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}