Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jul 19, 2024

Global consumer spending growth remained resilient in the second quarter, according to PMI survey data from S&P Global Market Intelligence, fueled by rising demand for both goods and services. Trends varied by region, however, with Europe seeing consumer spending lagging that of the US and Asia, the latter having led the global spending upturn since late-2022.

S&P Global Market Intelligence's PMI surveys are widely used in gauging national economic growth, inflation and labour market trends ahead of comparable official data. However, the survey data, which cover all major developed and emerging market economies, can also be aggregated to provide global economic data sets, allowing the analysis of worldwide economic trends on a sectoral basis.

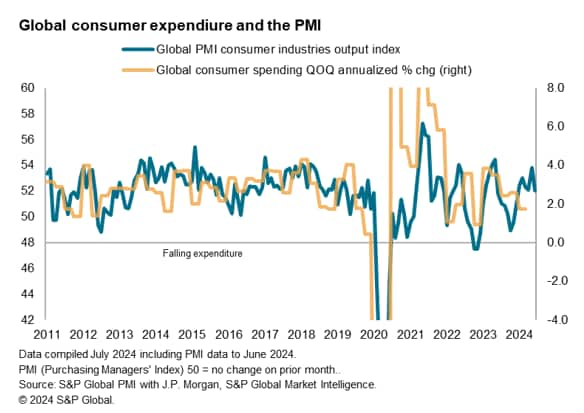

For example, the PMI data relating to consumer services activities, which includes spending in sectors such as tourism, restaurants and other recreation, can be combined with PMI data for consumer goods to provide an overall view of consumer industry activity. These data have in the past exhibited a robust correlation with official consumer expenditure data derived from national accounts data globally.

These PMI data showed output of these consumer-oriented sectors growing for a seventh successive month in June, albeit the rate of expansion slowing compared to May to the weakest since December 2023. The overall expansion in the second quarter nonetheless matched that seen in the first quarter, which had in turn signaled a recovery from a mild contraction seen in the fourth quarter of last year.

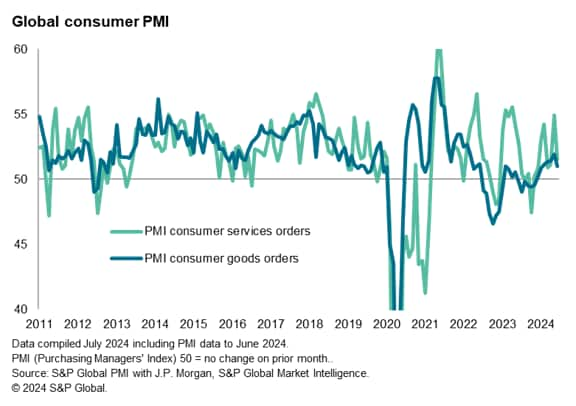

Looking at the consumer data by sectors, the PMI surveys reveal how, after falling dramatically during the early phase of the pandemic (when demand switched to goods during lockdowns), orders for consumer services have since been on a volatile path. Strong periods of demand for services such as travel and tourism were evident as economies reopened in the first halves of 2022 and 2023 (the latter seeing the sudden full removal of COVID-19 containment measures in mainland China). More recently, demand has risen for both goods and services among consumers during the year-to-date in 2024, albeit with services generally seeing the stronger uplift on average in the second quarter.

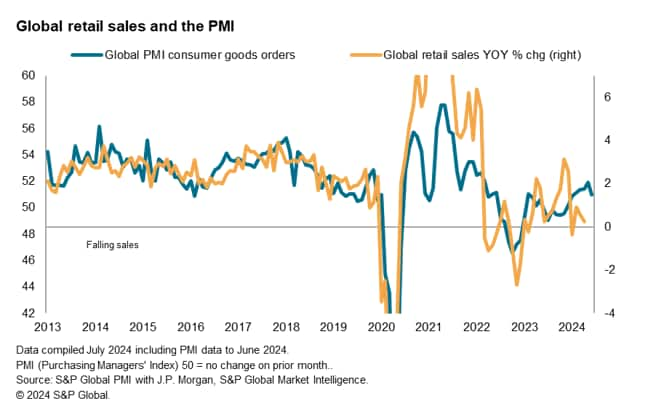

The PMI data relating to new orders for consumers goods has nevertheless also remained in growth territory during 2024, and given the PMI series' close correlation with official retail sales data, suggests retail spending on goods had been rising at an annual rate of approximately 1.5% in the second quarter.

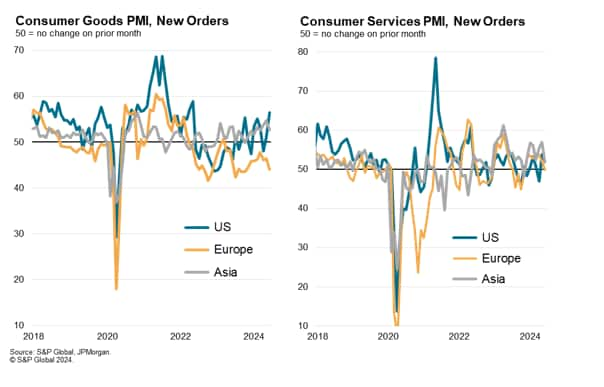

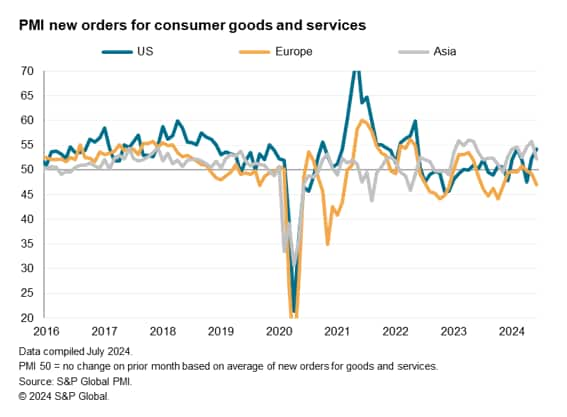

The sector data can be analysed on a regional basis, though with the caveat that metrics such as orders for goods will include export sales. These data showed demand for consumer goods diverging, with accelerating new orders growth in the US and Asia (the former notably exhibiting some volatility) contrasting with an increasing rate of decline for consumer goods orders in Europe.

In terms of consumer services, global orders have been led by Asian markets in recent months, with new orders for consumer services even falling into marginal decline in Europe during June for the first time since last November. Demand for consumer services in the US meanwhile expanded for a second successive month in June, rebounding from a fall in April to point to solid spending growth over the second quarter as a whole.

The combined index of new orders for consumer goods and services (equally weighted) averaged just 48.7 in Europe during the second quarter. That compared with averages of 51.4 in the US and 54.3 across Asia, underscoring a spending outperformance across Asia that has now been evident since late-2022.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.