Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jun 24, 2024

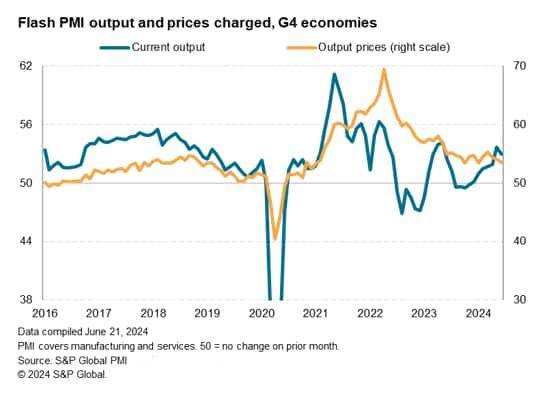

The flash PMI data for June from S&P Globalindicated sustained robust economic growth across the four major developed economies - the 'G4' - albeit with the overall pace of expansion losing some momentum. At the same time, inflation - in terms of average prices charged for goods and services - moderated on average across the G4 to one of the lowest rates seen over the past three and a half years. However, output and inflation trends varied markedly among the G4 economies: while the US bucked the global economic growth slowdown, the UK diverged from the trend of lower inflation.

June flash PMI survey data showed the G4 major developed economies expanding for a seventh successive month in June, further reviving from a brief and shallow four-month downturn seen in late 2023. Less positively, the aggregate expansion in June was weaker than seen in May, albeit still the second-strongest recorded over the past year to signal a robust expansion over the second quarter as a whole.

Moreover, a drill-down into the data reveals that at least some of this slowdown could prove temporary. In particular, there were notable growth divergences among the G4 economies, with further robust growth of business activity in the US contrasting with slowdowns in Europe and Japan, caused by differing factors.

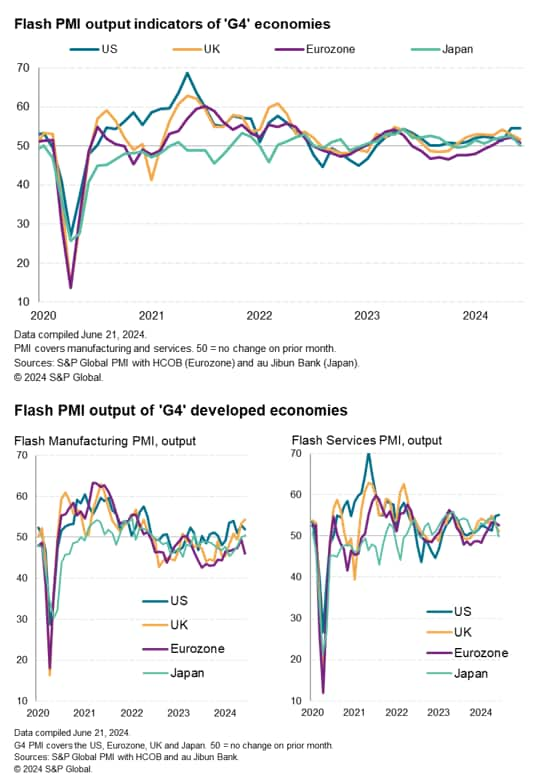

While the main survey measure of output across both manufacturing and services edged up to record the fastest economic expansion for 26 months in the US, comparable gauges fell elsewhere.

In Europe, the equivalent UK and eurozone PMIs fell to seven-month and three-month lows respectively, though importantly still registered growth. The UK PMI has now signalled growth for eight straight months and the eurozone PMI has been in expansion territory for four successive months. However, these European survey data were subdued in part by political uncertainty ahead of upcoming elections both in the UK and France, the latter dragging the eurozone services data lower. So, some of this weakness may prove temporary should businesses react positively to the July election outcomes.

Perhaps more worryingly, the PMI for Japan sank to a six-month low, signalling stagnation. Unlike in Europe, this stalling of growth in Japan could not be traced to any special factors according to survey responses, and therefore poses more of a concern that the Japanese post-pandemic upturn may be losing momentum as companies, households and tourists start to rein in spending. It is notable that services activity slipped into contraction for the first time in 22 months, contrasting sharply with relatively resilient service growth in the other G4 economies - and in particular an acceleration of growth in the US.

The US' strong performance among the G4 major developed economies over the second quarter is in part linked to companies often citing fewer cost-of-living issues and hopes of lower interest rates. Fortunately, the US PMI survey's main price gauge fell to one of the lowest levels seen over the past three years, adding to these hopes.

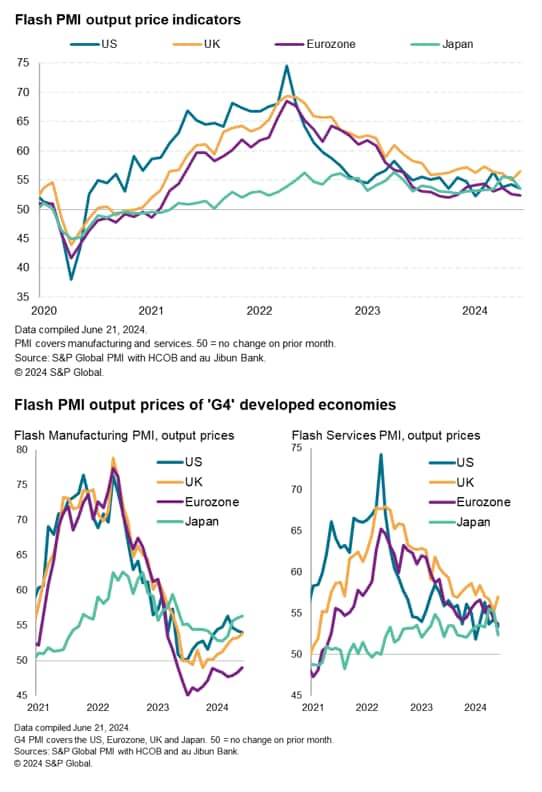

Average prices charged for goods and services in the US rose in June at the slowest rate for five months, and at the second-slowest rate recorded since October 2020. With central banks keenly focused on wage-related service sector cost inflation, it was also encouraging to see US service sector input cost inflation fall in June to one of the lowest levels seen over the past four years, helping drive down service sector selling price inflation further.

Selling price inflation rates also cooled noticeably in the eurozone and Japan, in both cases largely driven by moderating service sector price growth.

Rates of selling price inflation in the US and Eurozone are consequently now only modestly above their pre-pandemic ten-year averages. Although Japan's remains elevated, this is largely a consequence of the weaker yen, which has increased the cost of importing goods and services.

Bucking the cooling inflation trend was the UK, where selling prices rose at the steepest rate for four months in June. The UK rate also continues to remain worryingly elevated relative to its pre-pandemic average, notably in the service sector, to hint at stubbornly elevated core price pressures. However, not only did average prices charged for services in the UK rise at the sharpest rate for three months in June, but prices charged for goods also rose at a rate not seen for over a year.

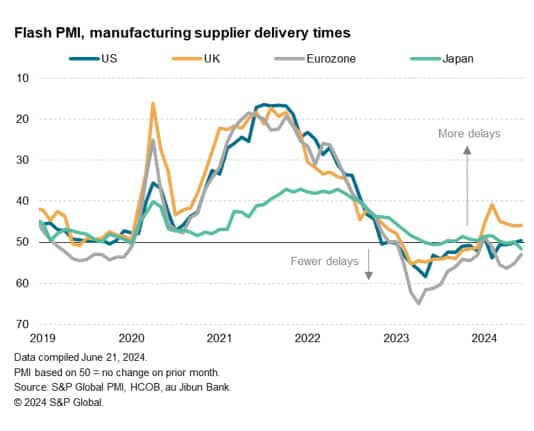

While higher goods prices are also being recorded in the US and Japan, the UK's rise is arguably more worrying as it is blamed on a disproportionally high level of supply chain delays relative to other G4 economies, which points to supply-side issues rather than being a simple function of rising demand.

Thus, despite the UK being the only economy in which headline inflation has already fallen to the central bank's target, the PMI data suggest that the UK's underlying price pressures remain the most worryingly elevated of the G4.

Access the US, UK, Eurozone and Japan press releases.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.