Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Feb 21, 2025

Early PMI survey data for February indicate that business activity remained largely stalled for a fourth successive month, with job losses mounting amid falling sales and rising costs. The lack of growth alongside rising price pressures points to a "stagflationary" environment which will present a growing dilemma for the Bank of England.

While marginal output growth was eked out in February, order books deteriorated at a rate not seen since August 2023 to hint at likely cuts to business activity in the coming months unless demand revives.

Firms' costs are meanwhile rising at a rate not witnessed since May 2023, the rate of inflation having now accelerated for four straight months, putting further upward pressure on selling prices for both goods and services. The survey data point to a further rise in inflation beyond the latest uptick to 3%.

A key factor behind the upturn in inflationary pressures is the growing number of firms reporting the need to raise prices in order to help offset the impending rise in staff costs associated with the National insurance hike and uplift to the minimum wage announced in the Autumn Budget.

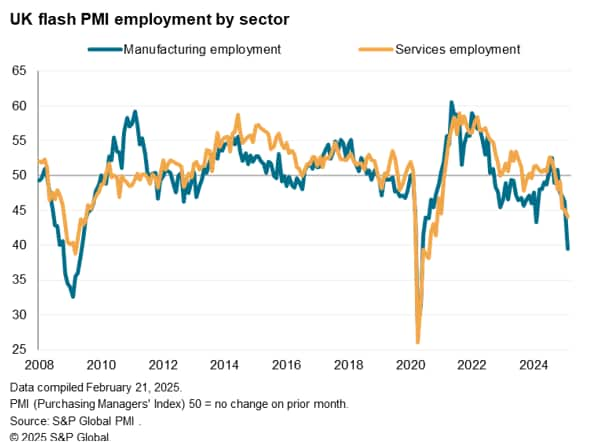

However, companies also reported that the Budget changes also played a major role in driving intensifying job cuts. Employment fell sharply again in February, dropping at a rate not seen since the global financial crisis if pandemic months are excluded. One in three companies reporting lower staffing levels directly linked the reduction to policies announced in last October's Budget.

Business activity growth remained largely stalled in February. The headline indicator from the flash PMI surveys, the seasonally adjusted S&P Global UK PMI Composite Output Index, edged down from 50.6 in January to 50.5 in February, running at a level signalling broadly zero GDP growth for a fourth successive month, according to historical comparisons.

While service sector business activity rose slightly, with growth nudging higher compared to January, the expansion was still one of the slowest seen over the past 16 months. Ongoing weakness was again reported among consumer-facing service providers, accompanied by growing signs of a deepening downturn in business services, contrasting with pockets of strength in financial services and IT. Manufacturing output meanwhile, contracted for a fourth successive month, the rate of decline gathering pace to the second-highest recorded over the past 14 months.

Worryingly, new orders across goods and services fell for the third successive month, with the rate of loss accelerating to the fastest since August 2023. Export orders fell especially sharply, likewise dropping at a pace not seen since August 2023.

By sector, orders dropped at greater rates in both manufacturing and services, deteriorating for a fifth and second consecutive month respectively. Notably, although manufacturers reported the steeper rate of decline of the two sectors, services new business inflows worsened at a rate not witnessed since November 2022.

New export orders for services fell at the sharpest pace since the COVID-19 lockdowns of early 2021 while goods exports fell at the fastest rate for just over a year.

With February seeing backlogs of uncompleted work fall sharply again in both sectors, job cutting remained widespread, intensified by reports of companies cutting headcounts, freezing hiring or not replacing leavers due to rising staff costs associated with changes announced in the Autumn Budget, notably around increased National Insurance contributions and the uplift in the minimum wage. One in three companies reporting lower staffing levels directly linked the reductions to October's Budget.

The overall drop in employment - the fifth consecutive decline -was consequently the highest since November 2020. This represents a pace of job losses not seen besides the pandemic since June 2009, with job shedding especially marked in the manufacturing sector.

Input costs meanwhile rose across both goods and services in February at the sharpest rate since May 2023, with the rate of inflation having risen for four successive months. Input costs in manufacturing rose at the fastest rate for 25 months and services cost inflation held steady on January's 17-month high.

Higher costs were passed through to customers, which rose overall at a rate only marginally below January's one-a-half year high. Prices charged for goods increased at the steepest rate for 22 months, with the rate of inflation jumping sharply higher. While service sector selling price inflation moderated slightly, it was still the second highest recorded over the past year.

Many cost and price increases reflected higher-than-usual annual uplifts for list prices, reportedly reflecting the need to help cover additional staffing costs associated with the Budget over the coming year.

The intensification of price pressures so far this year has pushed the PMI price gauges into territory broadly indicative of consumer price inflation running around 4%, suggesting that the rate of inflation in the UK could rise further above the Bank of England's 2% target after having already risen to 3% in January, according to official data.

Of concern, the rise in inflation in the service sector recorded by the PMI, an area of key concern to many policymakers, points to stubbornly elevated core inflation.

The weak growth profile in recent months, combined with the rise in price pressures, puts the Bank of England in an increasingly difficult position regarding interest rates. While lower interest rates will hopefully help lift sluggish growth, the recent upturn in prices may deter any further loosening of policy as rate setters assess whether the renewed inflationary pressures are transitory. Much will depend on the degree to which higher prices resulting from staffing costs and upcoming energy price increases feed through to second round effects, notably via wages. However, with the latter already rising at an annual 6% rate, according to the latest official data, it seems the inflation risks are tilted once again to the upside.

On a brighter note, having fallen to its lowest for just over two years in January, business sentiment about output growth in the year ahead improved in February, rising to the highest for four months. The overall level of sentiment remained subdued by historical standards, however, as companies remained concerned regarding the economic outlook and growth dampening aspects of recent government policies. Tariff worries were also cited in manufacturing.

The lift in confidence compared to January could be linked to increased reports of business investment and spending plans, as well as new product launches and greater marketing spend to help offset adverse demand conditions. Lower interest rates were also cited as an expected demand driver.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Products & Offerings