Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 20, 2024

Upcoming flash PMI survey data for August will provide important insights into economy growth and inflation trends in the UK, coming at a time of mixed views on the future policy path at the Bank of England.

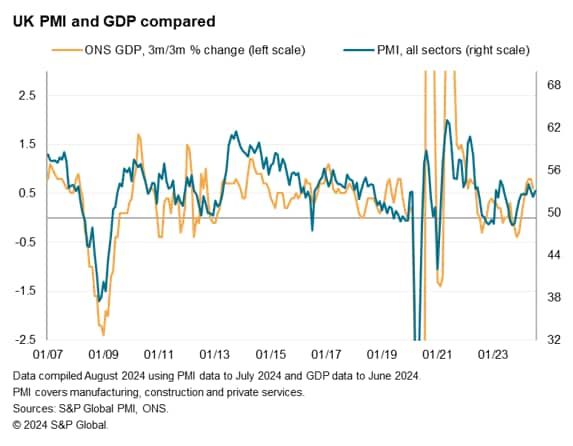

Official data have confirmed recent upbeat survey evidence, indicating that the UK economy is faring well in 2024. Gross domestic product rose 0.6% in the second quarter, according to initial estimates from the Office for National Statistics, building on a solid 0.7% gain in the first three months of the year. This follows robust S&P Global PMI readings for the UK in the year to date. The all-sector PMI index (tracking output in the manufacturing, services and construction sectors) has averaged 52.9 over the first seven months of 2024, having not fallen below 52.3 so far this year.

Further growth is anticipated for the second half of the year, though most economists - including those at the Bank of England - are expecting the pace of expansion to cool. The Bank's forecasters are expecting a 0.4% GDP rise in the third quarter followed by a 0.2% increase in the closing quarter of the year.

This slowing in part reflects base effects: the first half of the year has seen the economy rebound from a mild technical recession in the second half of 2023. However, survey data suggest that the underlying pace of growth has remained robust into July, suggesting that any slowdown in the third quarter GDP numbers should not be overly concerning.

The PMI's headline index tracking output in the manufacturing, services and construction sectors registered 53.1 in July, in line with the average seen in the second quarter.

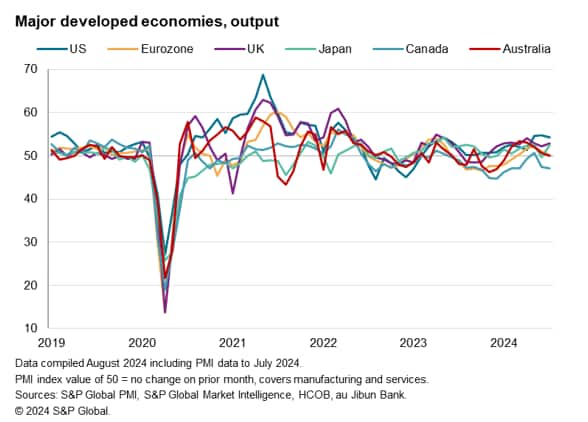

Note also that the PMI data show the UK outperforming all other major developed economies bar the US. In particular contrast, growth has near-stalled in the eurozone while Canada and Australia both saw falling output in July. Japan's growth has meanwhile recently been more volatile than that of the UK.

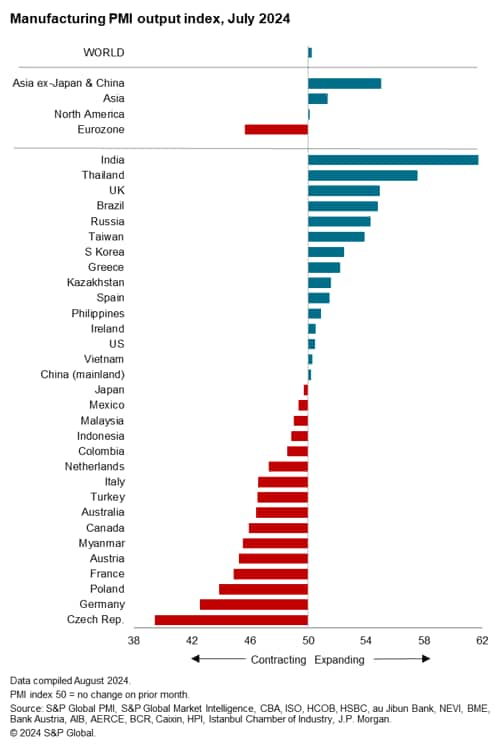

Much of the UK's recent economic strength is due to robust service sector activity growth, which is also propelling growth in the US and Japan. However, worthy of special note is a marked outperformance of manufacturing in the UK in recent months. Only India and Thailand reported faster manufacturing growth than the UK in July, according to S&P Global's PMI surveys. By comparison, factory output fell sharply in the eurozone and declines modestly in Japan, while only a modest increase was recorded in the US.

Alas, the UK's manufacturing growth is not linked to improved export performance, with Brexit and associating trading impediments exacerbating a broader global trade slowdown in July according to survey contributors, but the UK's strong production growth does nonetheless hint at reviving domestic demand.

Further clues of the UK's third quarter growth trend will be provided by the upcoming flash PMI data for August, and any stronger than expected performance could tip the Bank of England towards erring on the side of caution when it comes to cutting interest rates.

The Monetary Policy Committee cut interest rates for the first time since the pandemic at its August meeting, the policy rate falling from 5.25% to 5.00%. However, the decision was 'finely balanced' with five committee members voting to cut rates against four voting to leave rates unchanged. Any strengthening of economic growth will worry the hawkish rate setters that pricing power and wage bargaining power remain elevated.

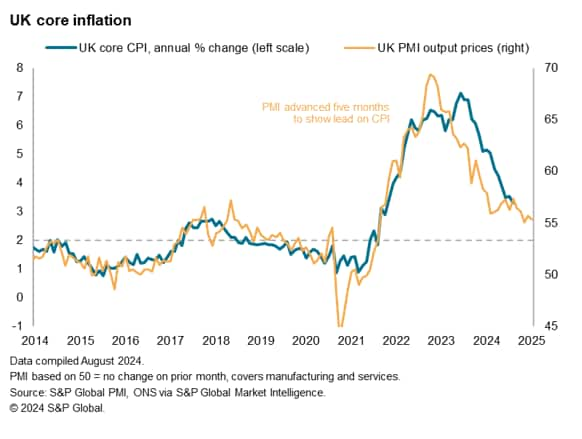

Moreover, although inflation fell to the Bank's 2.0% target in May and June, July saw the rate lift higher for the first time in a year to 2.2%.

However, the latest CPI increase was less than anticipated. Services inflation - which has been the bug-bear of the central bank's fight against stubborn inflation - encouragingly fell from 5.7% to 5.2% in July, and core inflation dipped from 3.5% to 3.3%, its lowest since September 2021; both of these key gauges moving in the right direction.

Some insights into the extent to which core inflation may fall further will also be provide by the flash PMI data. The survey's index of prices charged for goods and services correlates well with core inflation, acting with a lead of 5-6 months. This gauge fell in July to its second-lowest since February 2021.

While markets have been increasingly pricing in two more rate cuts by the Bank of England in 2024 since the lower-than-expected CPI reading for July, further downward progress in the PMI price gauges - especially for services - may be needed to convince the majority of policymakers that another cut interest rates is warranted any time soon.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.