Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Nov 22, 2024

The flash PMI® survey data for November showed the eurozone economy falling back into contraction, as malaise spread from the struggling manufacturing sector to the larger services economy.

A weakening demand environment, concerns over tariffs amid the changing US administration, and political uncertainty closer to home, meanwhile dampened the business mood to drive optimism about the year ahead to its lowest for over a year. Further job cuts were also reported.

The data therefore hint at a potential GDP decline in the fourth quarter, especially if the forward-looking confidence data lead to a further output decline in December.

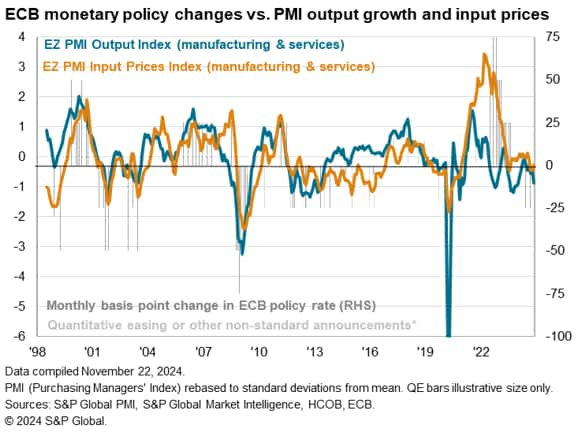

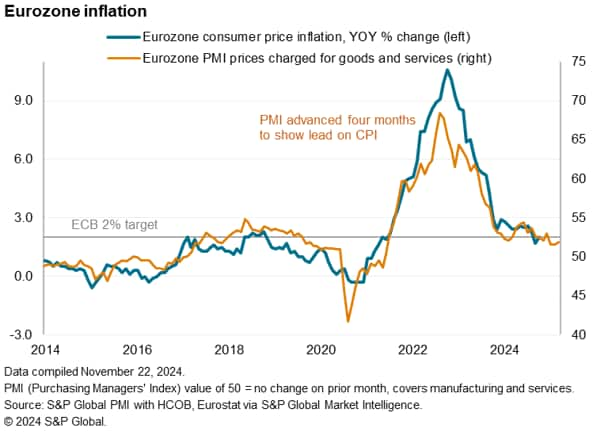

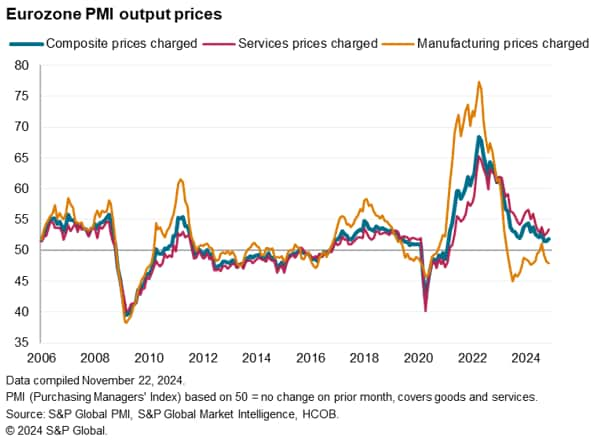

Fortunately, price pressures remained subdued, albeit ticking slightly higher in the service economy, remaining at a level broadly consistent with the ECB's inflation target.

All of this raises the question as to whether the ECB will feel there is room for one more rate cut in 2025 to follow the two 25 basis point rate cuts seen so far this year.

Here are our top takeaways from the November flash PMI data:

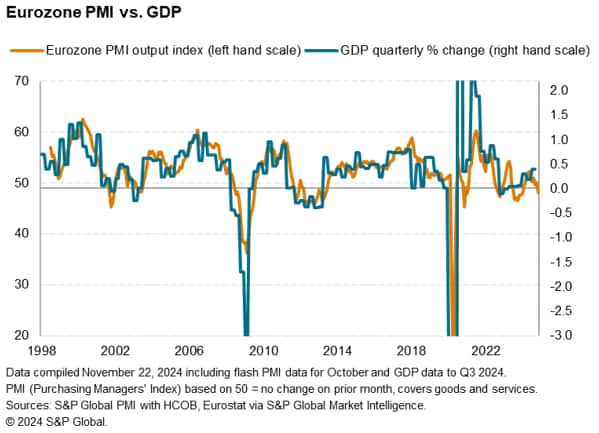

The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, fell from 50.0 in October to 48.1 in November. The latest reading signals a contraction of output for the second time in three months, with the rate of decline hitting the highest since January.

Comparisons with official data indicate the latest PMI reading is broadly indicative of GDP contracting at a quarterly rate of 0.2%. After a flat picture in October, a GDP contraction in the fourth quarter looks possible.

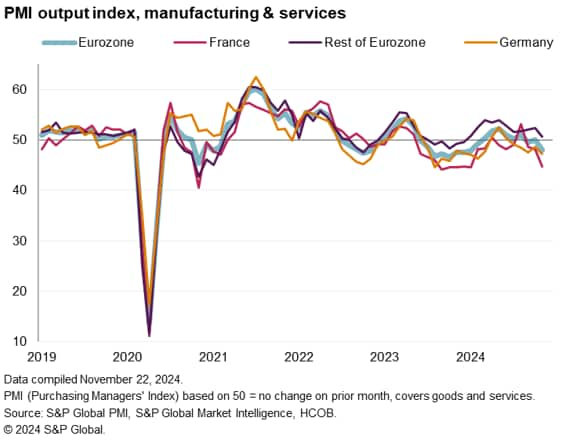

Output fell at increased rates in both France and Germany, the former seeing the steepest decline as the pace of contraction hit a 10-month high while the downturn in Germany hit a nine-month high. Output has now fallen in France for three successive months, following a brief return to growth in August thanks to the Olympics, and has fallen in Germany for five successive months. While the rest of the eurozone continued to grow, the pace of expansion ground almost to a standstill, registering the weakest growth since the recent upturn began at the start of the year.

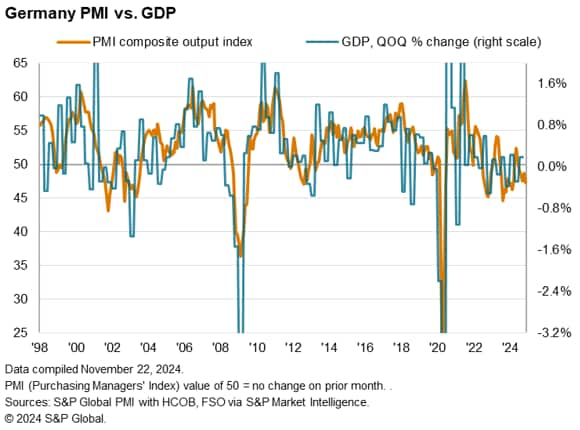

The flash November PMI for Germany, at 47.3, is consistent with GDP falling at a quarterly rate of just over 0.3%, according to historical comparisons.

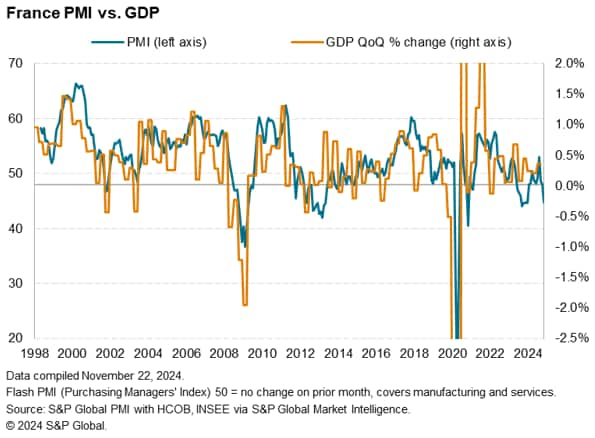

The flash November PMI for France, at 44.8, is consistent with French GDP falling at a quarterly rate of 0.2%, according to historical comparisons.

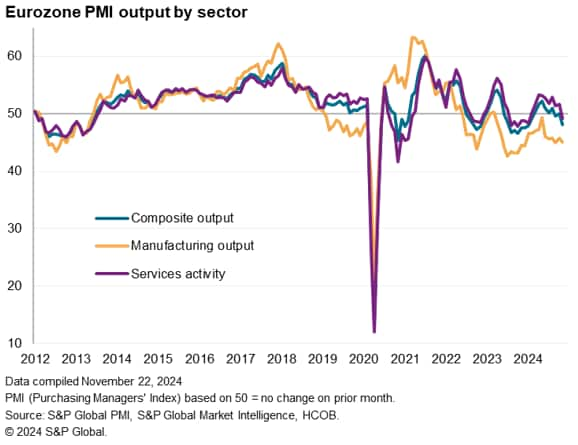

The economic malaise spread from manufacturing to services in November. Goods production fell for a twentieth straight month, dropping sharply again - and at an increased rate - in November. Steep falls were seen in both Germany and France with a more modest, but steepening, rate of decline seen in the rest of the region as a whole.

Service sector output meanwhile fell across the eurozone in November for the first time since January, with a third successive monthly decline in France accompanied by the first fall in services output in Germany since February. The rest of the region reported the slowest service sector expansion since January.

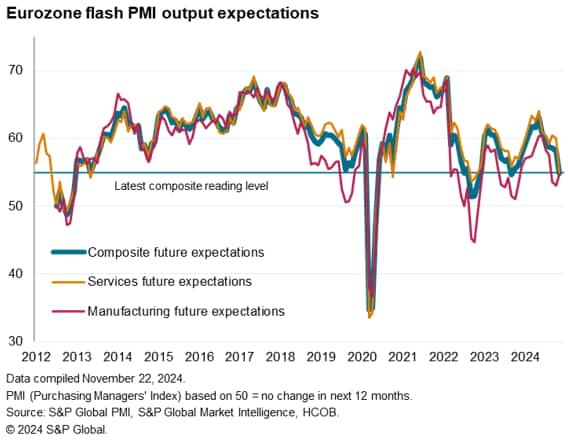

Business confidence about the year ahead meanwhile dropped for the sixth consecutive month to the lowest for 14 months, and a level increasingly below the series average. Confidence has rarely been this low in the survey's history since the fallout from region's debt crisis in 2012.

Although sentiment edged up in the manufacturing sector, it remained subdued by historical standards amid concerns over weak demand, political uncertainty and the rising threat of US tariffs. Sentiment about the outlook meanwhile soured to a two-year low in the service sector reflecting growing pessimism about the business environment in the coming year.

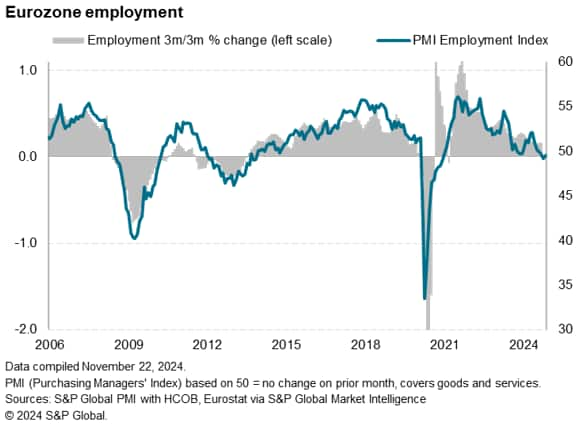

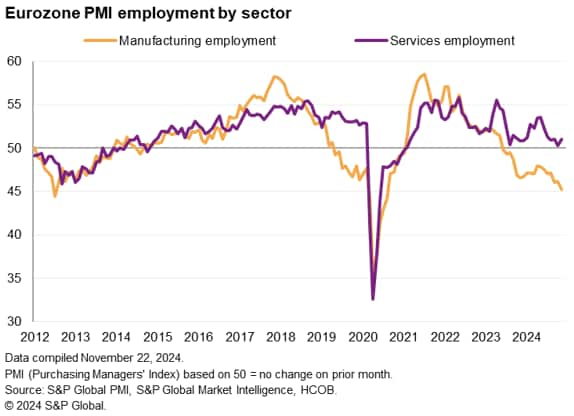

The survey respondents reported that the weak demand environment also led to a fourth straight month of modest job cuts, indicating that reduced private sector payroll numbers will weigh on overall employment across the eurozone in November. Reduced employment is in turn likely to dampen consumer spending.

Although a small increase in employment was reported in the service sector, manufacturing jobs were culled at the sharpest rate since 2012 barring only the COVID-19 lockdowns of 2020.

By country, falling employment in Germany was accompanied by only modest job gains in France and the rest of the region as a whole.

A rise in services charges, often linked to higher wages, was countered by a steepening rate of decline of manufacturing selling prices to result in another month of subdued inflationary pressures when measured across both sectors. Although ticking slightly higher, the survey's gauge of goods and services selling prices remained at a level broadly consistent with consumer price inflation close to the European Central Bank's 2% target.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Products & Offerings