Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Dec 11, 2024

By Byron McKinney and Chris Rogers

Learn more about our data and insights

Controlling the supply chains of Common High Priority Items (CHPIs) has been a critical part of sanctions applied by the US and EU, among others, against Russia. Judicious use of international trade data and supply network analysis can help trace the flows of these products through other countries.

The conflict in Ukraine has tightened the focus on the export of CHPIs due to the concern that products like semiconductors could end up in Russian weapons systems.

CHPIs, as defined by the US government, cover 50 products across four main categories and are focused on electrical and electronic products that have potential military dual uses.

• Tier 1 is focused on computer chips.

• Tier 2 targets network connectivity equipment and capacitors.

• Tier 3 is split into two parts including computers and cameras in one group and weapons parts in another.

• Tier 4 is also split, including electronics manufacturing equipment in one group and metal working equipment in the other.

Turkey's exports of CHPIs to Russia have already begun to decline after booming in 2023. S&P Global Market Intelligence data shows total exports in the three months ended Aug. 31, 2024, reached $13.5 million, down by 78.1% year-over-year and off by 85.3% compared to the February 2023 peak. The remaining exports are led by Tier 3A products, particularly computer power supplies and commercial-grade (under 1kV) electrical switching equipment.

Turkey has not been the only source of CHPI product flows to Russia. Constructing "mirror trade" calculations for Russia shows that total imports of CHPIs reached US$1.44 billion in the three months to July 31, 2024, down by 21.7% versus a year earlier.

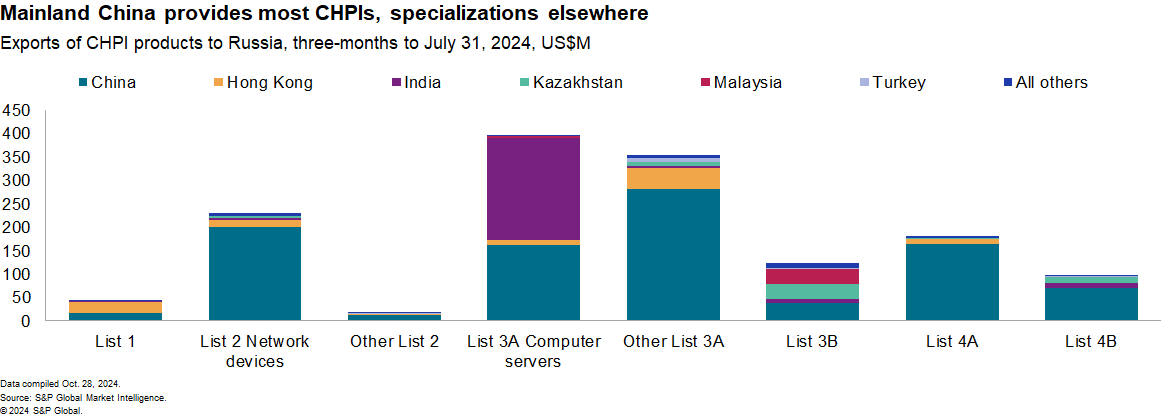

The largest exporting region in the three-month period ended Aug. 31 was Mainland China, accounting for 65.5%, while Hong Kong SAR represented a further 7.4%, with shipments having dropped by 28.3% and 49.9%, respectively.

The second largest supplier was India, accounting for 17.2% of shipments, but shipments surged 557% higher year-over-year. Turkey was a distant sixth at 1.1% of total flows after Malaysia's and Kazakhstan's 2.4% and 4.1% supplies.

From a product perspective, exports from China were led by networked devices (Tier 2) and computer servers (Tier 3A) in the three months to July 31, 2024, worth an aggregate $362 million. Hong Kong was the leading supplier of computer chips (Tier 1), accounting for $13 million of $18 million total shipped to Russia.

The trade in CHPIs could be carried out by private firms. Bloomberg reported that a private company had shipped computer servers to Russia from India. Such an indirect shipping routing and associated risks of breaching US or EU sanctions rules underscores the importance for firms of understanding their downstream supply chain network.

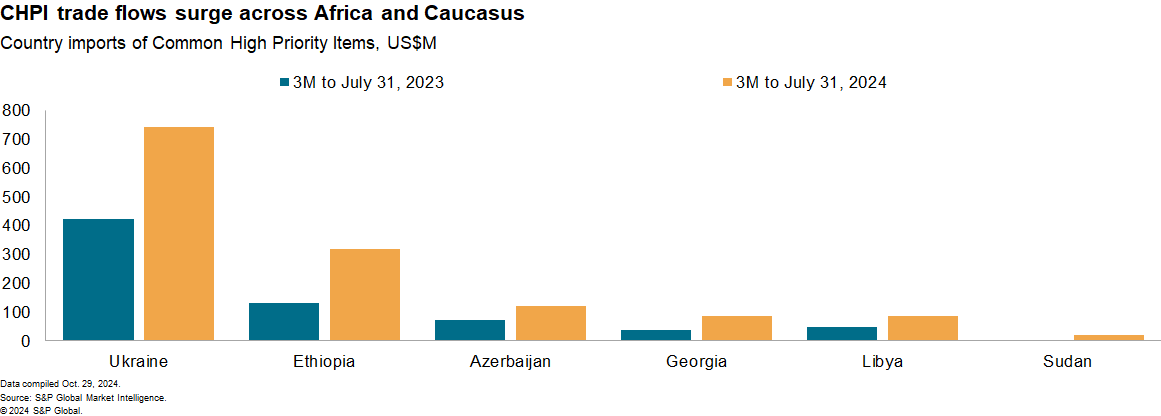

Not all CHPI shipments are easily visible in trade data, particularly where they are contained within other products. One route is to detect unusual changes in CHPI flows among countries that have not historically been significant importers.

Global trade in CHPIs increased by 11% year over year in the three months to July 31, 2024, S&P Global Market Intelligence data shows. Countries with rapid growth in both percentage and dollar terms (over $20 million of growth) include Ethiopia (142%), Georgia (128%) and Azerbaijan (67%). Shipments to Ukraine also increased 76%, likely reflecting resupplies to support the war effort.

In the case of Georgia, the growth was accounted for entirely by shipments of computer servers, principally from Hong Kong, while for Azerbaijan supplies were focused on servers and network equipment, led by shipments from mainland China.

Learn more about our Trade Compliance Secure solution

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.