Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 23, 2021

Eurozone flash PMI at five-month low as economy hit by bottlenecks and soaring prices

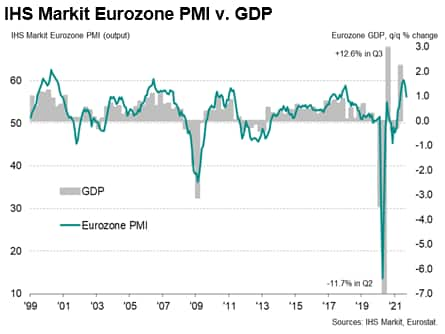

September's flash eurozone PMI highlighted an unwelcome combination of sharply slower economic growth and steeply rising prices.

Business activity grew at a markedly reduced rate, reflecting the peaking of demand, supply chain bottlenecks and concerns over the ongoing COVID-19 pandemic. Firms' costs meanwhile rose at the fastest rate in 21 years, with price rises increasingly feeding through from manufacturing to services.

The survey can therefore be characterised by slower growth and rising prices, representing an unwelcome scenario for policymakers in particular.

Business activity slowing, yet still strong

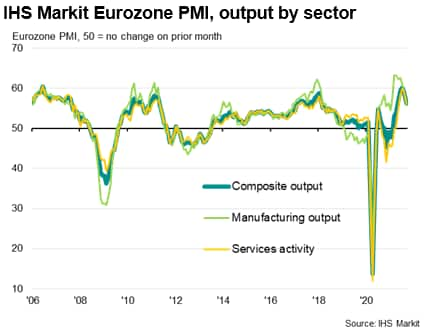

The headline IHS Markit Eurozone Composite PMI® fell sharply in September, dropping from 59.0 in August to 56.1 to indicate a further cooling of the rate of expansion from July's 15-year high, according to the 'flash' reading, which is based on around 85% of usual replies.

The latest increase in business activity was the smallest since April, albeit still well above the survey's pre-pandemic long-run trend (the index averaged 53.0 prior to COVID-19) to signal another month of above-average strong growth.

Robust but slowing growth was recorded across both manufacturing and services, with the latter outperforming modestly. Whereas the service sector merely saw growth slip to the weakest since May, manufacturers reported the smallest production gain since January.

COVID-19 fuels price and supply pressures

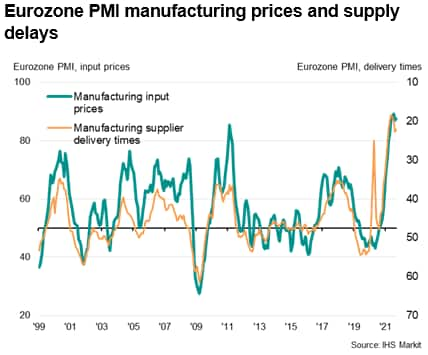

While the ongoing pandemic was again often blamed for subdued demand growth, most notably in curbing service sector exports, growth was also slowed by supply chain constraints, which affected some service providers but was most widely felt in manufacturing.

Suppliers' delivery times, a key gauge of supply chain delays in the manufacturing sector, lengthened at an increased rate in September, continuing to extend to a degree greatly exceeding anything seen prior to the pandemic.

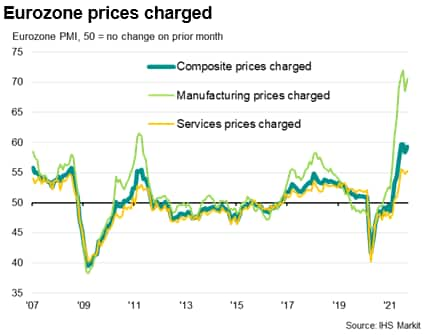

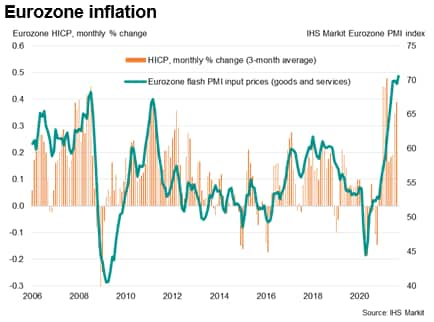

Shortages once again fed through to a steep rise in firms' input costs. Across manufacturing and services, input costs rose at the sharpest rate since September 2000. Service sector input cost inflation hit the highest since July 2008 while input price inflation in manufacturing remained close to all-time highs.

Higher costs were commonly passed on to customers. Measured overall, selling price inflation accelerated in September, rising to the third-highest rate seen over the past two decades, exceeded only by the increases seen in June and July.

The rise in the eurozone PMI input prices index is a particular concern, suggesting that supply shortages will continue to drive up consumer prices in coming months as these higher costs are passed on to final customers. Eurozone Consumer Price Index (CPI) inflation, having hit a decade high of 3.0% in August after posting a 0.4% monthly rise, therefore looks set to rise further.

ECB policy tweak

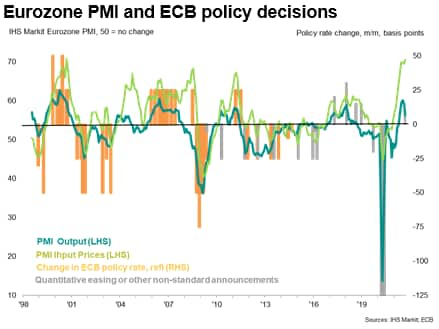

The divergence between the rising input prices index and cooling expansion signalled by the eurozone PMI's business activity index adds to the policy debate at the European Central Bank (ECB).

Concerns over rising prices have spooked policymakers into tightening policy in the past (2008 and 2011), only for those decisions to be rapidly reversed because weakness in the activity indicators was ignored.

With the ECB having decided to slow the pace of its asset purchases under the pandemic emergency purchase programme (PEPP), the latest eurozone PMI data suggest that there is a clear risk that this 'taper' or 'recalibration' may also prove ill-timed given the weakening growth trajectory.

Much will depend on the extent to which shortages can be resolved and demand can revive. But there is little indication of growth accelerating. Note that concerns over high prices, stressed supply chains and the resilience of demand in the face of the ongoing pandemic environment have eroded business confidence, pushing expectations for the year ahead down to the lowest since January.

For now, the overall rate of expansion remains solid, despite slowing, but growth looks likely to weaken further in coming months if the price and supply headwinds show no signs of abating, especially if accompanied by any rise in virus cases as we head into the autumn.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-at-fivemonth-low-as-economy-hit-by-bottlenecks-and-soaring-prices-sep21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-at-fivemonth-low-as-economy-hit-by-bottlenecks-and-soaring-prices-sep21.html&text=Eurozone+flash+PMI+at+five-month+low+as+economy+hit+by+bottlenecks+and+soaring+prices+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-at-fivemonth-low-as-economy-hit-by-bottlenecks-and-soaring-prices-sep21.html","enabled":true},{"name":"email","url":"?subject=Eurozone flash PMI at five-month low as economy hit by bottlenecks and soaring prices | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-at-fivemonth-low-as-economy-hit-by-bottlenecks-and-soaring-prices-sep21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+flash+PMI+at+five-month+low+as+economy+hit+by+bottlenecks+and+soaring+prices+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-at-fivemonth-low-as-economy-hit-by-bottlenecks-and-soaring-prices-sep21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}