Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 13, 2019

IHS Markit European GDP Nowcasts: Recession risk in Germany increases

In July 2019 we introduced two nowcasting models for the eurozone and the UK. The models utilise a range of data widely used to track economic developments and provide timely estimations of quarterly GDP growth.

As the datasets include information provided from business surveys, official statistics offices and the financial markets, there is a steady flow of new data available to us during a quarterly nowcasting cycle. With our model frameworks comfortably able to incorporate this new information in a statistically efficient manner, this calls for regular, real-time, nowcast updates which we present in this new report.

Alongside the nowcasts for the eurozone and the UK, we have also been able to extend our coverage to include updates for France, Germany and Italy.

Summary: 13th September 2019

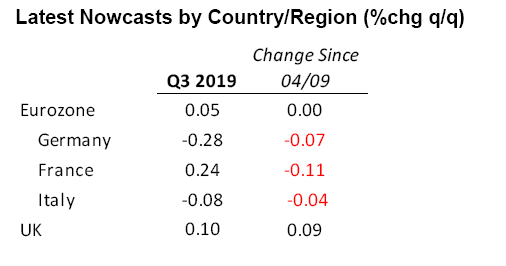

Our latest European Nowcasts give reason behind the Friday the 13th superstition, with the latest results showing a fright for economic prospects in the euro area. Our Q3 Nowcasts have been downgraded for Germany, France and Italy, indicating an increased likelihood of recession in the euro area's largest economy. While France looks set to maintain its outperformer status, albeit with a slower expansion than in the second quarter, stronger declines in GDP are forecast for Germany and Italy. Meanwhile, a positive flurry of data in the UK sees an upward revision to growth across the channel.

Technical recession risks have increased once again over in Germany thanks to another disappointing industrial production print for July, which our model has been pointing to for some time. However, the severity of July's decline was not fully captured and subsequently, the official outturn has led to a sharper contraction anticipated in the third quarter. Our Nowcast currently suggests Germany's economy has contracted by -0.28% (-0.21% previously).

The story is similar in Italy, where weak factory data has pushed the Q3 Nowcast into deeper negative territory (-0.08%, down from -0.04%). The outperformer continues to be France, which is being held aloft by resilience in the labour market. The plight of the regional manufacturing sector strikes once again, however, with a stronger-than-anticipated drop in industrial output contributing to a marked downward revision to +0.24% (+0.35% previously).

Nevertheless, the overall euro area projection was unchanged from last week at +0.05% as our model did a good job at anticipating the strength of July's drop in industrial production at the aggregated level this week.

The standalone upward revision was seen across the channel, with the UK third quarter nowcast improving to +0.10% (from +0.01%). The dataflow over the past week has been firmly positive, with growth in services and manufacturing during July flanked by strong wages figures. Official data for August will come in October, which will be crucial to weighing up any technical recession risk here, although we note that PMI data for August does not inspire a continuation of July's positive official data trend.

Paul Smith, Director, IHS Markit

Tel: +44 1491 461038

paul.smith@ihsmarkit.com

Joseph Hayes, Economist, IHS Markit

Tel: +44 1491 461006

joseph.hayes@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-recession-risk-in-germany-increases.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-recession-risk-in-germany-increases.html&text=S%26P+Global+European+GDP+Nowcasts%3a+Recession+risk+in+Germany+increases+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-recession-risk-in-germany-increases.html","enabled":true},{"name":"email","url":"?subject=S&P Global European GDP Nowcasts: Recession risk in Germany increases | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-recession-risk-in-germany-increases.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+Global+European+GDP+Nowcasts%3a+Recession+risk+in+Germany+increases+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-recession-risk-in-germany-increases.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}