Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 03, 2019

IHS Markit European GDP Nowcasts: Eurozone economy nears stagnation in Q3

Summary: 3rd October 2019

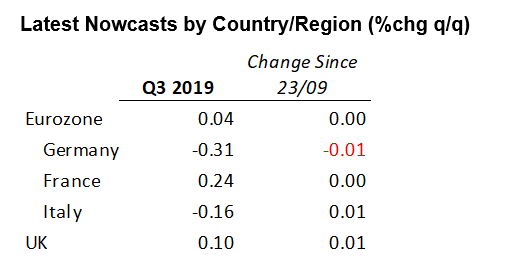

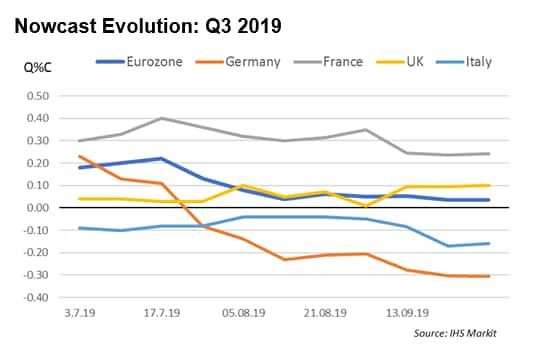

With the release of PMI data for September providing us with a well-rounded insight into economic performance for the third quarter, we have updated our nowcasts. However, we report little change since last week's influential flash PMI figures, with fractional movement at best recorded on the most part.

Our eurozone nowcast held steady at +0.04% for the third quarter, suggesting that the economy will come close to flatlining following the growth slowdown seen so far in the year-to-date. Here, forward-looking PMI indices such as new orders and employment show an economy losing steam. Indeed, the final September headline eurozone PMI fell to 50.1 (flash: 50.4), a level consistent with stagnation. Early signals from our nowcast model suggest heightened contraction risks for the fourth quarter.

Our estimate for Germany has faced several downward revisions over the current nowcast cycle, and the latest update once again comes in with a worsened trajectory (-0.31%). The last three model projections have all pointed to a contraction close to the -0.3% mark, although technical factors may see the actual GDP outturn come in not quite as severe as the nowcast anticipates.

We record no change in our third quarter nowcast for France, holding sturdy at a respectable +0.24%. PMIs here have been far more stable relative to the likes of Germany. Elsewhere, Italy's economy showed less resilience to the manufacturing slowdown. Uninspiring September PMI data failed to breathe any life back into our nowcast following the downgrade in the last update. Our model estimates the Italian economy will decline by -0.16% in the third quarter.

Last but not least, our UK nowcast was little changed at 0.1% for the third quarter, despite PMI data coming in on the soft side for September. With the exception of the immediate aftermath of the EU referendum (July 2016), survey data showed the first contraction in all three sectors (manufacturing, services, construction) since April 2009. August GDP figures are due next week, and we note that downside risks for UK growth cannot be ignored.

Paul Smith, Director, IHS Markit

Tel: +44 1491 461038

paul.smith@ihsmarkit.com

Joseph Hayes, Economist, IHS Markit

Tel: +44 1491 461006

joseph.hayes@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-eurozone-economy-nears-stagnation-in-q3-oct-19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-eurozone-economy-nears-stagnation-in-q3-oct-19.html&text=S%26P+Global+European+GDP+Nowcasts%3a+Eurozone+economy+nears+stagnation+in+Q3+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-eurozone-economy-nears-stagnation-in-q3-oct-19.html","enabled":true},{"name":"email","url":"?subject=S&P Global European GDP Nowcasts: Eurozone economy nears stagnation in Q3 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-eurozone-economy-nears-stagnation-in-q3-oct-19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+Global+European+GDP+Nowcasts%3a+Eurozone+economy+nears+stagnation+in+Q3+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-eurozone-economy-nears-stagnation-in-q3-oct-19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}