Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 02, 2020

Equity market uncertainty intensifies

Research Signals - March 2020

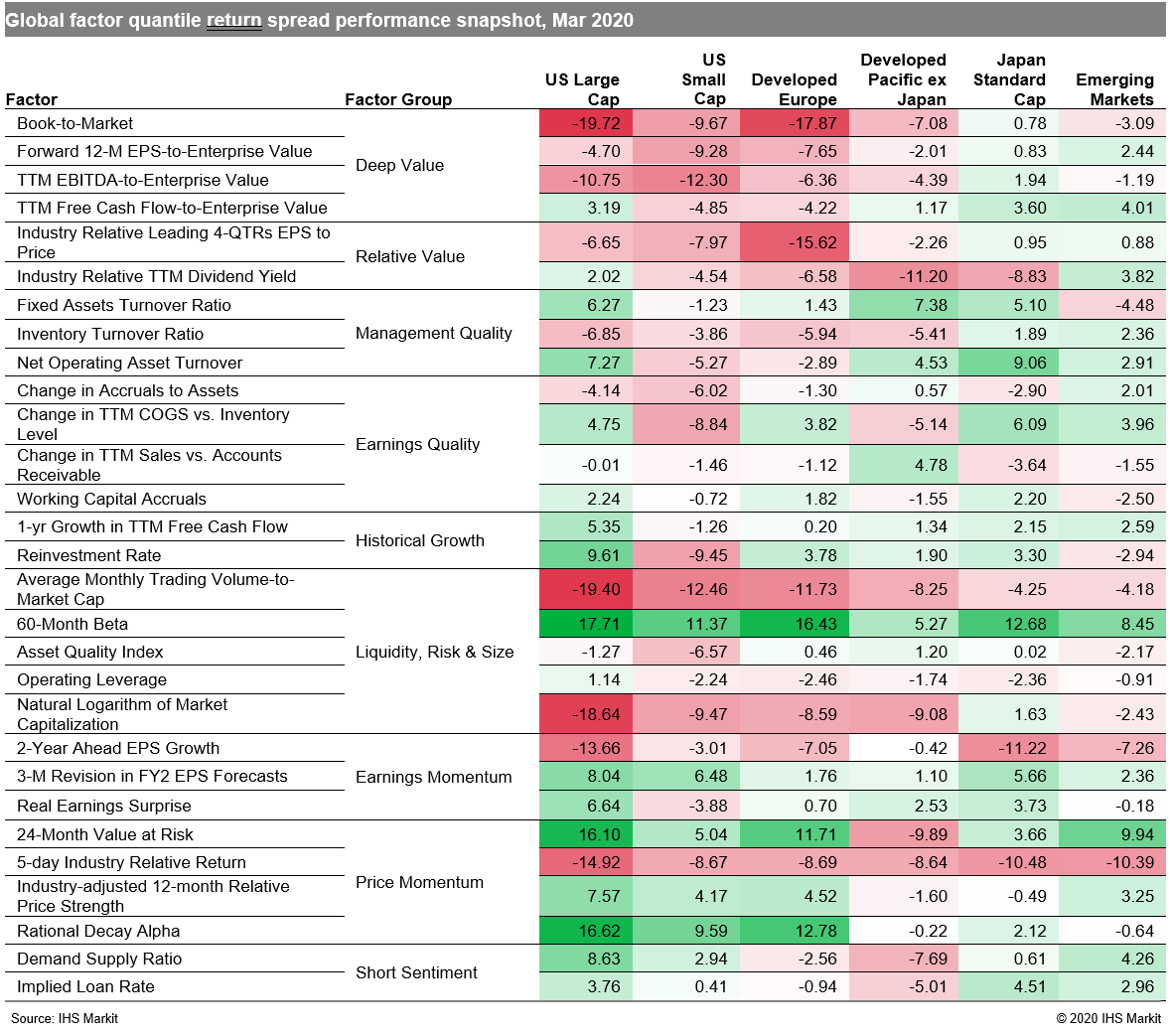

March's daily roller coaster ride in equity markets amid the growing coronavirus panic, which we recounted in a series of weekly factor performance reports, included an end to the near 11-year bull market, followed a quick snapback, as volatility reached levels in excess of the financial crisis. As investors grappled with the unknown impact on the global economy in both the near term and long term, many regional markets recorded their worst quarterly loss since the financial crisis. While there was a ray of hope from a slight rise in the J.P.Morgan Global Manufacturing PMI, this was almost entirely due to a stabilization in the China PMI from its severe downturn in February. In the face of the unknown, investors sought the safety of low risk trades, while socially distancing from value stocks (Table 1).

- US: Among large caps, 60-Month Beta outperformed Book-to-Market by a 37.4 percentage point spread, the highest outperformance in our factor history

- Developed Europe: Investors favored high momentum names, gauged by Rational Decay Alpha, but tempered the trade with low risk stocks, measured by 60-Month Beta

- Developed Pacific: High quality firms, such as those with high Fixed Assets Turnover Ratio, outperformed, while dividend payers struggled, as confirmed by Industry Relative TTM Dividend Yield

- Emerging markets: Underperformance to 5-day Industry Relative Return, a short-term price reversal metric and the weakest performing signal for the month, indicates that investors chased near-term winners higher

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fequity-market-uncertainty-intensifies.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fequity-market-uncertainty-intensifies.html&text=Equity+market+uncertainty+intensifies+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fequity-market-uncertainty-intensifies.html","enabled":true},{"name":"email","url":"?subject=Equity market uncertainty intensifies | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fequity-market-uncertainty-intensifies.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Equity+market+uncertainty+intensifies+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fequity-market-uncertainty-intensifies.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}