Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 24, 2021

By Thea Fourie

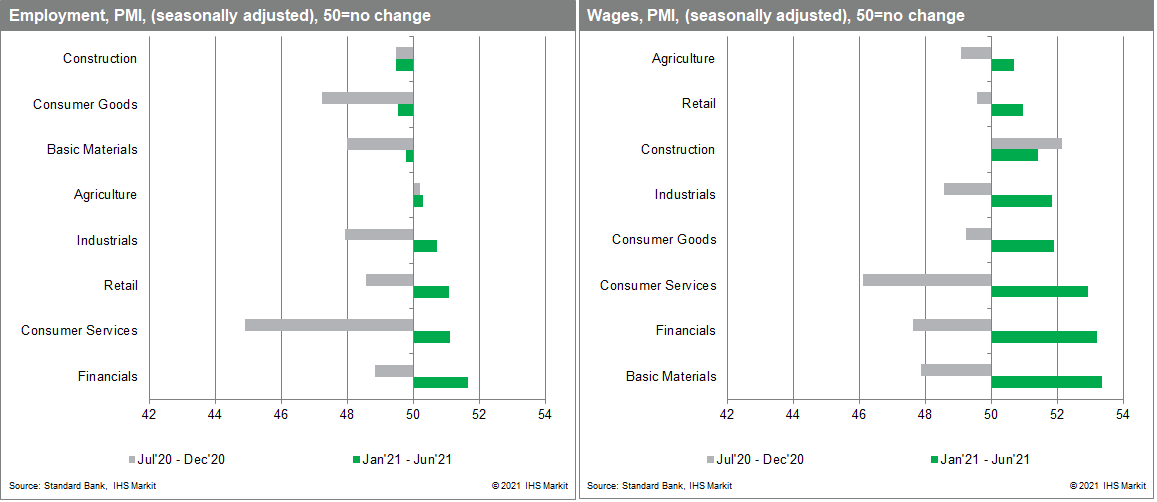

Employment in almost all sectors of the economy picked up during January-June 2021 in the SSA region, the latest statistics in the Standard Bank and IHS Markit purchasing managers' indices (PMIs) show. Using monthly PMI survey information, IHS Markit compiled an aggregate weighted employment PMI for SSA. A similar PMI for wages was compiled. Countries included in the analysis were Ghana, Kenya, Mozambique, Nigeria, South Africa, Uganda, and Zambia.

The aggregate SSA employment PMI shows that the recovery was the strongest in the financial sector (banks, real estate, and insurance), followed by the consumer services sector (media, retail, and hotels and restaurants). Of this group, retail employment showed the biggest gains. Employment conditions in the basic metals (chemicals and resources), consumer goods (automotive, household products, beverages, and food), and construction sectors were less favorable, with the aggregate SSA employment PMI reading for these sectors remaining below the 50-neutral level during the first half of 2021.

Wage increases accelerated during the first half of 2021, the aggregate wage PMI for SSA shows. The basic metals sector reported the strongest recovery in wages, followed by financial services and consumer services. The consumer services sector reported the biggest fall in wages over July-December 2020. However, the jobs created in the sub-Saharan Africa region were not enough to bring overall unemployment down to pre-coronavirus disease 2019 (COVID-19) pandemic levels. Initial indicators show that Nigeria's unemployment rate remained at 33.3% in the fourth quarter of 2020, from 27.1% in the second quarter of 2020. South Africa's unemployment rate shot up to 32.6% in the second quarter of 2021, from 27.6% in the second quarter of 2019. Angola's unemployment rate averaged 30.5% in the first quarter of 2021, from 29.0% in the third quarter of 2019. Of the smaller economies, Rwanda's unemployment rate also increased, to average 17.0% in the first quarter of 2021, from 15.0% in the second quarter of 2019.

More detailed unemployment data in South Africa show that the poorest in society - namely informal sector workers - have been severely impacted. Informal sector employment fell by 14.3% year on year (y/y) during the second quarter of 2021, compared with a 6.3% y/y fall in formal sector employment. Those countries that have the fiscal capacity have extended their social support programs. South Africa's basic income grant (BIG) for the unemployed - introduced in 2020 - has been extended until March 2022 and amounts to ZAR350/month (USD23/month), below the food poverty line of ZAR560/month. The additional government spending will be financed through a mining tax windfall in fiscal year 2021/22. In the future, it will be significantly more difficult to uphold this spending commitment. The slow rollout of the COVID-19 vaccine program will leave the SSA region vulnerable to the resurgence of new COVID-19 cases and increases the risk of exposure to new COVID-19 variants amid an ill-prepared healthcare system. The recovery in the tourism, aviation, entertainment, and hotel industries will be delayed as a result.

Posted 24 August 2021 by Thea Fourie, Director, Economics, S&P Global Market Intelligence