Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 15, 2024

By Jingyi Pan

Emerging market economic growth was sustained at the start of the second half of 2024, according to S&P Global's PMI surveys, albeit at the slowest pace in eight months. A marked deceleration in manufacturing output growth underpinned the latest change while services activity rose at a faster pace.

Meanwhile optimism about the business outlook remained subdued in July as the pace of new orders growth for emerging markets slowed amid concerns over future demand and elevated costs. Rising service sector price pressures were found to have largely offset slower increases in manufacturing sector prices.

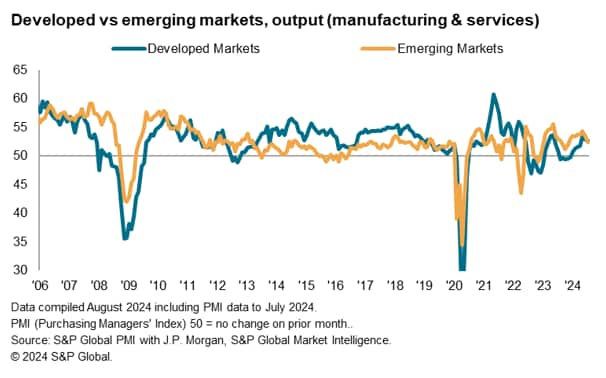

The PMI surveys compiled globally by S&P Global found that output across the emerging markets collectively expanded at the slowest pace since November 2023. The GDP-weighted Emerging Market PMI Output Index fell to 52.4 in July, down from 53.3 in June. This extended the sequence of growth to just over one-and-a-half-years. That said, not only did the pace of expansion moderate, but the pace of growth for emerging markets was slower compared to the 52.7 print for developed markets, the former recording a comparatively lower reading for the first time since May 2022.

Emerging markets nevertheless saw a more broad-based expansion than the developed world in July: as output rose in the emerging markets across both the manufacturing and service sectors while developed markets growth was wholly supported by an improvement in the service sector.

Central to the latest slowdown in emerging market growth was a slower rate of improvement in the goods producing sector. The pace at which manufacturing output expanded among emerging markets eased markedly in July, down to the slowest since October 2023. In contrast, services firms across emerging markets saw activity increase at a rate that was solid and faster compared with June.

The slowdown in emerging market manufacturing performance was part of a wider deterioration in global manufacturing performance in July, with instances of shipping delays playing a part to dampen export demand.

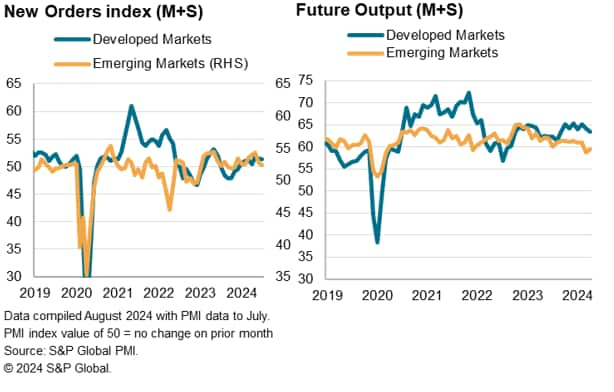

Focusing on forward-looking indicators, the PMI surveys' new orders data showed likelihood of this divergence sustaining into August, with manufacturing new orders near-stalling among emerging market firms while services new business rose at a faster pace in July.

Overall sentiment in the emerging markets also remained subdued, with optimism levels having improved from June but remained the second lowest in 28 months. Anecdotal evidence suggests that concerns from panellists ranged the outlook for growth and also elevated price pressures on sales.

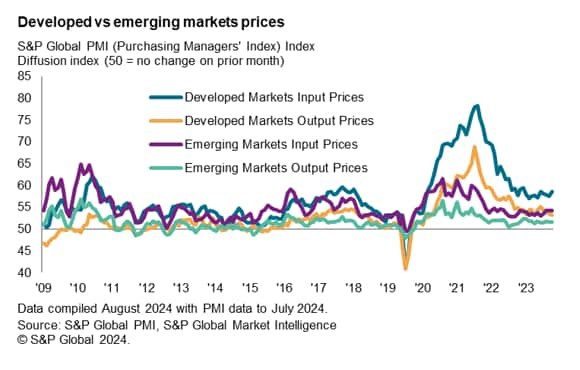

A divergence in sector trends were also apparent in the PMI price gauges. Input cost inflation rose to a near one-year high in the service sector but eased for goods producers. Both the rates of inflation were nevertheless above their respective 12-month rolling averages to indicate that cost inflation remained elevated going into the second half of 2024.

Compared to developed markets, however, cost pressures in emerging markets were relatively lower, with developed market input cost inflation having climbed to the highest level in ten months.

The relatively subdued level of optimism among emerging market firms meant that firms were keen to keep output (selling) price increases contained, despite the highest costs experienced during July. The overall emerging market Output Price Index declined to a three-month low with slower increases in both the manufacturing and service sectors.

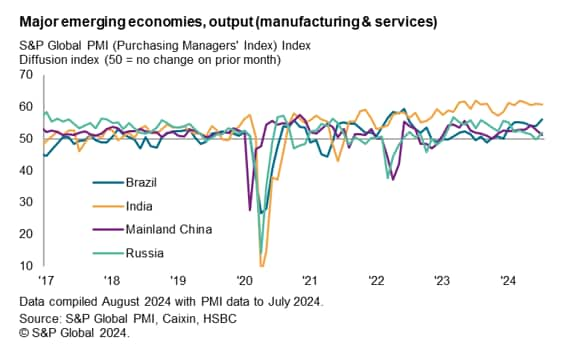

Looking at the four major emerging market economies, India retained the top spot in terms of economic growth for the twenty-fifth month in a row in July. Furthermore, the rate of output expansion in India remained well above the series average to indicate that the sharp expansion in activity sustained into the start of the second half of the year. India has also notably seen manufacturing output rise at a faster pace than services activity, running against the global trend.

Following India was Brazil, where the rate of growth rose for a second successive month to the fastest in just over two years. Mainland China and Russia meanwhile saw more modest rates of expansion, the latter returning to modest growth after declining in June.

Price-wise, all four major emerging market economies except mainland China saw average selling prices rise at a faster pace in July. A marginal decline in prices was meanwhile observed for mainland China for the first time since March, brought about by falling manufacturing selling prices as producers opted to reduce selling prices to support sales.

Access the global PMI press releases.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.