Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 06, 2024

By David Owen

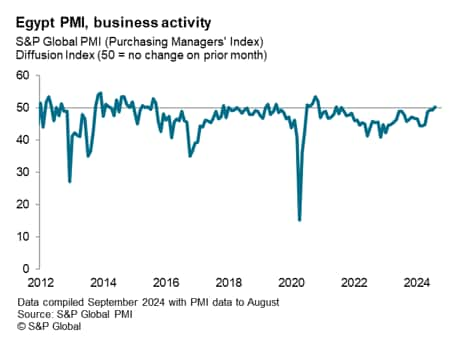

The Egypt PMI signalled the first improvement in business conditions across the non-oil private sector in nearly four years during August. Increases in output, employment and input purchases followed a broad stabilising of demand at non-oil companies in recent survey periods, with confidence in the economic outlook also strengthening.

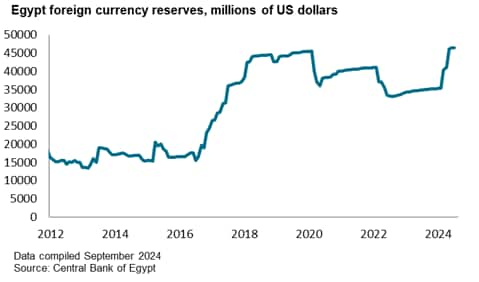

This new upturn comes only six months after the country was gripped by a foreign currency crisis, brought about the closely connected shipping crisis in the Red Sea. The economic and policy implementations then were considerable, which the PMI data was quick to reveal.

Now, the survey findings suggest that the domestic and international response to the crisis has set the non-oil sector on a path to recovery, albeit with some headwinds to growth such as rising price pressures and continued disruption to Suez Canal shipping volumes. The recovery also seems lopsided for now, with some sectors seeing growth emerge quicker than others.

The headline S&P Global Egypt Purchasing Managers' Index™ (PMI®) rose to 50.4 in August from 49.7 in July, cresting above the neutral mark of 50.0 that separates growth from contraction. This represented the first month of improving non-oil business conditions since November 2020, while the index compared with an average of 47.9 in 2023 and 48.3 in the first half of 2024. The index's historical relationship with official GDP figures suggests that the latest data is consistent with growth accelerating in the third quarter of the year. Latest S&P Global Market Intelligence forecasts show growth improving to 4.3% in fiscal year 2024-25 from 2.7% in 2023-24.

Businesses in the survey panel indicated a rise in output levels for the first time in three years in August. Although the uplift was only marginal, it was the strongest since late 2020, illustrating the improvement in the economic climate for non-oil companies after a long period of disruption.

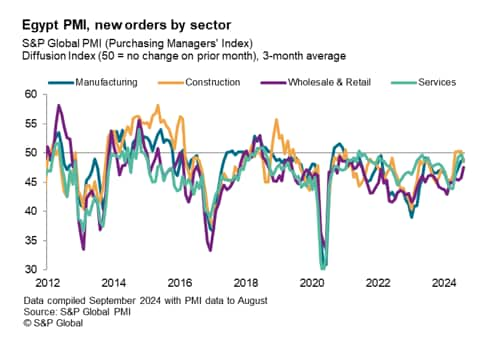

The uplift was largely linked to a broad stabilisation in new order volumes over the past three months. Although the latest data signalled that incoming orders were down, the pace of reduction was only mild and much softer than those recorded at the start of the year. Businesses reported that improving macroeconomic factors had aided client spending, such as an improvement in foreign currency availability and an easing of inflationary pressures.

The measures taken by Egypt's monetary policy committee in March 2024, including a 600 basis points rise in its key interest rate and a devaluation of the pound, were shown to have greatly improved the supply of foreign currency, which many businesses rely on for trade in both domestic and international markets. In the same timeframe, the annual inflation rate has fallen 10% since its recent peak in February, though remaining elevated at 25.7% in July.

While there was some upside on sales, a number of survey panellists signalled that market conditions remained stagnant in August due to heightened price pressures, contributing to the fact that demand has not yet made a full recovery. Furthermore, some parts of the non-oil economy are trailing behind others. Construction is one area where sales volumes have been relatively stable in recent survey months, whereas the wholesale and retail sector saw a solid decline, albeit one that is easing.

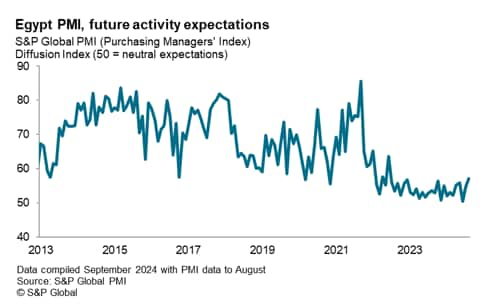

The uplift in business conditions supported an improvement in the outlook for future activity across the non-oil economy in August. In fact, the latest survey data signalled the strongest predictions for the next 12 months since June 2022. This marked a considerable turnaround from two months ago when predictions were at a record low, suggesting that the recent stabilisation in market demand has been a strong factor behind the improvement in sentiment. That said, with 16% of respondents giving a positive response, the level of optimism is still weak relative to the historical trend, implying there is further to go to restore confidence in the sector.

The strengthening of business confidence gave firms added impetus to increase their workforce in August. Overall employment numbers rose for the third time in the past four months, albeit at a slight pace. Anecdotal evidence suggested that hiring growth was largely reliant on the increase in output, with firms requiring extra workers to expand their capacity.

Despite the rosier picture from the August survey data, risks to the Egyptian non-oil economy remain prevalent. The rise in output was only slight and marked just a single month of expansion, suggesting that subsequent months of positive data may be required to infer a proper economic recovery.

Moreover, input price pressures faced by non-oil firms have accelerated in each of the past three months, and were at their highest level since March in the latest survey period. Panellists frequently linked this to a weakening in the exchange rate between the Egyptian pound and the US dollar, leading to upticks in import fees and supplier charges. Higher global shipping prices were also noted, as freight bottlenecks arising from the Red Sea crisis and hold-ups at several ports worldwide have led to additional strain on key shipping routes.

The Purchase Prices Index has demonstrated a good relationship with consumer price inflation over the survey's history, particularly as rising costs have often forced businesses to raise their selling prices to maintain control over their margins. The sharp acceleration in purchase price inflation therefore adds upside inflation risk to the wider economy for the rest of the year, derailing one of the driving forces of the sector's stabilisation.

Rising selling prices at non-oil companies have also been closely linked with a drop in order books - indeed, the Output Charges and New Orders survey indices share a strong relationship over the survey history. The latest rise in output charges, the highest in five months, suggests there could be a faster decline in sales on the horizon, which again could delay a full recovery in non-oil activity.

Access the Egypt PMI press releases here.

David Owen, Economist, S&P Global Market Intelligence

david.owen@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.