Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 29, 2018

Economic Preview - Week of 2 July 2018

- Global PMI surveys to add insight to growth, hiring and price trends at end of second quarter

- UK PMI surveys to give guidance to Bank of England policy stance

- US non-farm payrolls to follow PMI surveys and FOMC minutes

- Australia's policy meeting in spotlight

The coming week sees important data releases which include worldwide PMI surveys and US employment numbers. Policy highlights include the Reserve Bank of Australia's monthly meeting and the release of FOMC minutes.

Global PMI updates

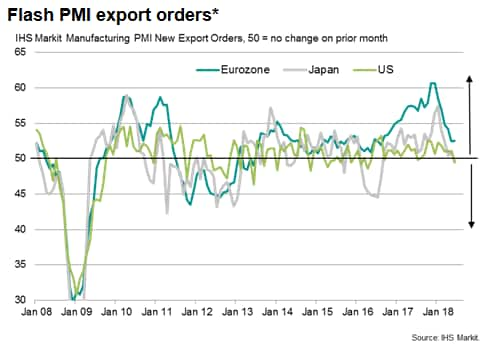

Key business survey data will be eyed for any signs that escalating trade wars and rising uncertainty are dampening growth. The global economic expansion picked up in May, according to the PMI surveys, but remained weaker than seen at the start of the year. Flash surveys for the US, Eurozone and Japan have meanwhile indicated that growth looks to have become increasingly dependent on service sectors in June, with manufacturing seeing downside risks as export trends deteriorated.

UK interest rate guidance

In the UK, the PMI data will be especially important in terms of guiding Bank of England policy. Rate setters will be hoping to see growth strengthen to justify an increasingly hawkish stance. Three of the nine Monetary Policy Committee members voted to hike interest rates at the June meeting. The next meeting is scheduled for 2nd August, meaning the June data will be the latest available services PMI at that gathering.

US PMI surveys and employment report

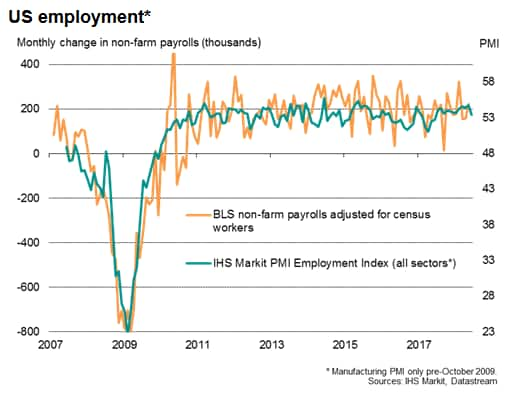

Markets will also receive some guidance on the likely trajectory of US interest rates amid a flurry of news updates. The minutes of the June FOMC meeting will add colour to the recent rate hike decision and outlook for rates, while PMI survey updates from IHS Markit and the ISM will provide new information for policymakers, as will the June employment report. The flash PMI survey's employment index, which acts as a reliable guide to non-farm payroll data, pointed to another healthy 190k rise in June.

Australia policy meeting

The Reserve Bank of Australia meets to set policy at a time when expectations of a hike have been pushed back into 2019, though an imminent rate rise has by no means been discounted by many. Economic growth accelerated to 3.1% in the first quarter and CBA PMI surveys have been resilient so far in the second quarter. However, while price pressures have also picked up, wage growth remains subdued and uncertainty about the global economic environment has intensified, suggesting policymakers will err on the side of caution and hold rates.

* Includes June flash data.

Download the report for a full diary of key economic releases.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-preview-week-of-2-july-2018.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-preview-week-of-2-july-2018.html&text=Economic+Preview+-+Week+of+2+July+2018+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-preview-week-of-2-july-2018.html","enabled":true},{"name":"email","url":"?subject=Economic Preview - Week of 2 July 2018 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-preview-week-of-2-july-2018.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Economic+Preview+-+Week+of+2+July+2018+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-preview-week-of-2-july-2018.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}