Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 12, 2018

Week Ahead Economic Preview: Week of 12 November 2018

- UK employment, pay, retail sales and inflation data

- US industrial production, retail sales, inflation and trade updates

- Eurozone and Japan GDP

UK data updates to employment, wage, inflation and retail sales data will be eyed to ascertain the economy's resilience in the face of intensifying Brexit uncertainty. US inflation, industrial production, trade and retail sales data will likewise be scoured to confirm the FOMC will hike rates again at its next meeting.

The week also sees GDP updates for the Eurozone, Japan, Malaysia and Hong Kong and a clutch of economic data out of China.

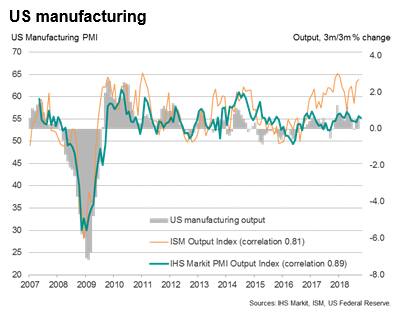

US growth and inflation updates

US industrial production, retail sales, inflation and trade figures will be scoured for confirmation that the economy grew at a robust rate at the start of the fourth quarter despite trade worries, with price pressures building to keep the Fed on course to hike interest rates again at its December meeting. The economy grew at a 3.5% rate in the third quarter and IHS Markit PMI numbers suggest a solid 2.5-3.0% pace was maintained in October, with prices rising sharply as tariffs and shortages exacerbated higher energy prices. Consumer prices are set to rise 0.3%, taking the annual rate of inflation to 2.5%.

UK earnings and inflation

The Bank of England will be watching the latest job market numbers keenly, especially pay data, which are expected to vindicate recent rate hike decisions and the Bank's hawkish rhetoric, leaving the door wide open for further rate hikes in the event of a suitably supportive Brexit deal. Recent recruitment agency survey data showed that an increased tightening of the labour market drove employee wages markedly higher again in October. The unemployment rate is meanwhile expected to hold at a multi-decade low of 4% and inflation is set to tick higher after showing a surprise fall to 2.4% in September. Retail sales should stage a modest rebound after falling in September.

China data updates

New lending data out of China will be eagerly watched, as will updates to fixed asset investment, foreign direct investment, industrial production and retail sales.

Clues will be sought as to whether the pace of economic growth will continue to wane after slipping to 6.5% in the third quarter. Recent Caixin PMI data indicating the slowest pace of growth in business activity for over two years.

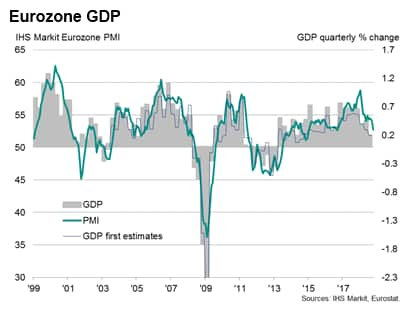

GDP updates

Next week also sees the release of third quarter GDP for the Eurozone Japan, Hong Kong and Malaysia.

The Eurozone GDP update is expected to confirm the weak 0.2% expansion indicated by the flash estimate, though at least some of the slowdown appears to have been temporary, linked to the auto sector emissions targets (which is likely to also be reflected in a drop in September's industrial production). However, recent PMI data suggest the underlying pace of growth has cooled, in line with softer global demand growth. Eurozone final inflation numbers are also updated and are expected to confirm a 2.2% annual rate.

Third quarter GDP is expected to shrink 0.3% in Japan, according to a Reuters poll, linked in part to natural disasters. PMI surveys have already indicated a rebound in growth at the start of the fourth quarter.

In Malaysia, expectations are for economic growth to accelerate to 5.2%, up from 4.5% and in line with the signal from PMI data back in September.

In Hong Kong, the Nikkei PMI indicates that slower growth in China and waning global trade flows are likely to have curbed GDP from the 3.5% annual rate.

Asian monetary policy

In Asia, central banks in Thailand, Indonesia and the Philippines meanwhile meet to set interest rates. While the consensus is for policy rates to remain on hold in Thailand, the central Bank has been building a case for policy normalisation to reduce risks to financial stability.

Bank Indonesia is also expected to hold its monetary policy steady, but clearly remains concerned that the rupiah remains vulnerable. The latest PMI data also pointed to softer demand conditions.

Read more about Asia's week ahead here.

Download the article for a full diary of key economic releases.

For further information:

If you would like to receive this report on a regular basis, please email economics@ihsmarkit.com to be placed on the distribution list.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-preview-week-of-12-november-2018.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-preview-week-of-12-november-2018.html&text=Week+Ahead+Economic+Preview%3a+Week+of+12+November+2018+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-preview-week-of-12-november-2018.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 12 November 2018 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-preview-week-of-12-november-2018.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+12+November+2018+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-preview-week-of-12-november-2018.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}