Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 26, 2018

Earnings Report: Facebook, Supervalu, CBL, Euronav, Capita & Monex

- Short covering ahead of Facebook earnings

- CBL shorted across capital structure

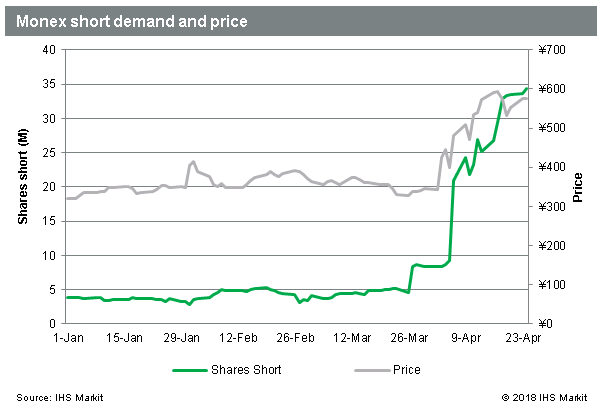

- Japanese crypto firm Monex see surge in price and short interest

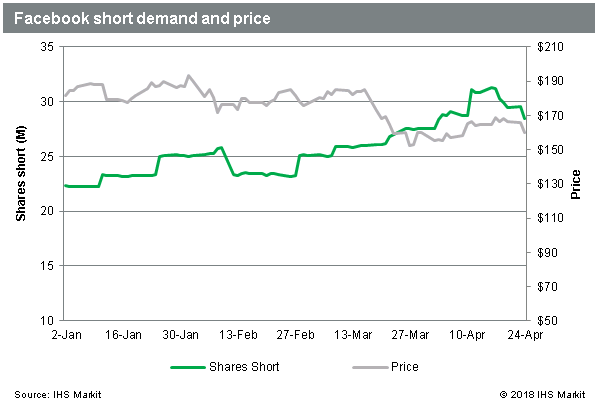

Short sellers are poised to take a hit from Facebook, which reported better than expected results after the close on Wednesday. While short demand for FB is up over 25% this year, there has been some notable covering over the last week with over 5m shares returned, largely undoing the early April spike in short demand. The exchange short interest number currently shows 32m shares but that was collected for April 13th.

Short sellers of Supervalu are also feeling some pain, with the share price spiking after they reported worse than expected earnings on Wednesday. The short side had the weaker than expected revenue and EPS right, but the price was up 7% intraday following the announcement that Suprevalu will sell and lease back eight of its owned distribution centers, and will also sell its Shop 'n Save locations.

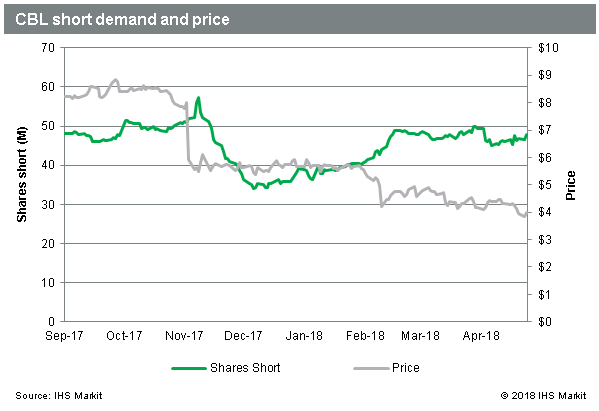

CBL & Associates announced they will report earnings on Friday, April 27th, and short sellers have increased positions into the numbers, with the mall operator struggling to gain its footing against a challenging backdrop. With a share price decline over 30% year to date, the 25% increase in shares short is essentially just maintaining a similar sized position in dollar terms.

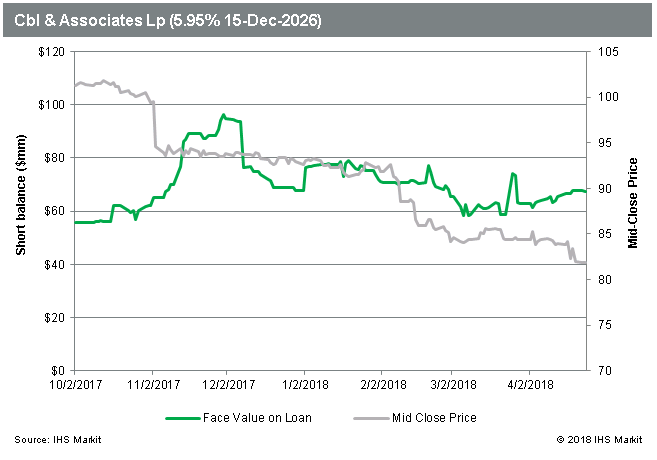

The CBL bonds have also attracted short sellers, who are increasing borrow rates as the bond price recently hit a new low of 81.88, down from 92.5 at the start of the year. Virtually all lendable supply of the bonds has been lent out, restricting the ability for short sellers to increase positioning.

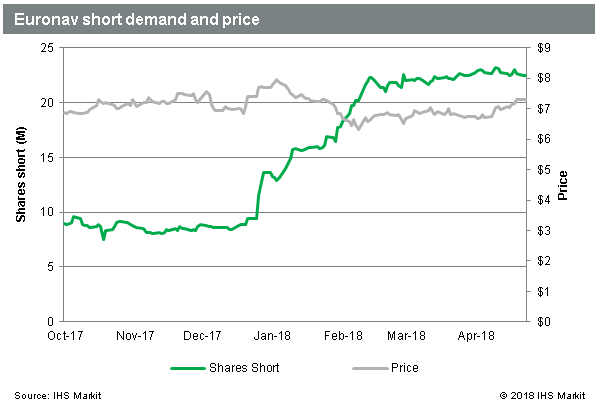

Heading over to Europe, shares of oil shipping firm Euronav were down more than 5% following a worse than expected loss in Q1, giving up some recent gains, but staying within the recent trading range. Short sellers are hoping for more, having timed the sell-off at the start of the year well, and extending shares short since then.

Despite the recent rally, shares of UK outsourcing firm Capita are down more than 50% since the start of 2018. The rally off the lows has been seen as an opportunity by short sellers who have increased their positions by more than 20m shares since the start of April. The firm has announced they will report earnings ahead of the open on Thursday.

Wrapping up in Japan, cryptocurrency firm Monex has also seen a run up in price and short demand coming into their earnings report, though in this case, a bit more extreme than Capita. Since the last week of March, the share price of Monex is up 75%, while short sellers have borrowed an additional 29m shares.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fearnings-report-facebook-supervalu-cbl-euronav-capita-monex.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fearnings-report-facebook-supervalu-cbl-euronav-capita-monex.html&text=Earnings+Report%3a+Facebook%2c+Supervalu%2c+CBL%2c+Euronav%2c+Capita+%26+Monex+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fearnings-report-facebook-supervalu-cbl-euronav-capita-monex.html","enabled":true},{"name":"email","url":"?subject=Earnings Report: Facebook, Supervalu, CBL, Euronav, Capita & Monex | S&P Global&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fearnings-report-facebook-supervalu-cbl-euronav-capita-monex.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Earnings+Report%3a+Facebook%2c+Supervalu%2c+CBL%2c+Euronav%2c+Capita+%26+Monex+%7c+S%26P+Global http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fearnings-report-facebook-supervalu-cbl-euronav-capita-monex.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}