Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 01, 2019

Dutch manufacturing sector struggles at start of fourth quarter

- October PMI signals slowest manufacturing expansion for over six years

- Production declines for the first time since April 2013 amid softer rise in new orders

- Output expectations weaken notably as political instability weighs on sentiment

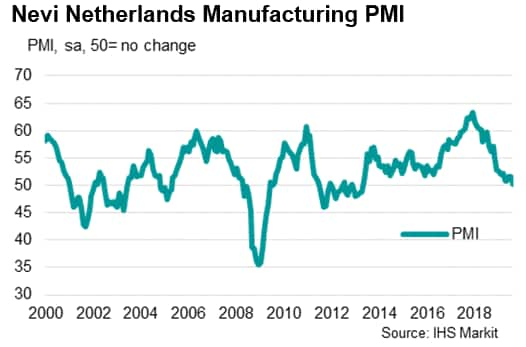

The Dutch manufacturing sector began the final quarter of the year on a weak footing, with the health of the sector improving only fractionally, according to the latest PMI® data from Nevi and IHS Markit. Adjusted for seasonal influences, the headline PMI - a single figure indicator of manufacturing performance - fell to 50.3 in October, down from 51.6 in September, to signal the slowest improvement in operating conditions since the current period of improvement began in June 2013.

The subdued performance of the manufacturing sector in October reflected the first fall in production since April 2013, alongside easing factory workforce growth and a slower rise in new orders.

Weak demand dampens output

Surveyed companies cited weaker demand conditions to have caused production to decline fractionally, ending the 77-month sequence of continual monthly expansion. The recent tax increase was reported to have reduced purchasing power, exacerbating weak consumer confidence, though domestic business spending was also reported to have remained under pressure.

Subdued client demand was reflected in softer growth of incoming new business, which rose at the slowest pace since April. Domestic demand conditions, however, contrasted with that abroad, as new export orders increased in a reversal of September's downward trend.

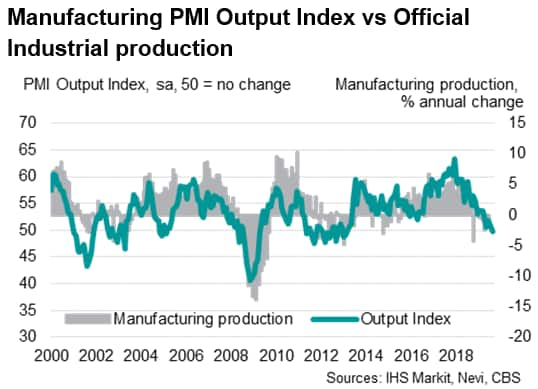

Manufacturing production declines

The survey data hint that worse may still be to come in terms of official data releases. Official industrial production data are currently only updated to August, for which a contraction of 0.8% on an annual basis was recorded. However, the more recent PMI data for September and October points to further falls of a potentially greater magnitude.

Inflationary pressures weaken

The October PMI data also highlighted the first fall in input prices for over three years, as softer demand reportedly drove down many raw material prices. Meanwhile, average prices charged by manufacturers continued to rise, although the rate of price inflation was the weakest since charges began rising over three years ago.

Expectations soften

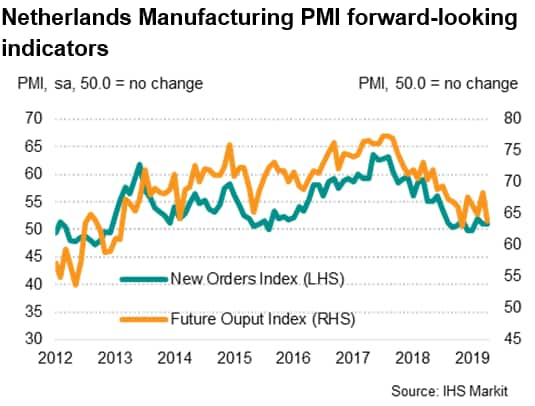

Alongside the weakening of current conditions, manufacturers also downgraded their output expectations for the next 12 months in October. Sentiment was among the lowest seen since the series began in June 2012. Respondents frequently cited declining production, easing new order growth and political woes as having dampened optimism about the year ahead. The political situation in the Netherlands has become increasingly uncertain after the coalition government lost its majority in mid-October. The increased probability of an election, changing political climate domestically and further global uncertainty is likely to continue clouding firms' outlooks in the coming months until resolved.

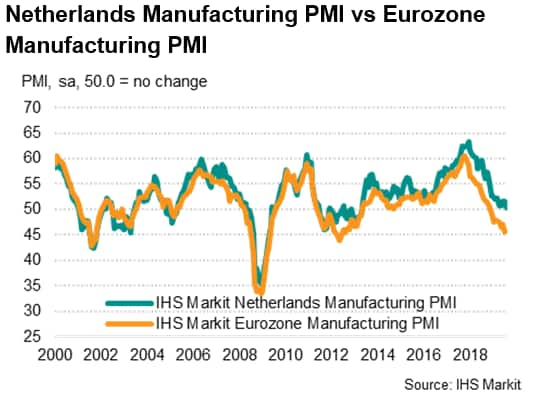

Eurozone manufacturers continue to struggle

Although weakening, the Dutch manufacturing sector has so far avoided the recent manufacturing downturn encompassing much of the eurozone. In fact, during September, the Netherlands was one of only two countries to report an uptick in the health of the goods producing sector. The headline manufacturing PMI figure for the Netherlands (51.6) was the second-highest across the eurozone in September, behind only Greece (53.6).

With Dutch operating conditions remaining firmly subdued, avoiding the eurozone manufacturing downturn is becoming increasingly unlikely. The current trend suggests that, unless the deterioration in the eurozone eases, the Netherlands may experience a similar contraction. October manufacturing data for the eurozone is released on Monday 4th November.

The next release of the Nevi Netherlands Manufacturing PMI will be Monday 2nd December 2019.

Lewis Cooper, Economist, IHS Markit

Tel: +44 1491 461019

lewis.cooper@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdutch-manufacturing-sector-struggles-at-start-of-fourth-quarter-011119.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdutch-manufacturing-sector-struggles-at-start-of-fourth-quarter-011119.html&text=Dutch+manufacturing+sector+struggles+at+start+of+fourth+quarter+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdutch-manufacturing-sector-struggles-at-start-of-fourth-quarter-011119.html","enabled":true},{"name":"email","url":"?subject=Dutch manufacturing sector struggles at start of fourth quarter | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdutch-manufacturing-sector-struggles-at-start-of-fourth-quarter-011119.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Dutch+manufacturing+sector+struggles+at+start+of+fourth+quarter+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdutch-manufacturing-sector-struggles-at-start-of-fourth-quarter-011119.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}